Irs Student Loan Offset

But last year they sent the offset amount back this year he got an email saying that the IRS wasnt restarting collection efforts until Sept 30 2021. RELATED POSTS Banks NBFCs need to build co-lending focused products for model to succeed says Union Bank MD Best Mid-Cap ETFs for Q1 2022 Santa Claus may be on.

Stop Tax Refund Garnishment Over Defaulted Student Loan Debt By Pleasantbarrel567 Issuu

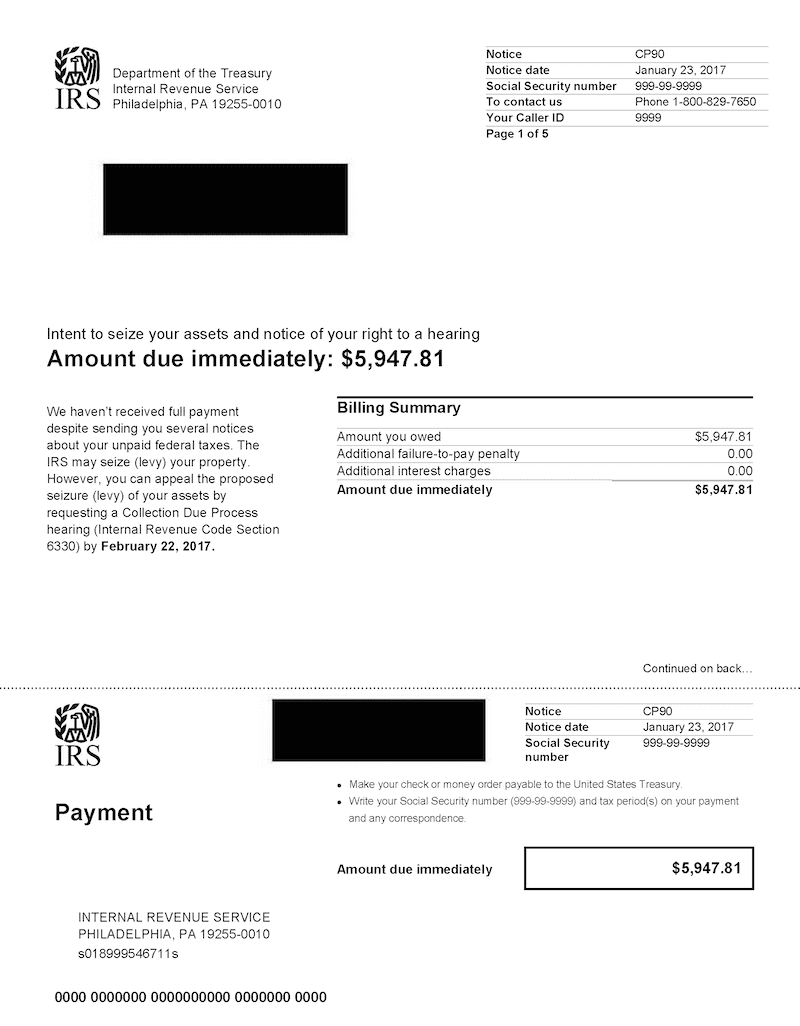

Additionally there is no statute of limitations for federal student loans meaning that you could deal with the Treasury Offset Program indefinitely.

Irs student loan offset. The government may take your income tax refund if you are in default. In one of those called a tax refund. Check with your loan provider for information on relief for debt payment during the COVID-19 pandemic.

Ad Start Your Application for Income-Based Federal Student Loan Forgiveness. Tax refund offsets are one of the governments powerful tools to collect federal student loans. Before you end up with a.

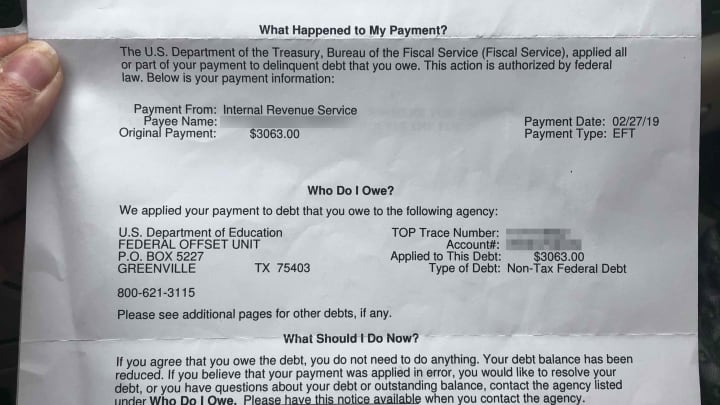

Do Not Click Here if You Make Less Than 25k per Year Because You Dont Qualify. Student loan tax offset refers to the governments power to garnish your tax refund through the IRS to satisfy your outstanding federal student loans in default. If you default on a student loan the Department of Education can use several different methods to collect student loans.

But if your federal student loans are in default because you havent been making payments for several months the Department of Education may request that your tax refund be. What Is a Tax Refund Offset. If you qualify a student loan tax offset hardship refund allows you to get back the money taken from your tax return.

These deferred payments dont necessarily apply to private student loans. Its important to note that because there is no statute of limitations for federal loans the IRS can offset your taxes for every year your federal student loans are in default. Having a tax refund offset on your student loans could result in less money than expected during tax season setting you back on your financial goals.

WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe harbor extending relief to. Not only are payments on federal student loans due once again after September 30th but collection activity on defaulted student loans is set to resume. Read on to learn more about how a student loan tax offset.

A number of states also. If you default on your federal.

Stop Tax Refund Garnishment Over Defaulted Student Loan Debt By Pleasantbarrel567 Issuu

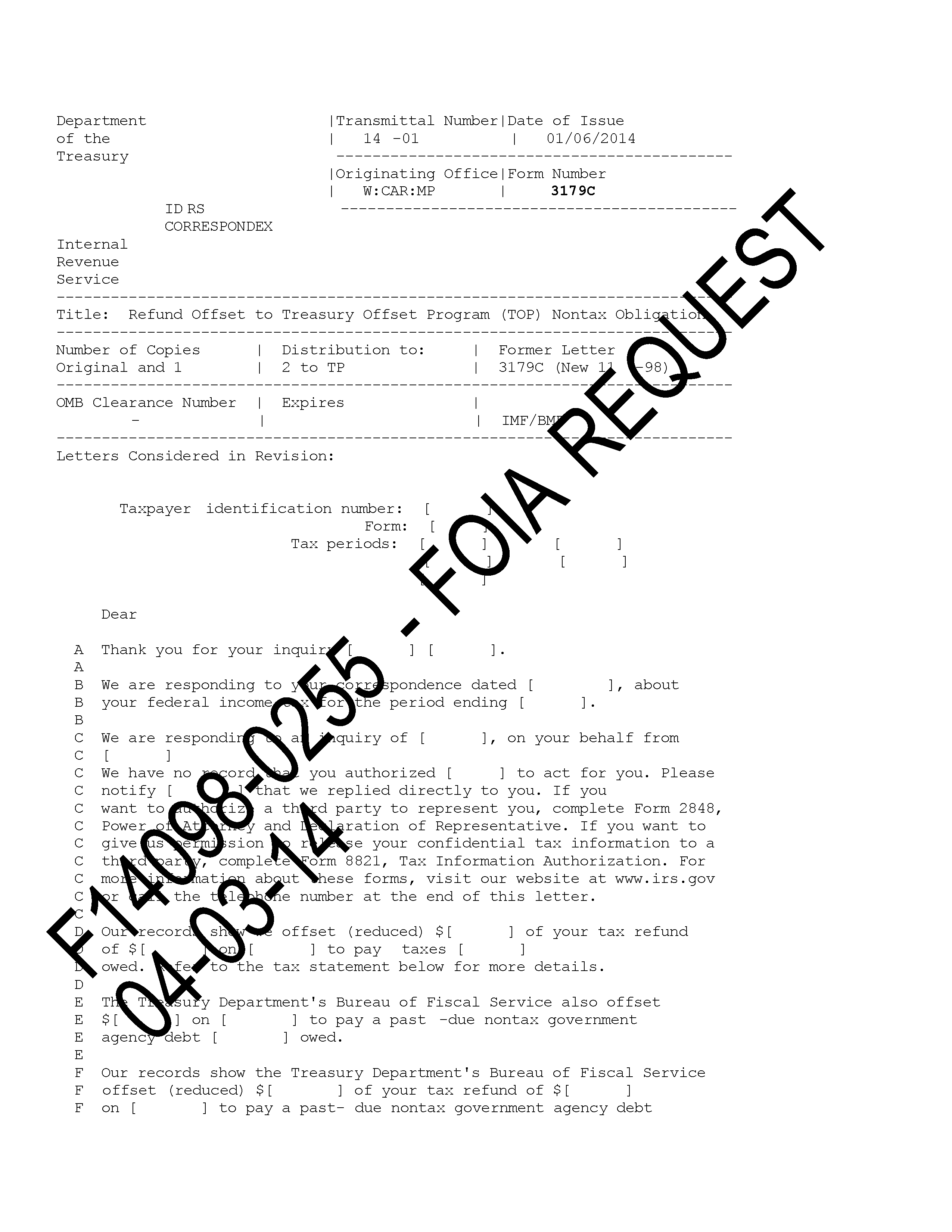

Irs Letter 3179c Refund Offset To Treasury Offset Program Nontax Debt H R Block

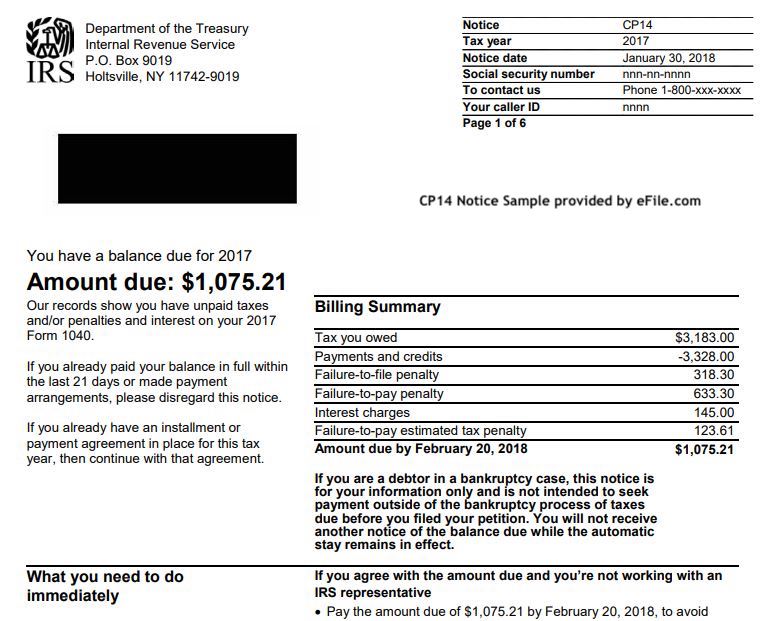

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

How This Borrower Got Her Coronavirus Tax Refund Back Student Loan Hero

More Student Loan Borrowers Are Getting Their Tax Refunds Seized

Irs Notice Letter 3179c Understanding Irs Letter 3179c Action Irs Made Regarding A Payment

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Student Loan Tax Offset Hardship Refund How To Get Garnished Tax Refunds Back That Went To Student Loans

Irs Offset Intent To Offset Tax Refunds Help Community Tax

Can Your State Tax Refund Be Garnished For Student Loans Loan Walls

My Wife Had An Outstanding Student Loan Debt Before Marriage She Hasn T Worked In Over 10 Years The Debt Collector

Irs Offset Intent To Offset Tax Refunds Help Community Tax

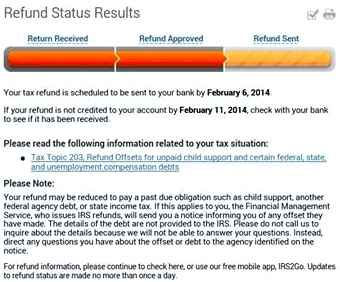

Tax Refund Status Is Still Being Processed

Student Loan Tax Offset Hardship Refund How To Get Garnished Tax Refunds Back That Went To Student Loans

Student Loan Tax Offset Hardship Refund How To Get Garnished Tax Refunds Back That Went To Student Loans

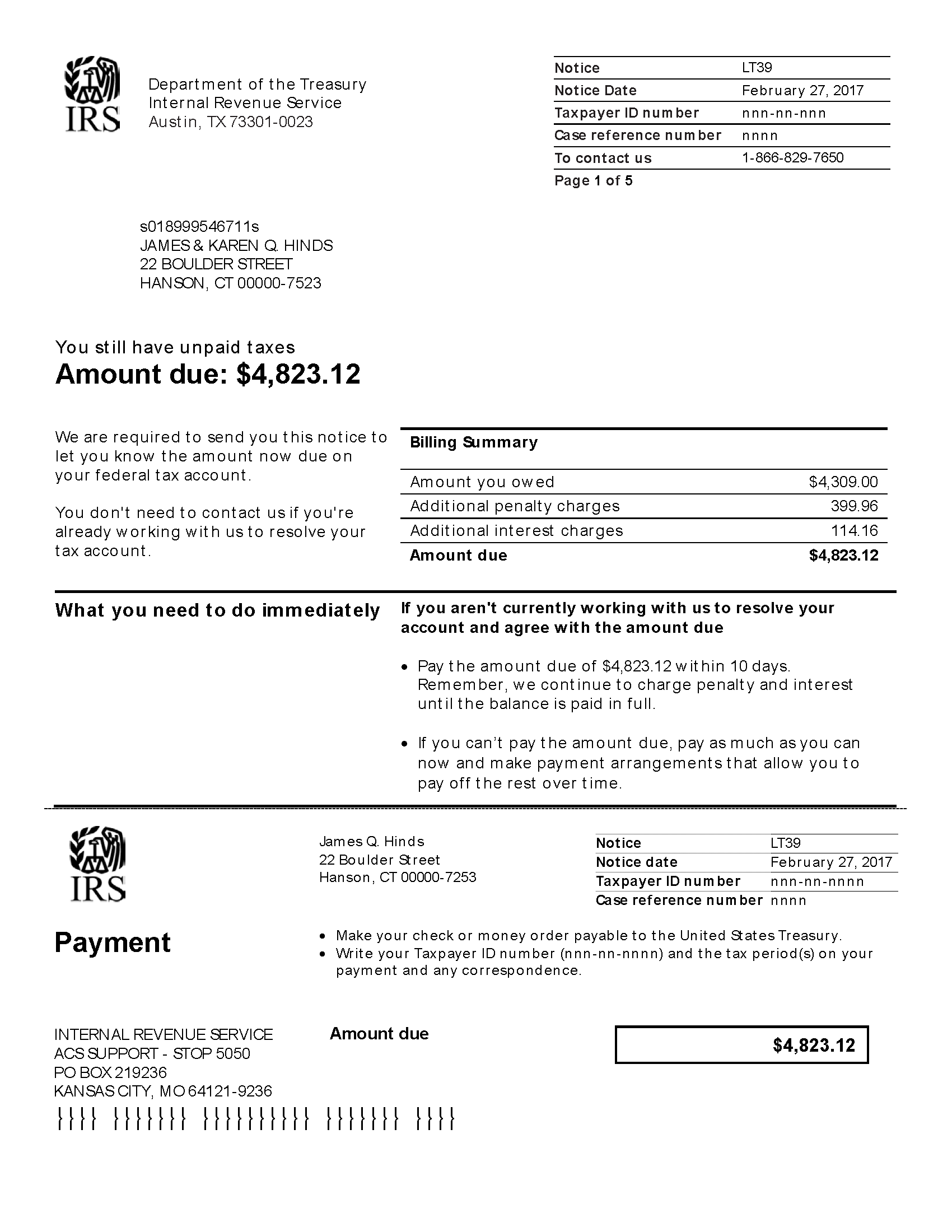

Irs Letter 39 Lt39 Reminder Of Overdue Taxes H R Block

Student Loan Wage Garnishment And Tax Refund Debt Com

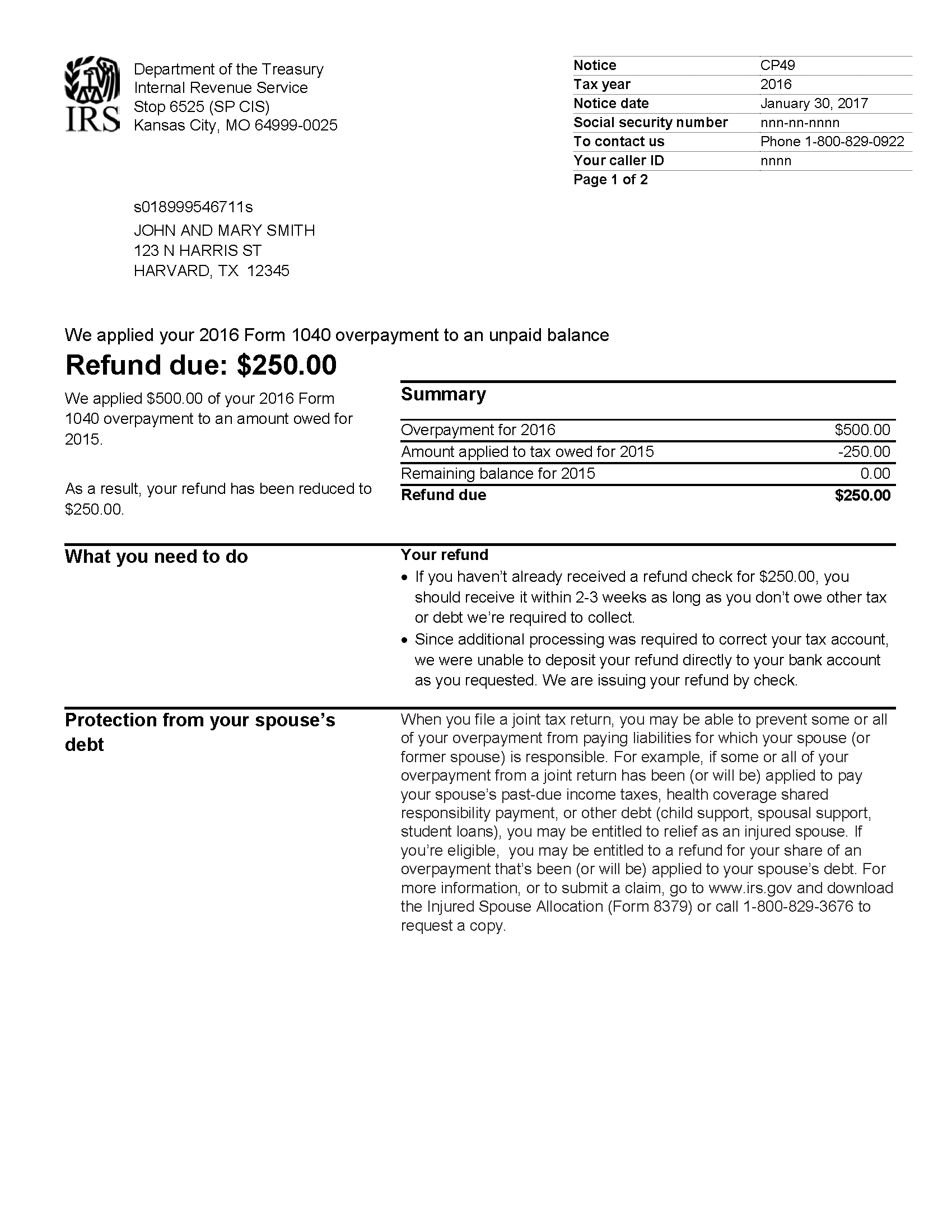

Irs Notice Cp49 Overpayment Applied To Taxes Owed H R Block

Post a Comment for "Irs Student Loan Offset"