Student Loan Interest Deduction 2020

You can claim the deduction if all of the following apply. How-to Assess Education Loan Interest Deduction.

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

It can be limited by your.

Student loan interest deduction 2020. For 2020 taxes which are to be filed in 2021 the maximum student loan interest deduction is 2500 for a single filer head of household or qualifying widow or widower with a. This is known as a student loan interest deduction. Even if you didnt.

For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and. Student loan interest can quickly add up. Only you can claim an amount for the interest you or a person related to you paid on that loan in 2020 or the preceding 5 years.

Refinance Parent Plus loans Spouse Loans Individual Student Loans. You can claim the student loan interest tax deduction as an. That interest could still be deductible but the.

Student loans must furnish this statement to you. You paid interest on a qualified student loan in tax year 2020. The answer is yes.

The student loan interest deduction allows you to subtract up to 2500 from your taxable income for interest paid on student loans. The maximum student loan interest deduction you can claim is 2500 as of the 2020 tax year and it might be less. Theres a wrinkle for 2020.

Student loan interest deduction. You get the full amount of your qualified interest deduction to your AGI since it is above the line and not an itemized deduction though it can be taken whether you itemize. If you made interest rate.

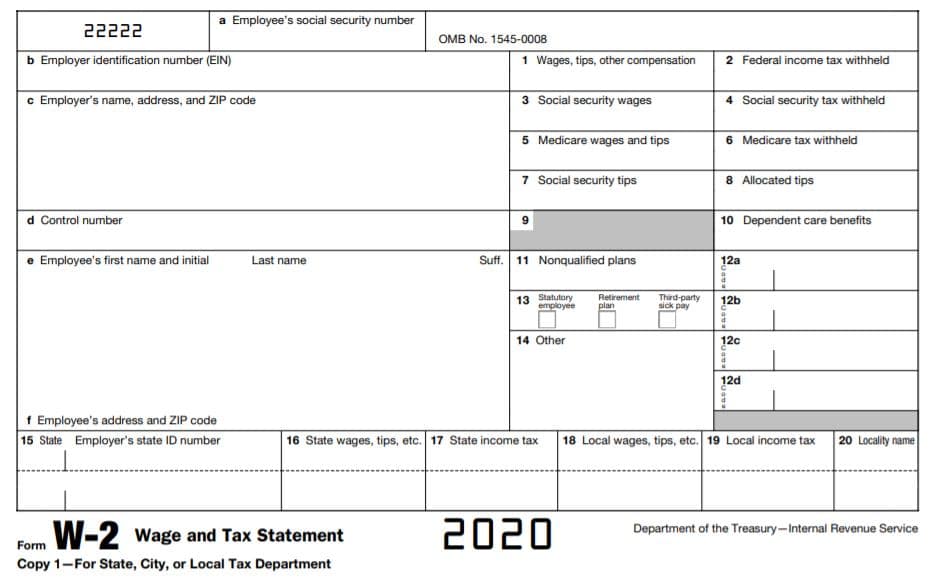

Just how to Assess Education Loan Interest Deduction. Ad Answer a few questions to find your student loan refinance rate. Your student loan servicer who you make payments to will send you a copy of your 1098-E via email or postal mail if the interest you paid in 2020 met or exceeded 600.

The interest deduction is only available for interest the parent pays on a qualifying loan not for any interest the child-student may pay on a loan he or she may have taken out. E-File Today Get Your Tax Refund. Refinance Parent Plus loans Spouse Loans Individual Student Loans.

However you may not be able to. The maximum amount of student loan interest you can deduct each year is 2500. Heres how it works.

You can claim an amount only for interest you have not already. The student loan interest deduction is a tax benefit that can help offset the costs of borrowing and repaying this debt. You may be able to deduct student loan interest that you actually paid in 2022 on your income tax return.

If you made federal student loan payments in 2020 you may be eligible to deduct a portion of the interest paid on your 2020 federal tax return. As they file their income taxes in 2020 borrowers can. If youre repaying student education loans you may well be capable deduct around 2500 in interest payments out of.

In fact you could qualify to deduct up to 2500 of student loan interest per return per year. Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out. If youre repaying student loans you are in a position to take up to 2500 in interest repayments out of your nonexempt.

If you deferred student loan payments you might have paid less than 600 in loan interest. You can subtract up to 2500 of interest paid each year from your taxable income. Ad Answer a few questions to find your student loan refinance rate.

It can be limited by your income. Youre legally obligated to pay interest on a qualified student loan. The deduction is phased out if your adjusted gross income AGI exceeds certain levels.

But for the 2020 tax year this deduction will look different for many federal student loan.

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

Can The Student Loan Interest Deduction Help You Citizens Bank

Can The Student Loan Interest Deduction Help You Citizens Bank

Learn How The Student Loan Interest Deduction Works

Learn How The Student Loan Interest Deduction Works

How To Deduct Student Loan Interest On Your Taxes 1098 E Federal Student Aid

Ecsi Student Loan Tax Incentives

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

![]()

Record Low Student Loan Interest Rates Set For 2020 2021 Student Loan Hero

Busting Myths On Student Loan Forgiveness Debate Student Loan Hero

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

Your Irs Form 1098 E Interest Statement Does It Matter Now

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

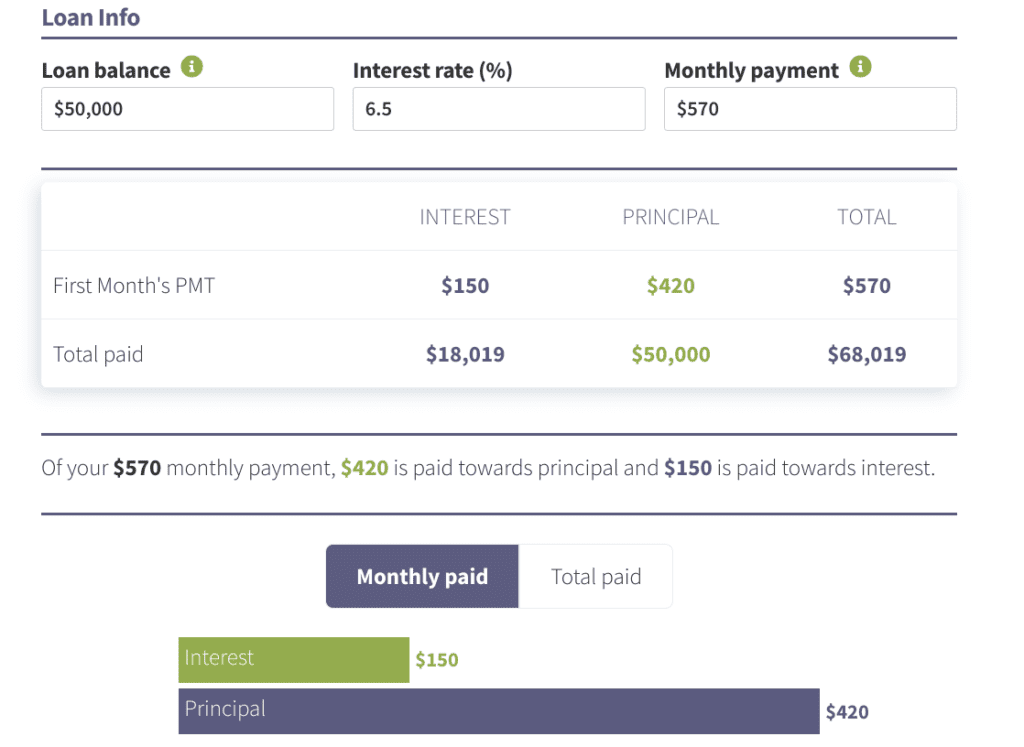

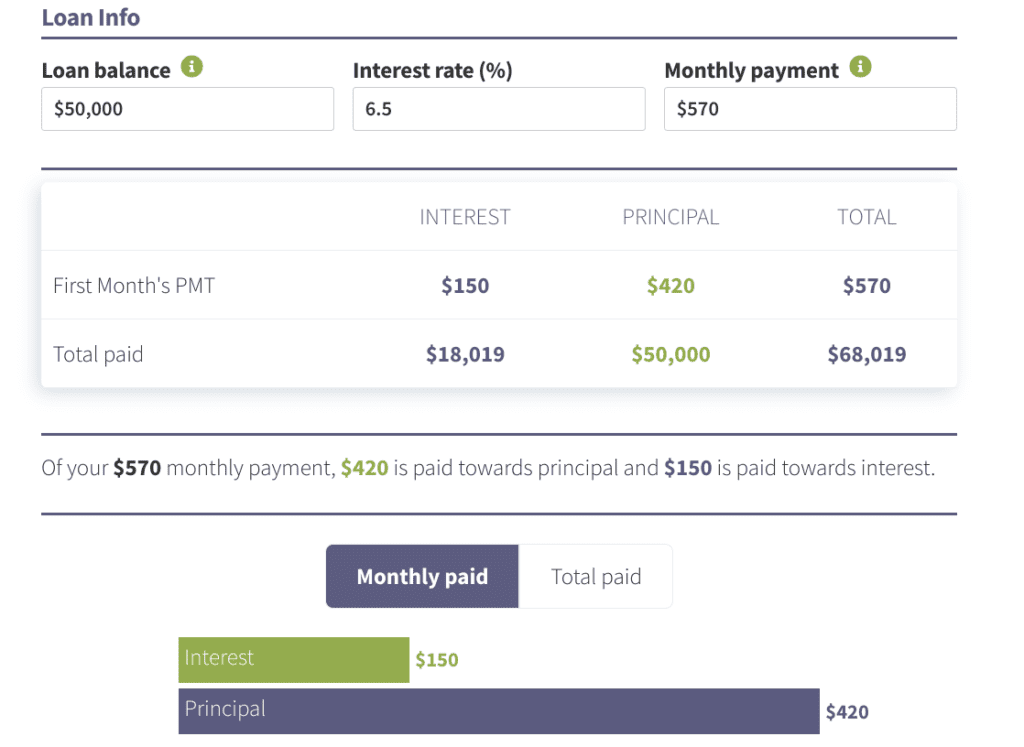

Student Loan Interest Deduction Calculator Student Loan Hero

How To Claim Your Student Loan Interest Deduction

Learn How The Student Loan Interest Deduction Works

Student Loan Interest Calculator Student Loan Planner

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

Post a Comment for "Student Loan Interest Deduction 2020"