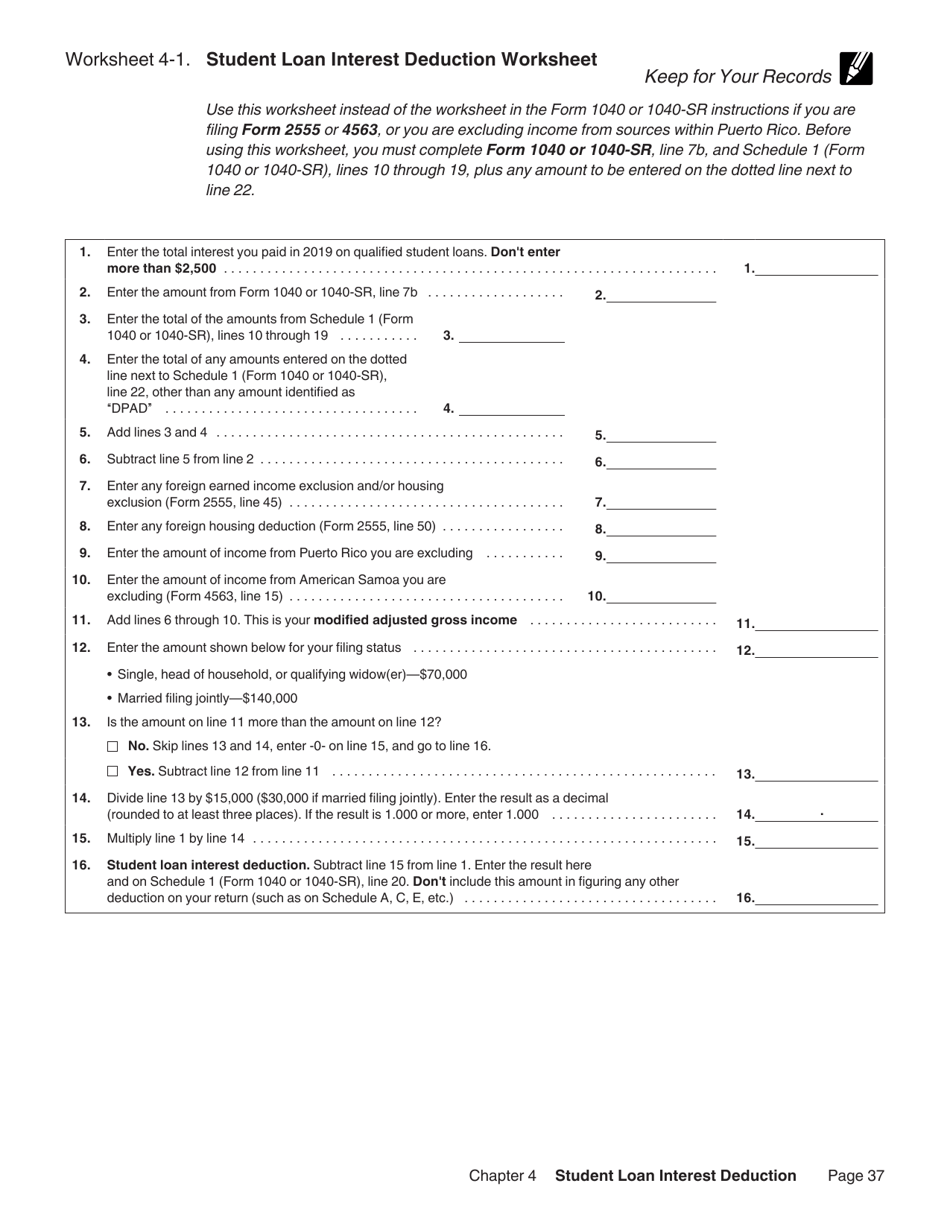

Student Loan Interest Deduction Worksheet 2019

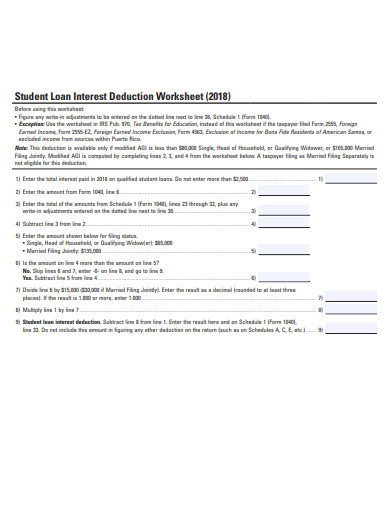

Student Loan Interest Deduction WorksheetSchedule 1 Line 33. For loans made on or after September 1 2004 box 1 must include loan origination fees.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

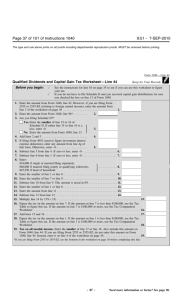

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Ad Answer a few questions to find your student loan refinance rate.

Student loan interest deduction worksheet 2019. Yes California does offer a student loan interest deduction. In this case your taxable income is lowered by the. The student loan interest tax deduction can be tricky to calculate so we created this calculator to help current and former students estimate.

June 1 2019 222 PM. Ad Read Expert Reviews Compare Your Private Student Loan Options. Refinance Parent Plus loans Spouse Loans Individual Student Loans.

The Comfort of a Simple Student Loan is Priceless. Form 1040 or 1040-SR Department of the Treasury. Where does student loan interest deduction go on 1040.

DO NOT FILE July 11 2019 DRAFT AS OF. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1 line 36 see the instructions for Schedule 1. You may deduct the lesser of 2500.

Ad Read Expert Reviews Compare Your Private Student Loan Options. Shows the interest received by the lender during the year on one or more student loans made to you. Can I claim student loan interest as a deduction for California.

Refinance Parent Plus loans Spouse Loans Individual Student Loans. Student loan interest is interest you paid during the year on a qualified student loan. Ad Check your eligibility quickly and apply easily on mobile or desktop.

Like other tax deductions the student loan interest deduction helps you by reducing how much of your income is taxed. The Student Loan Interest Deduction Act of 2019 aimed to increase the deduction to 5000 or 10000 for married taxpayers filing joint returns when it was introduced to. For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and.

Ad Answer a few questions to find your student loan refinance rate. Compare Online Save Money. Your deduction is gradually reduced if your modified AGI is 70000 but less.

The student loan interest deduction can be very valuable. You may be able to deduct student loan interest that you actually paid in 2019 on your income tax return. Qualified student loan interest deductions are reported on Form 1040 Schedule 1.

To claim the student loan deduction enter the allowable amount on line 20 of the Schedule 1 for your 2019 Form 1040. You must enter your. Compare Online Save Money.

You can claim the full 2500 student loan deduction if your modified AGI is 70000 or less. Student loan interest deduction. If youre in the 22 marginal tax bracket a 2500 student loan interest deduction translates to 550 in tax savings.

However you may not be able to deduct the full amount of interest reported on this. 2019 Student Loan Interest Tax Rate Calculator. It includes both required and voluntarily pre-paid interest payments.

The Comfort of a Simple Student Loan is Priceless. Ad Check your eligibility quickly and apply easily on mobile or desktop. A qualified student loan is any.

E-File Today Get Your Tax Refund. Your student loan interest deduction if you file Form 2555 2555-EZ or 4563 or you exclude income from sources within Puerto Rico. Ad Get Instantly Matched With the Ideal Student Loan Refinancing Option for You.

Loan Refinancing Can Saves You Thousands of Dollars by Replacing Existing College Debt.

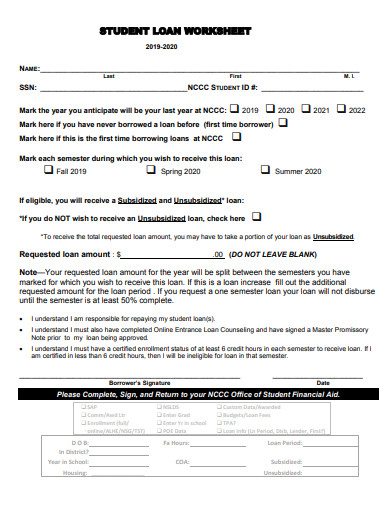

9 Loan Worksheet Templates In Pdf Doc Free Premium Templates

Learn How The Student Loan Interest Deduction Works

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

How To Claim Your Student Loan Interest Deduction

Student Loan Interest Deduction Worksheet Line 33

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

Student Loan Interest Deduction Worksheet 2020 Fill Online Printable Fillable Blank Pdffiller

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

Form Mnp Nol Dw Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Net Operating Loss Deduction Worksheet Ohio Templateroller

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

1040 Schedule 1 Drake18 And Drake19 Schedule1

Student Loan Interest Deduction Worksheet 2020 Fill Online Printable Fillable Blank Pdffiller

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign Printable Template Online Us Legal Forms

Student Loan Interest Deduction Worksheet Line 33

Student Loan Interest Deduction Worksheet Line 33

9 Loan Worksheet Templates In Pdf Doc Free Premium Templates

Post a Comment for "Student Loan Interest Deduction Worksheet 2019"