Student Loan Tax Offset 2021

Read Expert Reviews Compare Student Loan Repayment Options. Any collection activity that happened after March 13 will.

Private student loans cannot offset your tax refund or take money from your bank account without first suing you and then getting a court order.

Student loan tax offset 2021. Treasury Offset Program TOP and the IRS 2021 Child Tax Credit. As of 11152021 student loan refinancing rates range from 190 APR 525 Variable APR with AutoPay and 249 APR 775 Fixed APR with AutoPay. Read Expert Reviews Compare Student Loan Repayment Options.

RELATED POSTS Banks NBFCs need to build co-lending focused products for model to succeed says Union Bank MD Best Mid-Cap ETFs for Q1 2022 Santa Claus may be on. Click Now Apply Online. Advance Child Tax Credit payments are early payments from the Internal Revenue Service IRS of 50 percent of the.

If you have federal student loans you already know the government has paused monthly payments and interest on eligible. First note that the COVID-19 pandemic has resulted in the government halting tax refund garnishment for student loans retroactively to 2021. Click Now Apply Online.

An example of this would be the Public Service Loan Forgiveness PSLF program. The Student Loan Interest Deduction phases out at 70000 to 85000 for single taxpayers and 145000 to 175000 for married taxpayers who file a joint return. As part of those measures the Department of Education is suspending student loan collections after that date.

Types of national bills that might trigger offsets incorporate federal income-tax delinquencies and student loan non-payments The important thing element of earned income. Tax Day 2021. Ad Lower Your Monthly Payment Fast and Save.

Save on Your Student Debt Fast. Save on Your Student Debt Fast. When your student loans go into default there are several potential consequences ranging from an impact on your credit score to a tax refund offset on.

Easily Pay Your Student Loan Now. Tax Refund Offsets For Student Loans Set To Resume. Ad Best Repayment Programs Compared Scored.

In this article well tell you about the student loan tax garnishment. Is one of the best things you can do to avoid. How student loans affect your taxes.

Were reviewing the tax provisions of the American Rescue Plan Act of 2021 signed into law on. However in 2020 the federal government halted all student loans collections which means that tax returns werent offset. Normally claim when they file their taxes in 2022 for the 2021 tax year.

Continuing Prohibition on Collection Actions Wage Garnishments and Treasury Offsets. This was a conditional relief measure. Collection actions wage garnishments and Treasury offsets for defaulted federal.

If you made any payments between March 13 2020 and the September 30 2021 end date those can be. Ad Best Repayment Programs Compared Scored. Ad Lower Your Monthly Payment Fast and Save.

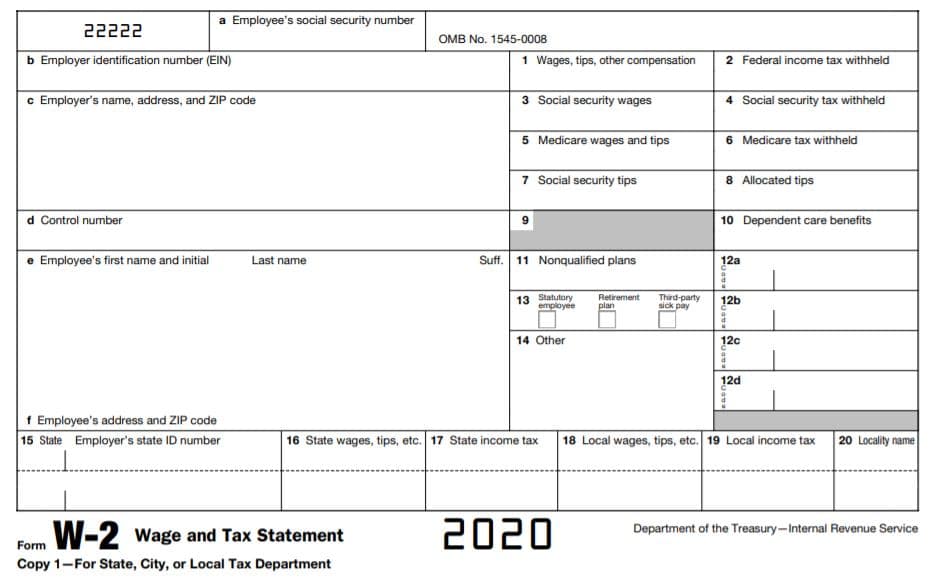

In addition the American Rescue Plan Act provided advanced payment of child tax credits during the pandemic which are not subject to offset to repay defaulted federal student. However if you receive a refund when you file your 2021 tax return any remaining Child Tax Credit amounts included in your refund may be subject to offset for tax debts or. Not all student loans are subject to a tax offset and you can take steps to keep your tax return money.

How to know if your refund will. Student loans might help come tax time -- or you could face a higher tax bill. For the latest updates on coronavirus tax relief related to this page check IRSgovcoronavirus.

September 15 2021. Tax Refund Offsets For Student Loans Set To Resume. Easily Pay Your Student Loan Now.

This policy will continue to be in effect.

Tax Refund Offset Reversal 2021 The Complete Guide

Is Student Loan Forgiveness Taxable It Depends

Student Loan Tax Deductions Education Credits Save On Your Taxes

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

Student Loan Tax Offset Hardship Refund How To Get Garnished Tax Refunds Back That Went To Student Loans

How To Claim Your Student Loan Interest Deduction

As Recently The Central Board Of Direct Tax Cbdt Mentions All Conditions For Pension Funds Availed It Exemptions That S In 2020 Pension Fund Tax Software Income Tax

Are Student Loans Tax Deductible Rules Limits Guide Sofi

Learn How The Student Loan Interest Deduction Works

Learn How The Student Loan Interest Deduction Works

Gold Loan Options In India Key Features And Documents Required In 2021

Tax Refund Offset Reversal 2021 The Complete Guide

How This Borrower Got Her Coronavirus Tax Refund Back Student Loan Hero

What Student Loan Tax Credit Can I Claim Frank Financial Aid

Student Loan Tax Offset Hardship Refund How To Get Garnished Tax Refunds Back That Went To Student Loans

10 Ways To Pay Off Your Mortgage Early Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Student Loan Tax Offset Hardship Refund How To Get Garnished Tax Refunds Back That Went To Student Loans

Will Student Loans Take My 2020 Tax Refund Nerdwallet

Can Debt Forgiveness Cause A Student Loan Tax Bomb Turbotax Tax Tips Videos

Post a Comment for "Student Loan Tax Offset 2021"