Employer Student Loan Repayment Taxable

Ordinarily any student loan repayment assistance you receive from your employer is taxable. Thus employees had to pay income taxes and employers were required to pay payroll taxes on any student loan assistance paid to employees.

Student Loan Forgiveness For Disabled Veterans

The Consolidated Appropriations Act of 2021 signed into law by then-President Donald Trump on Dec.

Employer student loan repayment taxable. The Consolidated Appropriations Act extends for five years COVID-19 relief that allows employer-provided student loan repayment as a tax-free benefit to employees under. Read Expert Reviews Compare Student Loan Repayment Options. Click Now Apply Online.

Repayments made by employers and their employees can now be made pre-tax up to 5250 annually significantly. Ad Lower Your Monthly Payment Fast and Save. Ad Best Repayment Programs Compared Scored.

Student loan repayment benefit means the benefit provided to an employee under this part in which an agency repays by a direct payment on behalf of the employee a qualifying student. Traditionally an employers student loan contributions are subject to payroll taxes and are taxable income to the employee. Pennsylvania provides tax-free status for student loan debt that is.

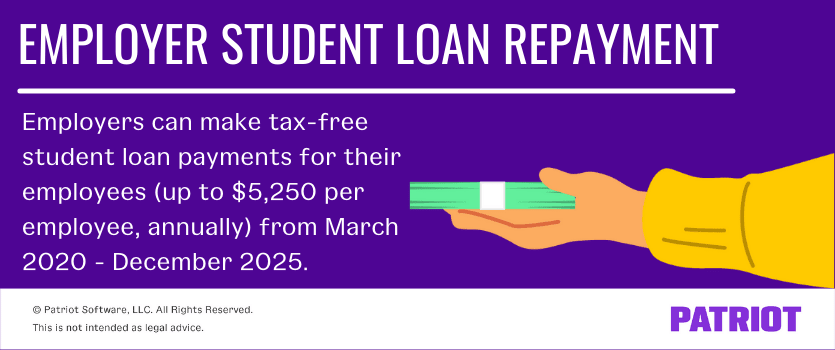

That all changed with the Coronavirus Aid Relief and Economic Security CARES Act. With the recent extension of the rules set forth in the CARES Act employer student loan repayment contributions up to 5250 are payroll-tax and income-tax-free until January. Ad Lower Your Monthly Payment Fast and Save.

Prior to March 2020 student loan repayments of any amount were taxable. Click Now Apply Online. Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in.

Helping employees pay their student loans. Ad Best Repayment Programs Compared Scored. Easily Pay Your Student Loan Now.

The legislation allows employers to make tax-free contributions of up to 5250 a year to their employees student debt without the payments being included in the employees. Student Loan Repayment Benefits Are Now Tax-free. Employer tax benefits of student loan repayment programs The sheer amount of student loan debt individuals are graduating from higher education with has been increasingly covered in.

Tax consequences of an employer paying your student loans. Employers can now provide up to 5250 in annual student loan repayment assistance benefits to employees on a tax-free basis through 2025. Employer student loan repayment assistance programs LRAPs are taxable in North Carolina in 2020.

Easily Pay Your Student Loan Now. But while it hasnt gotten as. 27 2020 allows employer-provided student loan repayment as a tax.

Federal tax breaks and the potential to recruit and retain qualified employees are encouraging more employers to help lighten student loan debt for their workers. Read Expert Reviews Compare Student Loan Repayment Options.

More Than 178 000 Troops May Be Eligible For This Student Loan Debt Forgiveness Benefit Watchdog Says

Employer Student Loan Repayment Tax Free Benefit Q A

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

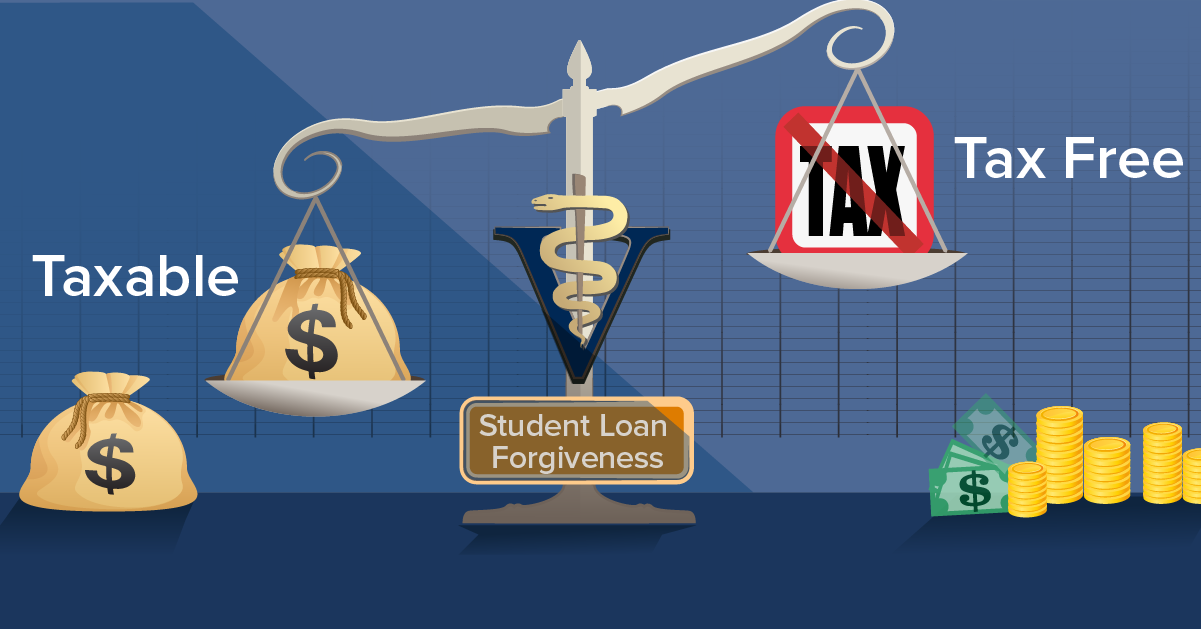

Taxes Are Forgiven Student Loans Taxable Or Tax Exempt Strategic Finance

Tax Free Student Loan Payments

Student Loan Forgiveness Taxable Or Tax Free Vin Foundation

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Is Student Loan Forgiveness Taxable It Depends

Up To 5 250 Of Employer Student Loan Assistance Is Tax Free Through 2025

Student Loan Refinancing Rates Hit Another New Low Credible Refinance Student Loans Student Loans Student Loan Consolidation

Employer Student Loan Repayment Tax Free Benefit Q A

Pause On Federal Student Loan Payments Extended Through May 1 Wjhl Tri Cities News Weather

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Your Employer Can Pay 5 250 Annually Towards Your Student Loans Tax Free Until 2025

Student Loan Repayment Programs Military Com

Why Employers Need To Take Student Loan Repayment Benefits Seriously Benefitspro

How To Claim Your Student Loan Interest Deduction

Tax Free Employer Paid Student Loan Benefit Extended Njbia New Jersey Business Industry Association

These Companies Offer Student Loan Repayment Assistance

Post a Comment for "Employer Student Loan Repayment Taxable"