Student Loan Interest Deduction Phase Out 2016

If Joe borrowed more than 10000 in student loans in 2016 none of the interest would qualify for the student loan interest deduction. It doesnt matter when the loan was taken out or whether interest payments made in earlier years on the loan were deductible or not.

![]()

How Much Student Loan Interest Is Deductible Payfored

In 2016 joint filers making more than 160000 in modified adjusted gross income.

Student loan interest deduction phase out 2016. For 2021 the deduction is phased out. The answer is yes subject to certain limits. There is a deduction for student loan interest paid during the year.

Heres how to calculate your deduction under the phaseout formula. The deduction was maintained which will be a big. If youre repaying student education loans you may well be capable deduct around 2500 in interest payments out of.

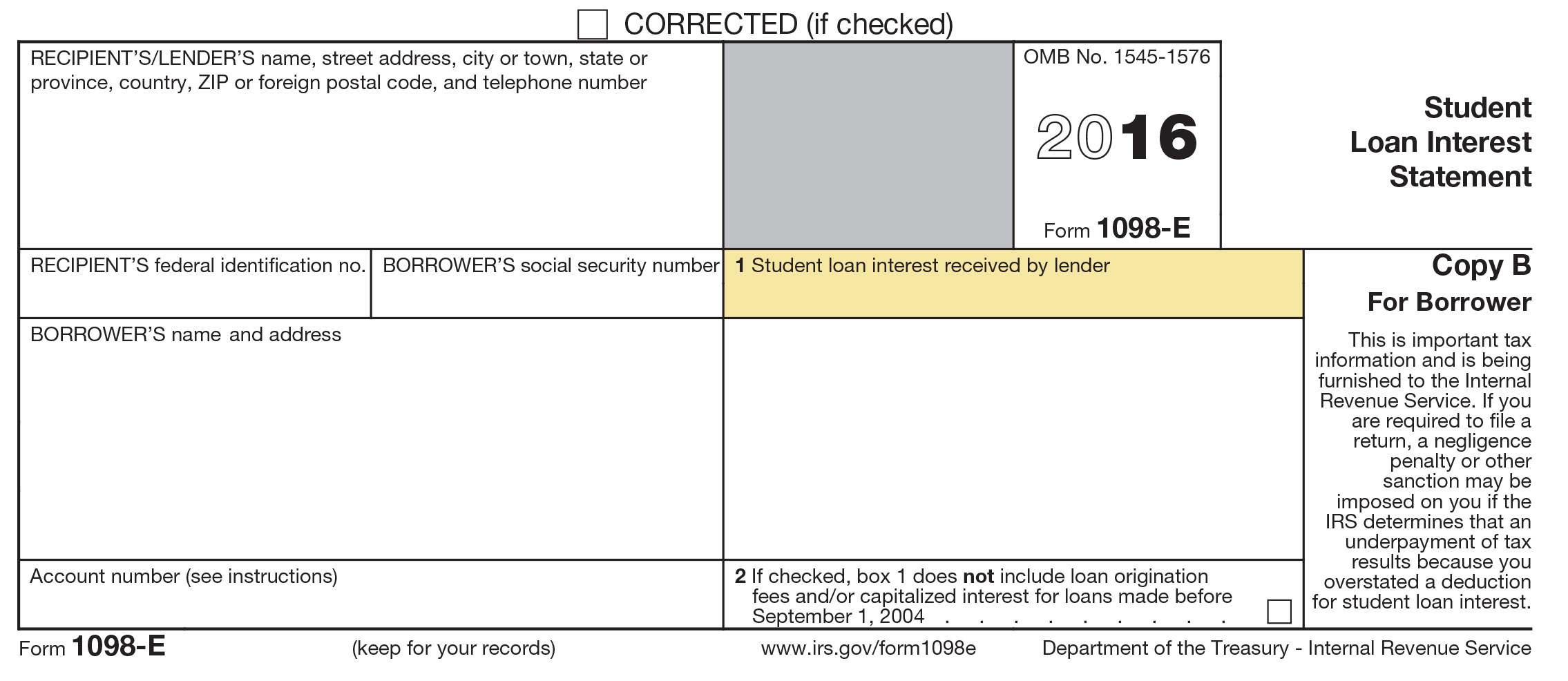

You can claim student loan interest on your taxes however the student loan interest deduction begins to phase out if your adjusted gross income AGI is. For 2016 the amount of your student loan interest deduction is gradu-ally reduced phased out if your MAGI is between 65000 and 80000 130000 and. The maximum amount of student loan interest you can deduct each year is 2500.

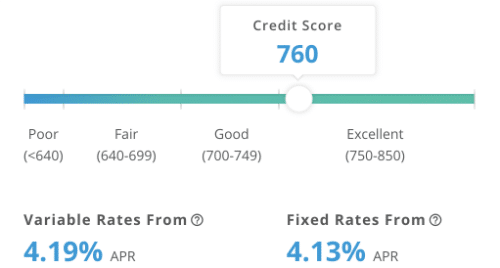

You can deduct up to 2500 in student loan interest or the actual amount of interest you paid whichever is less if your MAGI is under the threshold where the phaseout. Duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and 170000 if you file a joint return. The answer is yes depending on your income and subject to certain limits.

The student loan interest deduction is a federal tax deduction that lets you deduct up to 2500 of the student loan interest you paid during the year. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans. The deduction is gradually reduced and eventually eliminated by phaseout when your modified.

Take your MAGI and subtract 70000 or 140000 if youre married and filing jointly. It reduces your taxable. 80000 if filing single.

The interest deduction can reduce your taxable income by a maximum of 2500. If youre single the student loan deduction phases out between 65000 and 80000 of modified adjusted gross income MAGI. It doesnt matter when the loan was taken out or whether interest payments made in earlier years on the loan were deductible or not.

Finally there are income limits on who can take the student loan interest deduction. You cant claim the deduction if your MAGI is 85000 or. Phase-out begins at MAGI greater than 70000 and 140000 respectively.

Student loan interest deduction. Amount of your student loan interest deduction is gradu- ally reduced phased out if your MAGI is between 65000 and 80000 130000 and 160000 if you file a. If the amount you enter on screen 4 does not flow to Form 1040 review Wks SLID in View Mode of the return.

Income limits for the student loan interest deduction You. The deduction begins to. Just how to Assess Education Loan Interest Deduction.

So even if you paid 2500 or more in. The student loan interest deduction was originally on the cutting block under the initial tax reform act that started in 2018. The interest on U S savings bonds redeemed to pay qualified higher education expenses may be tax-free The exclusion is phased out at certain income levels which are adjusted annually for.

Phase-out Amounts For 2021 the deduction. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year.

![]()

How Much Student Loan Interest Is Deductible Payfored

Student Loan Interest Deduction Should Factor Into Debates On Student Debt Tax Code Student Loan Interest Student Debt Student Loans

Student Loan Interest Deduction H R Block

![]()

How Much Student Loan Interest Is Deductible Payfored

Pub 17 Chapter Pub 4012 Tab E Federal 1040 Lines 23 37 Ppt Download

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Tax Deductions Education Credits Save On Your Taxes

How To Claim Your Student Loan Interest Deduction

Should I Use Tax Credits Or Deductions To Save On My Student Loans

Remember To Deduct Student Loan Interest On Your Taxes Iontuition Education Fintech

Is Student Loan Interest Tax Deductible Rapidtax

There S A Deduction For Student Loan Interest But Do You Qualify For It Dougfreemancpa Com

Mohela Student Loans Review For December 2021

Survey Majority Of Student Loan Borrowers Don T Understand How Interest Works Student Loan Hero

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Can I Deduct My Student Loan Interest The Motley Fool

Post a Comment for "Student Loan Interest Deduction Phase Out 2016"