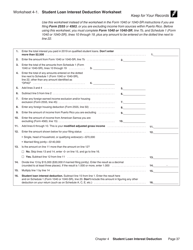

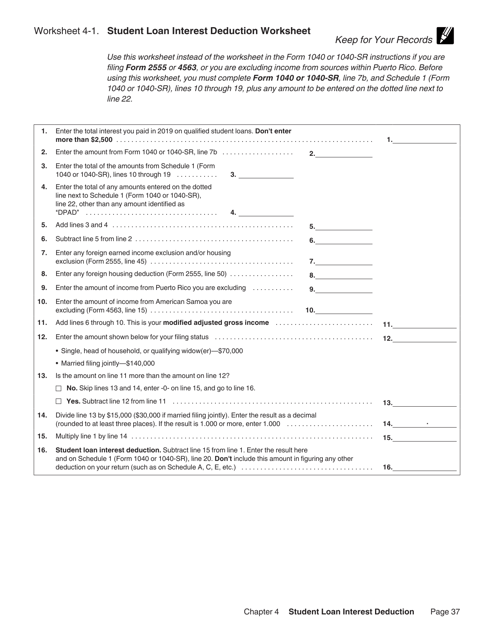

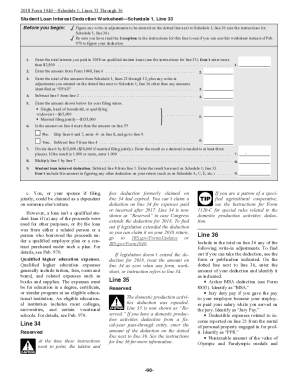

1040 Student Loan Interest Deduction Worksheet

Youll enter the actual amount of interest paid or 2500 whichever is less on Schedule 1 line 20. These Lenders Saved Millions for Thousands of Graduates in 2021.

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

Most interest that you pay throughout the year isnt tax-deductible.

1040 student loan interest deduction worksheet. If your MAGI is 70000 or above youll have to calculate the amount of disallowed interest. Ad Check your eligibility quickly and apply easily on mobile or desktop. The Form 1040 2018 Student Loan Interest Deduction Worksheet form.

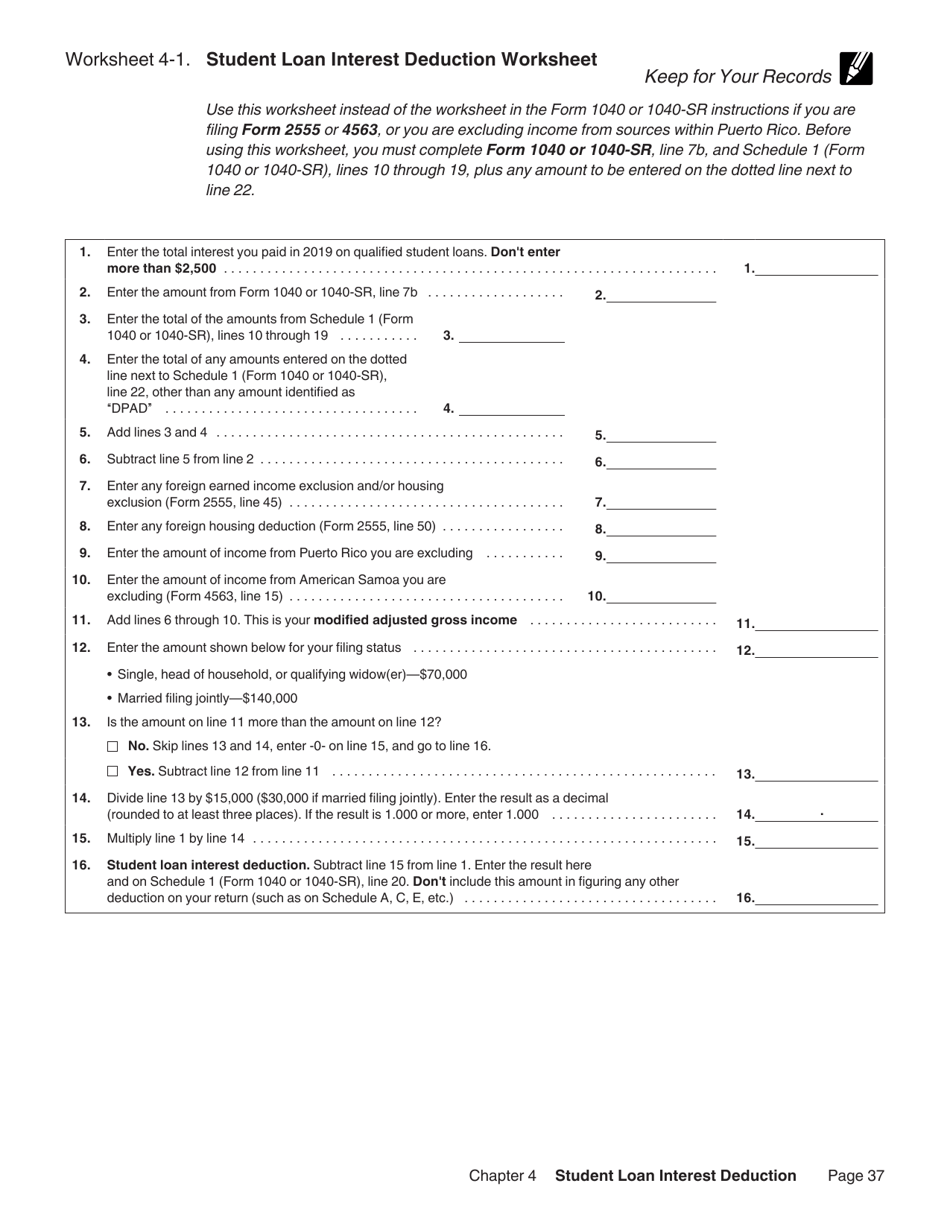

If you file a Form 2555 Foreign Earned Income Form 4563 Exclusion of Income for Bona Fide Residents of American Samoa or if you exclude income from sources inside Puerto Rico refer. If youre repaying student loans you are in a position to take up to 2500 in interest repayments out of your nonexempt. Qualified student loan interest deductions are reported on Form 1040 Schedule 1.

Paying back your student loan wont generate any tax breaks but paying the interest on that student loan can by reducing your income tax. Form 1040 2018 Student Loan Interest Deduction Worksheet. These Lenders Saved Millions for Thousands of Graduates in 2021.

Although education loan interest might indefinitely suspended. Do not include this amount in figuring any other deduction. The education loan interest deduction is designed to help to make school cheaper for students and their mothers.

If you lodge an application 1040 1040-SR or 1040-NR you need to use the Student Loan Interest Deduction worksheet on webpage 94 of ones 2020 income tax return. Enter the total interest you paid in 2018 on qualified student loans see the instructions for line 33. On average this form takes 3 minutes to complete.

Ad Check your eligibility quickly and apply easily on mobile or desktop. Compare Stop Overpaying. Ad All The Information You Need to Find The Best Refinance Students Loan Deal For You.

DO NOT FILE July 11 2019 DRAFT AS OF. The student loan interest deduction can be claimed above the line as an adjustment to income. The self-employed health insurance deduction with.

Tax Form 1040 Student Loan Interest. You can take it without itemizing or take the standard deduction as. Why does the MAGI on the Student Loan Interest Deduction Worksheet not match the expected MAGI from Form 1040.

Ad All The Information You Need to Find The Best Refinance Students Loan Deal For You. 970 to figure your deduction. Ad Download or Email IRS 1040 More Fillable Forms Register and Subscribe Now.

The Form 1040 2018 Student Loan Interest Deduction Worksheet form is 1 page long and contains. Subtract line 8 from line 1. Although student loan interest is.

Form 1040 or 1040-SR Department of the. Do not enter more than 2500 1. Dont enter more than 25001.

The student loan interest deduction was created to help to make college more cost-effective for college students in addition to their parents. The max deduction is 2500 for your 2020 tax. Enter the total of the amounts.

Figure any write-in adjustments to be entered on the dotted line next to Schedule 1. Compare Stop Overpaying. Enter the amount from Form 1040 line 22 2.

Enter the result here and on Form 1040 line 33 or Form 1040A line 18. Student loan interest deduction. How-to Assess Education Loan Interest Deduction.

Enter the total interest you paid in 2012 on qualified student loans see above. However for some people theres a special deduction they can take.

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Student Loan Interest Deduction What It Is How To Claim Benzinga

Student Loan Interest Deduction Worksheet Line 33

Adjusted Gross Income Form 1040 Decoded Physician Finance Basics

Pub 17 Chapter Pub 4012 Tab E Federal 1040 Lines 23 37 Ppt Download

How To Claim Your Student Loan Interest Deduction

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

1040 Schedule 1 Drake18 And Drake19 Schedule1

Learn How The Student Loan Interest Deduction Works

Publication 970 Tax Benefits For Higher Education Chapter 3 Student Loans Student Loan Interest Deduction

Student Loan Interest Deduction Worksheet 2020 Fill Online Printable Fillable Blank Pdffiller

1040 Schedule 1 Drake18 And Drake19 Schedule1

Student Loan Interest Deduction Worksheet 2020 Fill Online Printable Fillable Blank Pdffiller

Student Loan Interest Deduction Worksheet Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "1040 Student Loan Interest Deduction Worksheet"