Maximum Student Loan Interest Deduction 2016

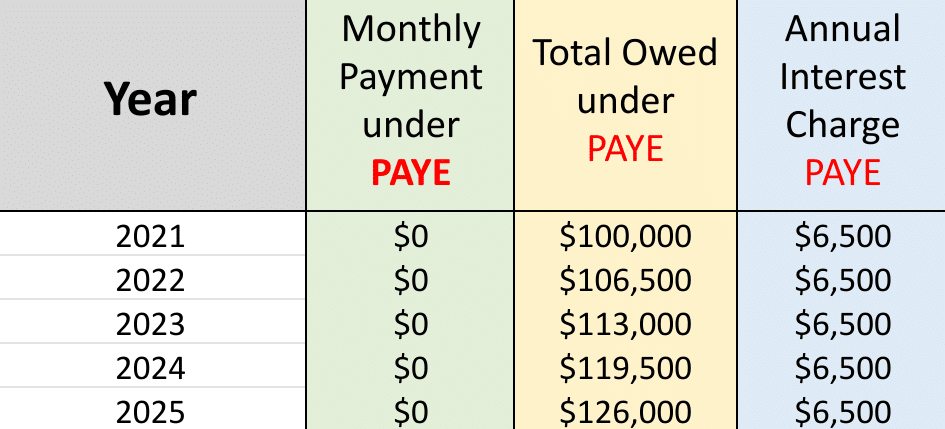

The focus of this post is on that lovely time in your life after graduation or youve stopped going to school when you must start paying back your student loans. For 2016 the amount of your student loan interest deduction is gradu-ally reduced phased.

![]()

How Much Student Loan Interest Is Deductible Payfored

Unfortunately the deduction is phased out if your adjusted gross income AGI.

Maximum student loan interest deduction 2016. The maximum amount of student loan interest you can deduct each year is 2500. The deduction is gradually. Save on Your Student Debt Fast.

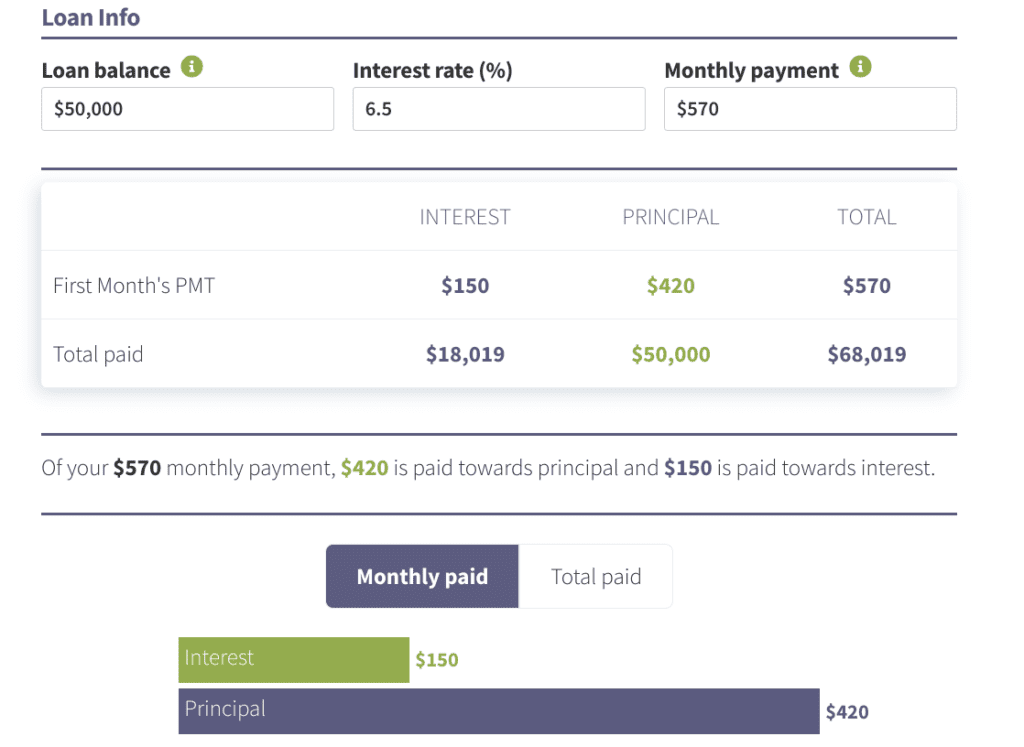

Tax Deductions for Student-Loan Interest You can deduct up to 2500 in interest if you meet the income limits. The answer is yes subject to certain limits. I estimate Ill have paid roughly 10000 in student loan interest over the seven year span.

You can deduct up to 2500 of student loan interest paid in a given year. Finally there are income limits on who can take the student loan interest deduction. It includes both required and voluntarily pre-paid interest payments.

Student Loan Refi 1. The maximum deduction is a modest 2500. Save on Your Student Debt Fast.

Section 221 b of the Internal Revenue Code of 1986. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans. Increase in deduction for student loan interest.

Your deduction is gradually reduced if your modified AGI is 70000 but less. As with many tax rules there is an income limit to this deduction. Opportunity credit MAGI limits are unchanged see chap-ter 2.

In July 2016. The answer is yes subject to certain limits. For your 2020 taxes which you will file in 2021 the student loan interest deduction is worth up to 2500 for a single filer head of household or qualifying widow er with MAGI of.

You can deduct up to 2500 in student loan interest or the actual amount of interest you paid whichever is less if your MAGI is under the threshold where the phaseout. You can claim the full 2500 student loan deduction if your modified AGI is 70000 or less. Student Loan Interest Deduction Phases Out.

Unfortunately the deduction is phased out if your adjusted. Ad Lower Your Monthly Payment Fast and Save. In 2016 joint filers making more than 160000 in modified adjusted gross income.

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. A Increase in dollar limitation and repeal of limitation based on income. There is a phase-out of this deduction based on how a person or couple files their taxes and their income.

Ad Lower Your Monthly Payment Fast and Save. The maximum amount of student loan interest you can deduct each year is 2500. Student loan interest deduction.

How Does Student Loan Interest Work When Interest Compounds More

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

5 Reasons To Stop Prioritizing Student Loan Payments

2020 Guide To Private Student Loan Forgiveness Discharges Refunds Fsld

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

How To Claim Your Student Loan Interest Deduction

![]()

How Much Student Loan Interest Is Deductible Payfored

Student Loan Interest Calculator Student Loan Planner

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

![]()

How Much Student Loan Interest Is Deductible Payfored

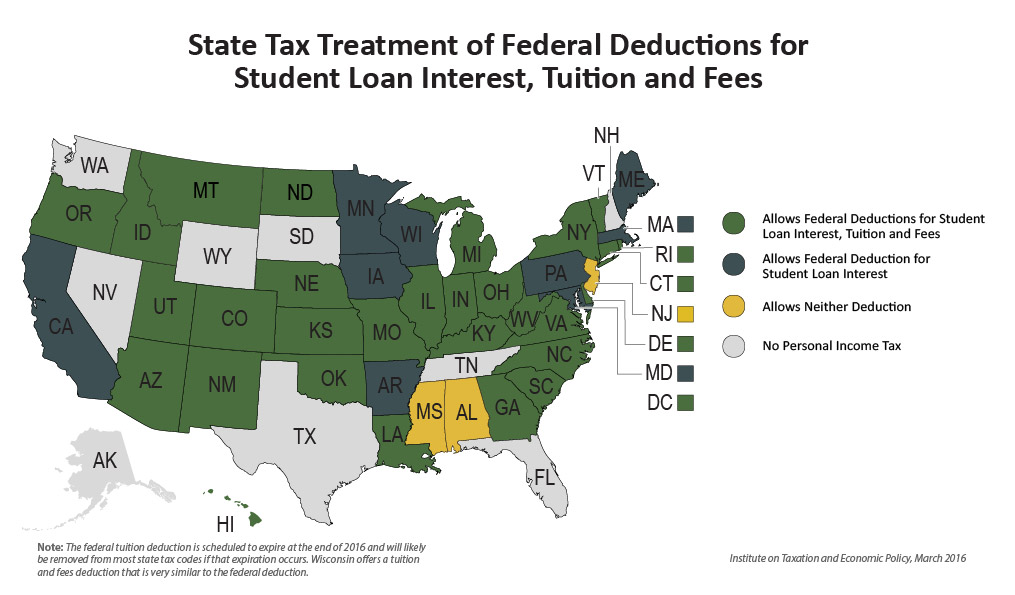

Higher Education Income Tax Deductions And Credits In The States Itep

Student Loan Interest Can You Deduct It On Your Tax Return Cordasco Company

Student Loan Tax Deductions Education Credits Save On Your Taxes

Is Student Loan Interest Tax Deductible Rapidtax

Student Loan Interest Deduction H R Block

Survey Majority Of Student Loan Borrowers Don T Understand How Interest Works Student Loan Hero

Can I Deduct My Student Loan Interest The Motley Fool

Student Loan Interest Deduction Should Factor Into Debates On Student Debt Tax Code Student Loan Interest Student Debt Student Loans

Is Student Loan Interest Tax Deductible Rapidtax

Post a Comment for "Maximum Student Loan Interest Deduction 2016"