Student Loan Interest Deduction Cap

In this case you would want to take the standard deduction of 12400 instead because you would get 4000 more deducted from your taxable income. As with many tax rules there is an income limit to this deduction.

Learn How The Student Loan Interest Deduction Works

The maximum student loan interest deduction you can claim is 2500 as of the 2020 tax year and it might be less.

Student loan interest deduction cap. The student loan interest deduction allows you to deduct up to 2500 on your federal income tax return for the loan interest you paid during the year. The largest amount you can claim for a student loan interest deductible is 2500 for 2021 but that is limited by your income eligibility. If you are married you can earn 140000 before the phase-out begins.

The answer is yes subject to certain limits. You can claim student loan interest on your taxes however the student loan interest deduction begins to phase out if your adjusted gross income AGI is. For 2020 taxes which are to be filed in 2021 the maximum student loan interest deduction is 2500 for a single filer head of household or qualifying widow or widower with a modified adjusted gross income of.

Student loan interest deduction. For example say youre an undergraduate dependent student who borrowed the maximum amount of unsubsidized federal student loans each year from 2014 to 2018. Mortgage interest 6000 student loan interest 1000 and charitable donations 1200.

If you qualify you can deduct up to 2500 of student loan interest per year. The deduction is reduced for taxpayers with modified adjusted gross incomes MAGIs in a certain phaseout range and is eventually eliminated entirely if your MAGI is too high. The interest must be for a qualified education loan.

It can be limited by your income. When your modified adjusted gross income MAGI reaches the yearly limit for your tax filing status the deduction. Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out.

The maximum amount of student loan interest you can deduct each year is 2500. How it works The student interest loan deduction is an above-the-line deduction. E-File Today Get Your Tax Refund.

You get the full amount of your qualified interest deduction to your AGI since it is above the line and not an itemized deduction though it can be taken whether you itemize deductions or not. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the annual limit for your filing status. The deduction is completed phased out if your AGI is.

What is the income limit for student loan interest deduction 2020. Is student loan interest deductible in 2021. 80000 if filing single head of household or qualifying widow er 165000 if married filing jointly.

The exact amount you can deduct depends on how much interest you paid and your. The maximum amount of student loan interest you can deduct each year is 2500. You can deduct up to 2500 of student loan interest paid in a given year.

Unfortunately the deduction is phased out if your adjusted gross income AGI exceeds certain levels and as. If you are single head of household or eligible widower or widower the phase-out of your student loan interest starts at 70000 AGI modified and elimination ends at 85000. Not all loans will qualify.

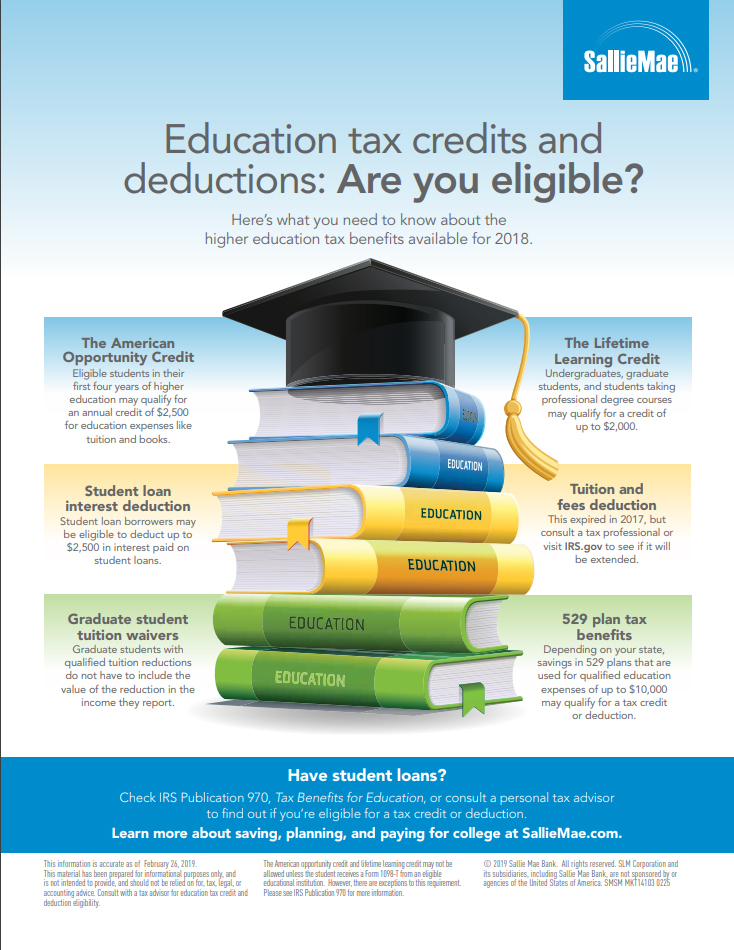

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. If you paid interest on your student loans last year then you may be eligible for a deduction of up to 2500 on your 2018 federal tax return. If you happen to qualify for the 22 tax rate you have the best deal because your.

Student loan interest can quickly add up. If you made interest rate payments on your student loans during the tax year you could deduct up to 2500 in interest paid. The maximum student loan interest deduction limit is 2500 as of the current 2018 tax year even if you paid more to your student loans in a given year.

Write off up to 2500 of student loan interest on their taxes. Loans must have been used for qualifying educational expenses according to the IRS. You may take the deduction if all four of the following apply.

The amount you can write off will depend on your marital status and your modified adjusted gross income MAGI The federal government offers tax credit programs you can use to lower your income tax payment. You itemize the following deductions as a single individual. For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and 170000 if you file a joint return.

You paid interest during the year on a qualified student loan any loan you took out to pay the qualified higher education expenses for yourself your spouse or anyone who was a dependent when the loan was taken out. Qualified borrowers can deduct think. These deductions add up to 8200.

The 60-month limit on interest payments no longer applies. You cant claim the deduction if your MAGI is 85000 or more 170000 or more if you file a joint return. It can be limited by your income.

And while you cant deduct a student loan on your federal tax return the interest from student loan payments is tax-deductible. 80000 if filing single head of household or qualifying. It includes both required and voluntarily pre-paid interest payments.

Unfortunately the deduction is phased out if your adjusted gross income AGI exceeds certain levels and as explained below the levels arent very high. Income limits for claiming the deduction For your 2020 taxes which you will file in 2021 the student loan interest deduction is worth up to 2500 for a single filer head of household or qualifying widower with MAGI of. You would owe 27000 plus 3276.

Learn How The Student Loan Interest Deduction Works

Student Loan Tax Deductions Education Credits Save On Your Taxes

Higher Education Tax Benefits Do You Qualify Business Wire

Student Loan Interest Deduction How Much Can I Save In 2022

Section 221 Of Internal Revenue Code Deals With Student Loan Interest Tax Deduction Allowed To A Taxpayer Student Loans Tax Deductions Student Loan Payment

How To Claim Your Student Loan Interest Deduction

Survey Majority Of Student Loan Borrowers Don T Understand How Interest Works Student Loan Hero

Are Student Loans Tax Deductible Rules Limits Guide Sofi

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Learn How The Student Loan Interest Deduction Works

Can The Student Loan Interest Deduction Help You Citizens Bank

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

Student Loan Interest Tax Benefits Fact Vs Fiction

Can The Student Loan Interest Deduction Help You Citizens Bank

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

Student Loan Interest Deduction Definition

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

Student Loan Interest Deduction H R Block

Student Loan Interest Deduction How Much Can I Save In 2022

Post a Comment for "Student Loan Interest Deduction Cap"