Cares Act Student Loan Forgiveness Employer

Ad Start Your Application for Income-Based Federal Benefits for Federal Student Loans. Employers That Help Pay Off Student Loans.

4 Loan Forgiveness Programs For Teachers Federal Student Aid

One effective way to do this is to help employees apply for loan.

Cares act student loan forgiveness employer. The CARES Act provision allowing employers to contribute up to 5250 tax-free annually to their employees. Ad Check your eligibility quickly and apply easily on mobile or desktop. Zlatar views the end of the CARES Act as an opportunity for employers to step up and support their workforce.

Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in. A growing number of employers offer student loan repayment assistance as a company benefit. Section 2206 of the CARES Act allows a portion of student loan payments to be excluded from income.

The CARES Act and Employer Student Loan Contributions Update 1227. Until the end of 2020 employers can. Private student loans qualify for this program.

In addition to establishing the Paycheck Protection Program and Employee Retention Credit the CARES Act made employer student loan repayments tax-free until the end. 748 3513 gives temporary relief to federal student loan borrowers in the form of. One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt.

Whether those payments are made directly to the employee or the. Ad Check your eligibility quickly and apply easily on mobile or desktop. A notable aspect of the CARES Act in terms of student loans is a provision that allows employers to make tax-free payments of up to 5250 towards their employees student.

The Coronavirus Aid Relief and Economic Security Act the CARES Act signed into law on March 27 2020 provides employers with a new mechanism to assist their. The CARES Act an economic stimulus bill signed by the president on March 27 2020 HR. Most tend to be large companies.

About 42 million Americans have federal student loans collectively owing. Allows companies to pay up to 5250 of employees student loan payments on a tax-free basis through Dec. Thanks to the CARES Act payments made to employees after March 27 2020 and before January 1 2021 under an educational assistance program may now be applied to the.

The CARES Act and the forgiveness of student loans.

The Complete List Of Student Loan Forgiveness Programs And Options Student Loan Hero

What S Changing In Student Loan Forgiveness And Do I Qualify Kxan Austin

The Full List Of Student Loan Forgiveness Programs By State

/iStock-469187462.college.grad.money-c61d58b7dd65417492484e1b0e34b522.jpg)

Student Loan Forgiveness Definition

Student Loans May Qualify For Federal Forgiveness

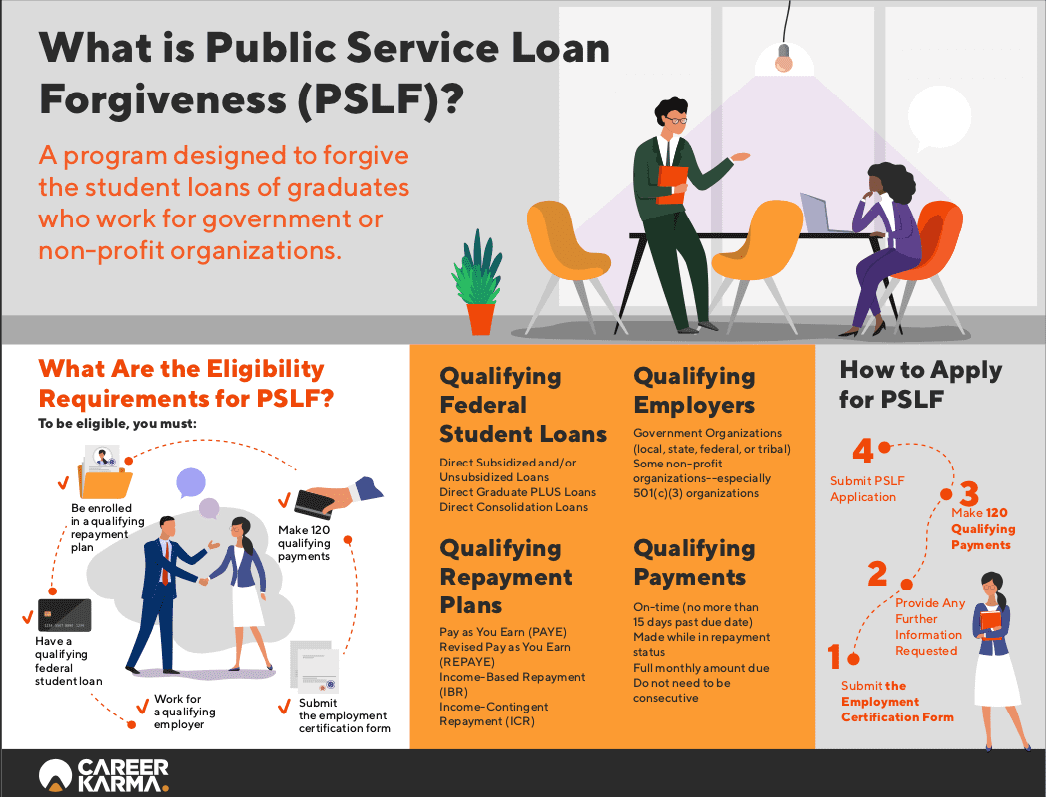

Public Service Loan Forgiveness The Definitive Guide Career Karma

Trump Student Loan Forgiveness Changes And Proposals

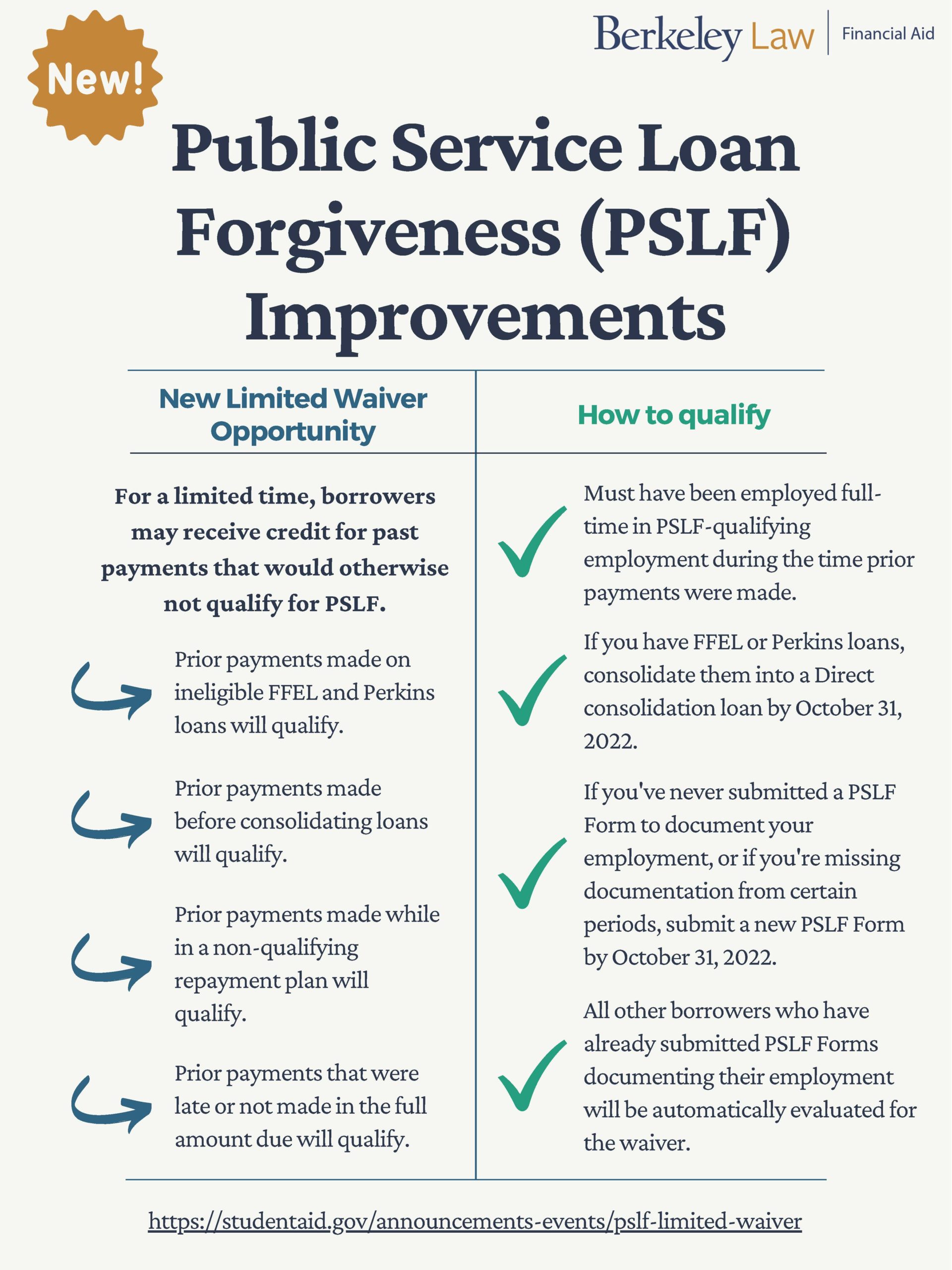

Covid 19 Student Loans Berkeley Law

6 Things To Know About Public Service Loan Forgiveness During Covid 19 Federal Student Aid

Student Loan Forgiveness And Deferment Military Benefits

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

Student Loan Forgiveness Here S Where Members Of Congress Stand

6 Things To Know About Public Service Loan Forgiveness During Covid 19 Federal Student Aid

Student Loan Forgiveness Statistics 2021 Pslf Data

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

4 Loan Forgiveness Programs For Teachers Federal Student Aid

4 Loan Forgiveness Programs For Teachers Federal Student Aid

6 Reasons Student Loan Forgiveness Might Not Be Worth It Student Loan Hero

How Private Student Loan Refinance And Consolidation Companies Can Hurt Your Employees My Education Solutions

Post a Comment for "Cares Act Student Loan Forgiveness Employer"