Employer Student Loan Repayment Program Cares Act

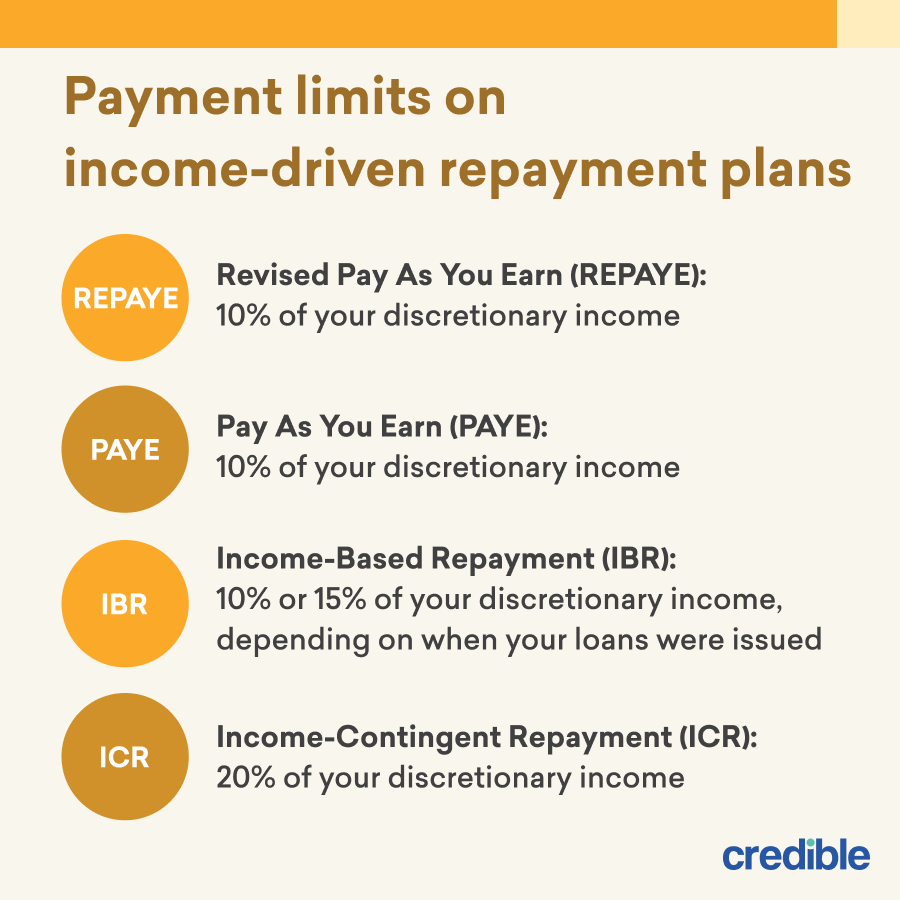

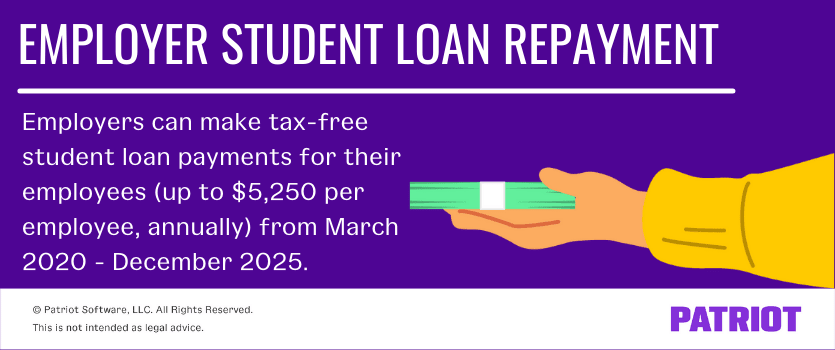

With the new CARES Act employers can pay up to 5250 toward student loans and this amount is tax free to the. Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in.

4 Loan Forgiveness Programs For Teachers Federal Student Aid

Ad Help Your Employees Pay Off Student Loans Faster with Loan Repayment Admin from ISTS.

Employer student loan repayment program cares act. The Coronavirus Aid Relief and Economic Security Act the CARES Act signed into law on March 27 2020 provides employers with a new mechanism to assist their. Click Now Apply Online. Federal Student Loan Consolidation and Forgiveness under the Obama Forgiveness Program.

Comprehensive Services Proven Technology and Expert Program Managers. Find Your Path To Student Loan Freedom. The Coronavirus Aid Relief and Economic Security Act CARES Act contains a temporary provision that provides tax-free status to employer-paid student loan repayment.

Under the Coronavirus Aid Relief and Economic Security CARES Act employers can now make nontaxable payments of. The CARES Act and student loan repayment. The 5250 that employees are permitted to receive.

The CARES Act provision allowing employers to contribute up to 5250 tax-free annually to their employees. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. The Coronavirus Aid Relief and Economic Security CARES Act of 2020 and its extensions include a provision that allows employers to provide.

127 which addresses employer-paid tuition benefits to cover student loan payments. The Coronavirus Aid Relief and Economic Security CARES Act signed into law in March 2020 temporarily allowed employers to provide up to 5250 in tax-exempt student loan. In addition to establishing the Paycheck Protection Program and Employee Retention Credit the CARES Act made employer student loan repayments tax-free until the end.

Comprehensive Services Proven Technology and Expert Program Managers. The Coronavirus Aid Relief and Economic Security Act the CARES Act provides a way for employers to help repay employee student loans with tax benefits for both the. The Coronavirus Aid Relief and Economic Security Act CARES Act provides numerous methods.

Ad Get a Low Payment Based on your Income and Get Forgiven after 240 Months. Read Expert Reviews Compare Student Loan Repayment Options. Ad Best Repayment Programs Compared Scored.

Essentially the CARES Act expands the scope of Sec. Easily Pay Your Student Loan Now. CARES Act Expands Employer-Paid Student Loan Debt Repayment.

The CARES Act initially provided that employers could pay for or reimburse up to 5250 of an employees student loans on a tax-free basis from March 27 2020 the date of. David Joffe Caleb L. Employer Student Loan Repayment - CARES Act.

Prior to the CARES Act employer-provided tuition assistance up to 5250 was tax exempt under Section 127 of the tax code but loan-repayment contributions were taxable. Ad Help Your Employees Pay Off Student Loans Faster with Loan Repayment Admin from ISTS. The CARES Act and Employer Student Loan Contributions Update 1227.

A notable aspect of the CARES Act in terms of student loans is a provision that allows employers to make tax-free payments of up to 5250 towards their employees student.

Student Loan Expert Calls Repayment System Frankenstein S Monster Student Loans Student Loan Repayment Repayment

Student Loan Forgiveness Statistics 2021 Pslf Data

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

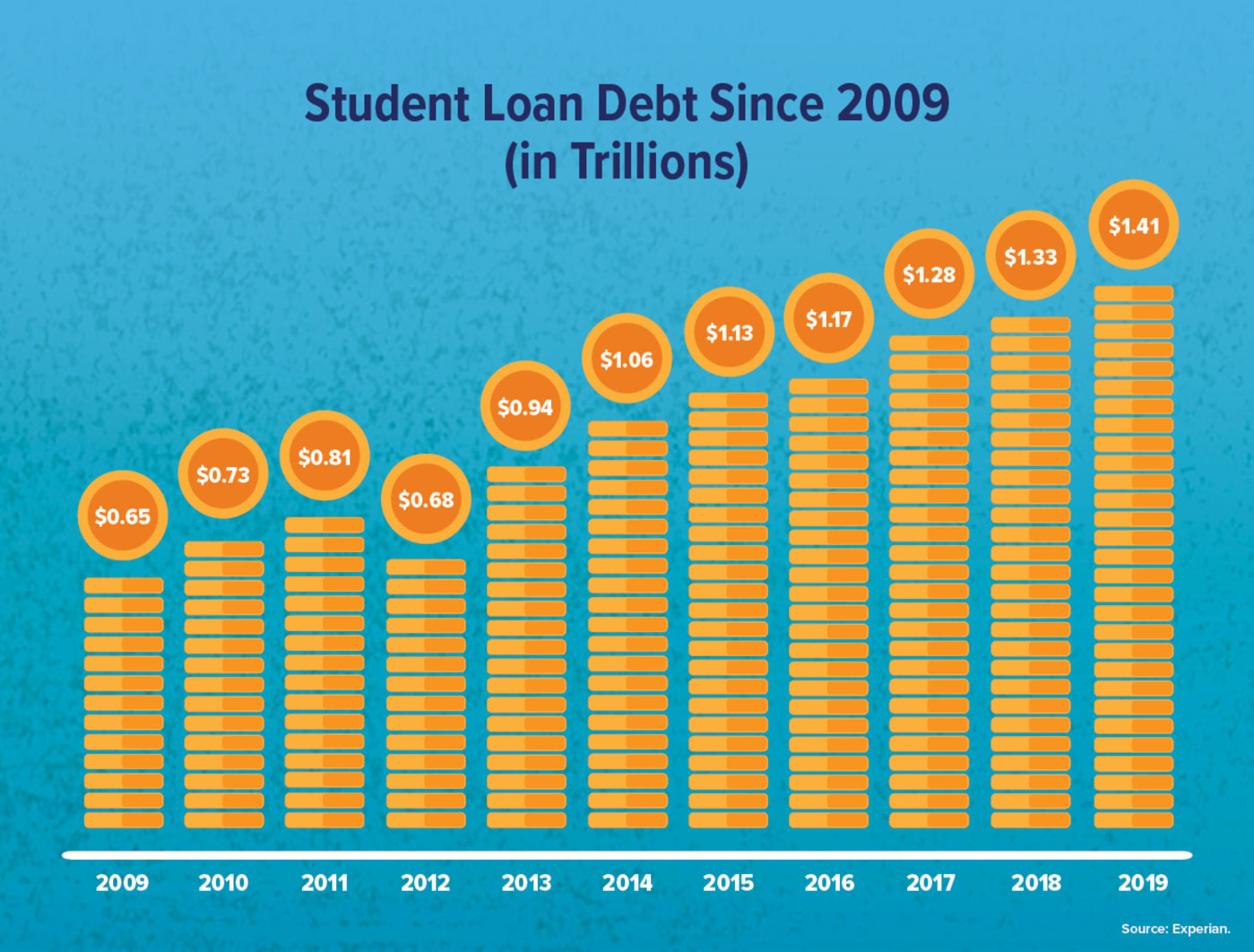

The Definitive Guide To Student Loan Debt

Student Loan Consolidation Calculator Simplify Your Loans Earnest

The Full List Of Student Loan Forgiveness Programs By State

Private Student Loan Forgiveness Alternatives Credible

Employer Student Loan Repayment Tax Free Benefit Q A

4 Loan Forgiveness Programs For Teachers Federal Student Aid

How Employers Can Help With Student Loan Debt Plansponsor

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

The Business Case For Employee Student Loan Repayment Programs

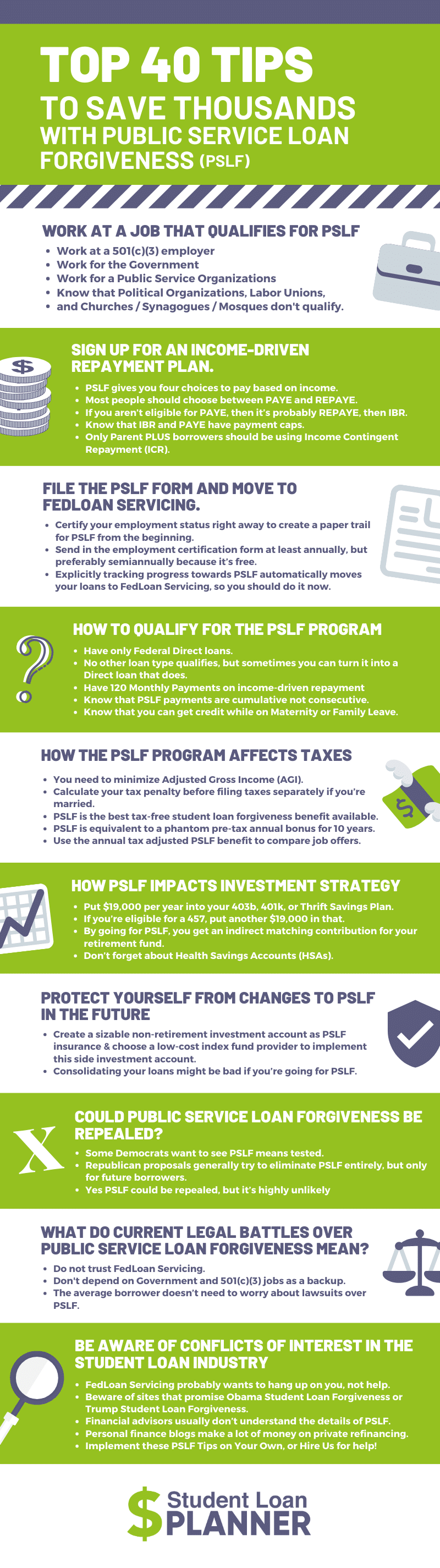

Public Service Loan Forgiveness 40 Tips To Save Thousands

6 Things To Know About Public Service Loan Forgiveness During Covid 19 Federal Student Aid

4 Loan Forgiveness Programs For Teachers Federal Student Aid

Student Loan Forgiveness And Deferment Military Benefits

What Is The Reserve Student Loan Repayment Program Air Reserve Personnel Center Article Display

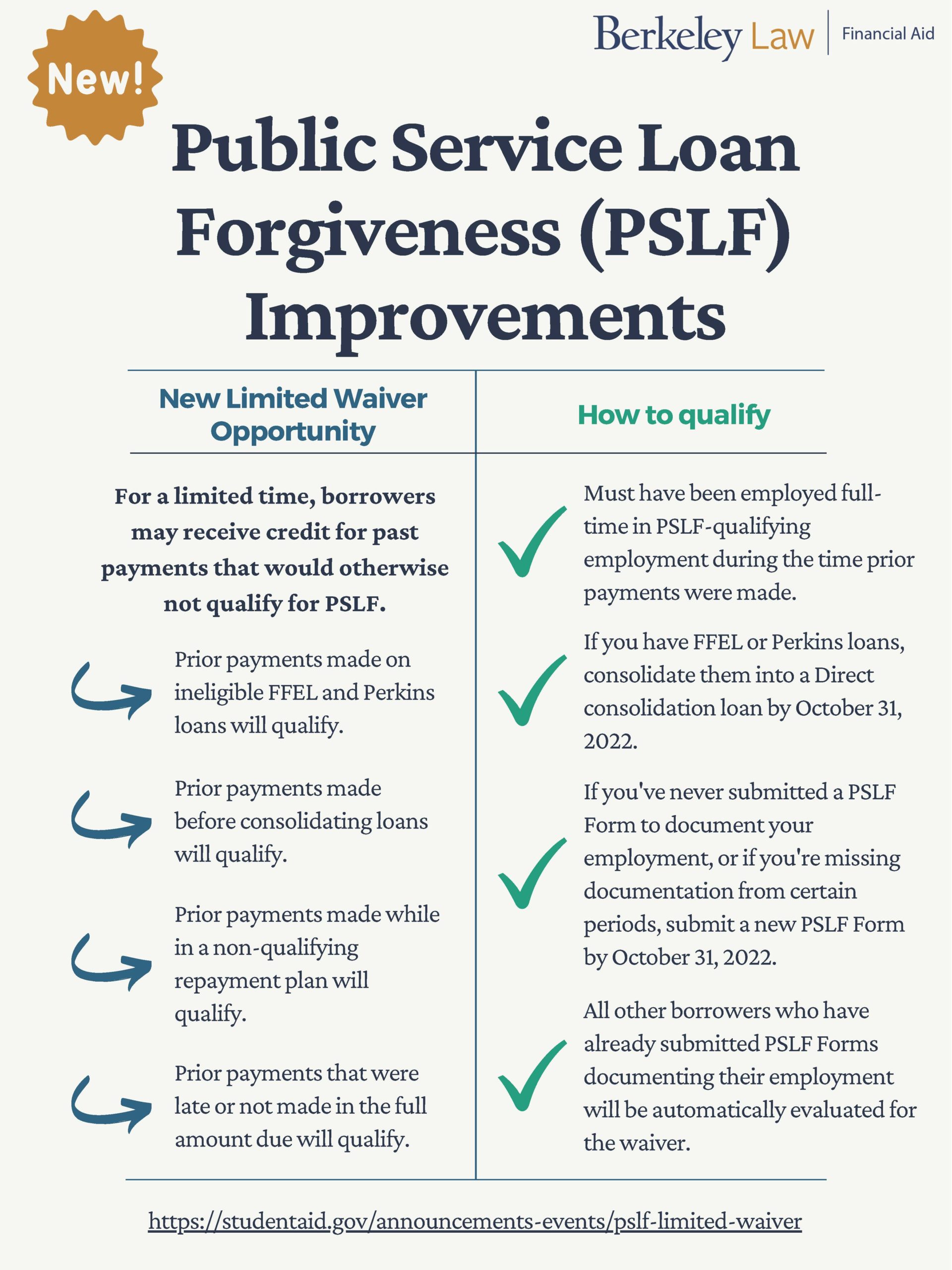

Covid 19 Student Loans Berkeley Law

Post a Comment for "Employer Student Loan Repayment Program Cares Act"