Student Loan Interest Deduction Phase Out 2016 Calculator

You can claim student loan interest on your taxes however the student loan interest deduction begins to phase out if your adjusted gross income AGI is. The student loan interest tax deduction can be tricky to calculate so we created this calculator to help current and former students estimate.

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

If you apply before 12152021 the index is the one-month London Interbank.

Student loan interest deduction phase out 2016 calculator. It includes both required and voluntarily pre-paid interest payments. 2021 Student Loan Interest Tax Rate Calculator. Modified AGI is less than the threshold amounts.

Income limits for the student loan interest deduction You. For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and. 80000 if filing single.

If Joe borrowed more than 10000 in student loans in 2016 none of the interest would qualify for the student loan interest deduction. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans. For 2021 the deduction.

You can deduct up to 2500 in student loan interest or the actual amount of interest you paid whichever is less if your MAGI is under the threshold where the phaseout. There is a phase-out of this deduction based on how a person or couple files their taxes and their income. If you lodge an application 1040 1040-SR or 1040-NR you need to use the Student Loan Interest Deduction worksheet on webpage 94 of ones 2020 income tax return.

Average student loan interest deduction worth 188. Deductible interest from a student loan can be entered directly on screen 4 Adjustments line 20 line 33 in Drake18 and prior. The answer is yes subject to certain limits.

For 2016 the amount of your student loan interest deduction is gradu-ally reduced phased out if your MAGI is between 65000 and 80000 130000 and. Student loan interest is interest you paid during the year on a qualified student loan. Like other tax deductions the student loan interest deduction helps you by reducing how much of your income is taxed.

If you are single head of household or a qualifying widower your student loan interest phase-out starts at 70000 modified AGI and the phase-out ends at 85000. The student loan interest tax deduction can be tricky to calculate so we created this calculator to help current and former students estimate. 2019 Student Loan Interest Tax Rate Calculator.

Student loan interest deduction. For instance if youre single paid 1000 in deductible interest and had income of 72500 then youd only be able to deduct 500 of your interest because the deduction was. You may deduct the lesser of 2500.

It doesnt matter when the loan was taken out or whether interest payments made in earlier years on the loan were deductible or not. As an example using the student loan interest deduction. Student loan interest deduction.

Student Loan Interest Deduction Phases Out. Additionally the student loan interest deduction is only available up to 2500 per year for qualified student loans. Earnest variable interest rate student loan refinance loans are based on a publicly available index.

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

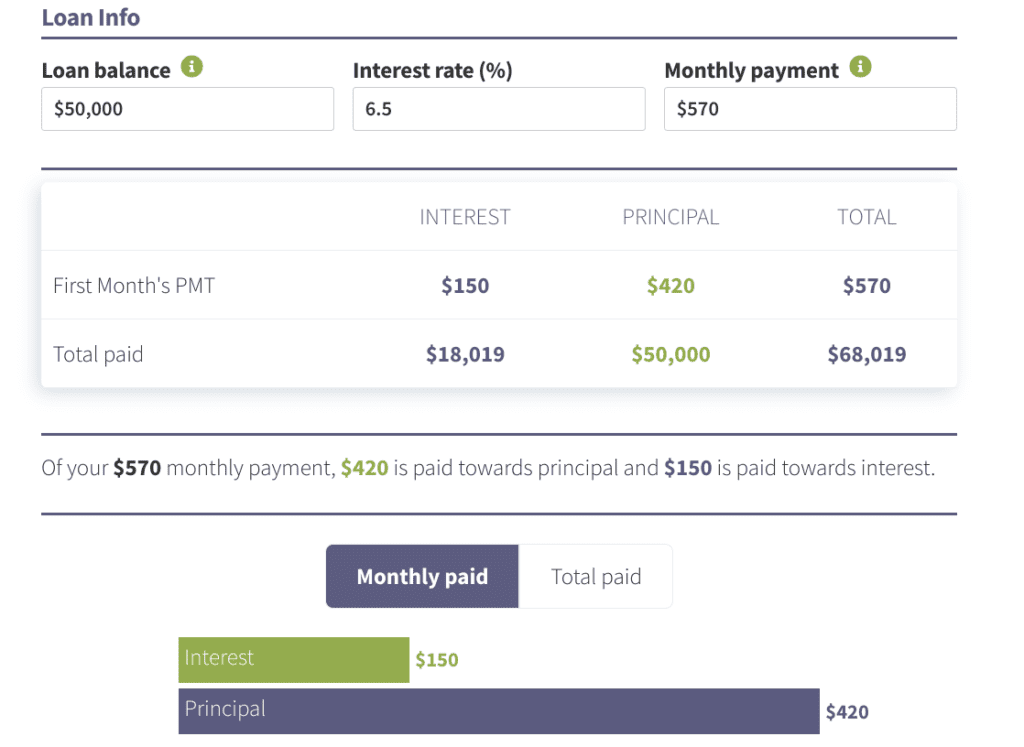

Student Loan Interest Calculator Student Loan Planner

Student Loan Interest Deduction Calculator Student Loan Hero

Survey Majority Of Student Loan Borrowers Don T Understand How Interest Works Student Loan Hero

![]()

How Much Student Loan Interest Is Deductible Payfored

Student Loan Interest Deduction Calculator Student Loan Hero

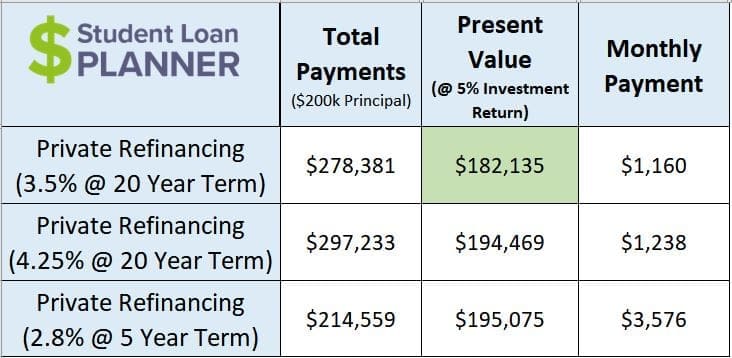

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

Should I Use Tax Credits Or Deductions To Save On My Student Loans

Student Loan Interest Deduction Calculator Student Loan Hero

How Does Student Loan Interest Work When Interest Compounds More

![]()

How Much Student Loan Interest Is Deductible Payfored

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Interest Deduction H R Block

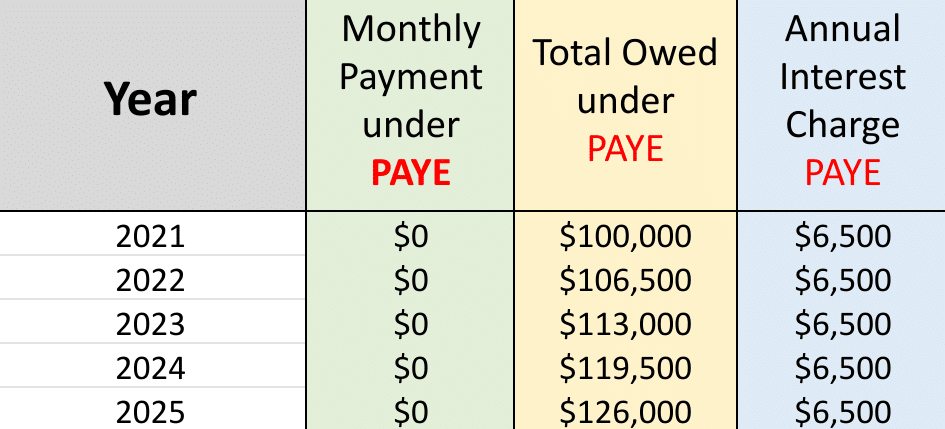

Biden Student Loan Payment And Interest Pause Extended What It Means

![]()

How Much Student Loan Interest Is Deductible Payfored

How To Claim Your Student Loan Interest Deduction

Is Student Loan Interest Tax Deductible Rapidtax

Student Loan Interest Deduction Calculator Student Loan Hero

Irs Late Payment Penalty Calculator Https Www Irstaxapp Com Irs Late Payment Penalty Calculator Calculator Tax Deductions Irs

Post a Comment for "Student Loan Interest Deduction Phase Out 2016 Calculator"