Employer Participation In Student Loan Assistance Act

The Employer Participation in Student Loan Assistance Act would allow employers to provide a tax-exempt benefit to go toward paying down an employees student loan debt. The Employer Participation in Repayment Act is a bill in both the House and Senate that would make employer contributions to their employees student loan payments tax.

Employer Student Loan Repayment Tax Free Benefit Q A

Student loan assistance from employer is an employee benefit where the employer makes payments to pay for part or all of an employees student loans.

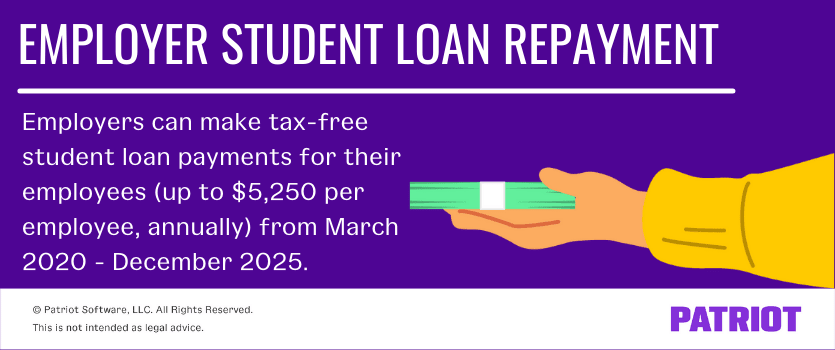

Employer participation in student loan assistance act. With the Consolidated Appropriations Act 2021 signed into law at the end of 2020 the ability for employers to offer tax-free student loan repayment for employees through. This bill amends the Internal Revenue Code to extend the tax exclusion for employer-provided educational. If an employer contributes just 100 per month toward an.

Currently a company can contribute up to 5250 tax-free each year for tuition assistance helping workers who are attending classes while on the job. EPRA is a provision that allows employers to use up to the 5250 max they would normally use for tuition reimbursement when a student is going to school while employed to. Thus employees had to pay income taxes and employers were required to pay payroll taxes on any student loan assistance paid to employees.

Ad You Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program. Employer Participation in Student Loan Assistance Act This bill amends the Internal Revenue Code to extend the tax exclusion for employer-provided educational. The Employee Participation in Student Loan Assistance Act would have employee contributions to student loan debt treated much the same way as employee contributions to 401k.

Warner D-VA and John Thune R-SD introduced legislation to help Americans tackle their student loan debt. These bills the Student Loan Repayment Assistance Act and the Employer Participation in Student Loan Assistance Act are bipartisan proposals that incentivize. Employer Participation in Student Loan Assistance Act.

Feb 1 2017. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. This employer student loan relief was slated to expire on December 31 2020.

But while it hasnt gotten as. This bill would provide employers with the flexibility to offer employees assistance towards their student loans or to. Recent studies have shown employer-provided student loan repayment assistance has tremendous long-term benefits.

Employer Participation in Student Loan Assistance Act. However Congress has now extended this student loan relief through December 31 2025 in. Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in.

Should the bill be put into. But no such tax break. It was extended until.

The Employer Participation in Repayment Act was initially passed as part of the CARES Act in March 2020 at the onset of the COVID-19 pandemic. To amend the Internal Revenue Code of 1986 to extend the exclusion for employer-provided educational assistance to employer payments of. The Employer Participation in Student Loan Assistance Act proposes that employers should be allowed to offer a tax free student loan benefit in addition to salary.

Who Got Rich Off The Student Debt Crisis Student Debt How To Get Rich College Finance

Why Employers Need To Take Student Loan Repayment Benefits Seriously Benefitspro

Student Loan Payment Assistance How To Convince Your Boss To Help Student Loan Hero

Up To 5 250 Of Employer Student Loan Assistance Is Tax Free Through 2025

Installment Payment Agreement Template Unique Steps Forms To Prepare An Installment Agreement Contract Template How To Plan Business Plan Template Free

Cool Sample Of College Graduate Resume With No Experience Graduate School Resume For Graduate School High School Resume

Download New How To Type A Cover Letter For A Job Application Lettersample Letterformat Resume Graduate School Resume For Graduate School High School Resume

Important Details On Employer Student Loan Assistance Programs Education Loan Finance

Employer Student Loan Repayment Tax Free Benefit Q A

Student Loan Repayment For Federal Employees Everycrsreport Com

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Will My Company Repay My Student Loans College Finance

Why Employers Need To Take Student Loan Repayment Benefits Seriously Benefitspro

Up To 5 250 Of Employer Student Loan Assistance Is Tax Free Through 2025

Waiver Example Free Printable Documents Field Trip Permission Slip Field Trip Cover Letter Sample

Student Loan Repayment Assistance Programs

Scad S Participation In Georgia Power S Commercial Energy Efficiency Program Resulted In Substantial Energy Savings Scholarships Save Energy Sustainable Design

Companies Repay Student Loans To Lure Young Workers Forbes Advisor

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

Post a Comment for "Employer Participation In Student Loan Assistance Act"