Phaseout Of Student Loan Interest Deduction

Student loan curiosity deduction phase-out. 80000 if filing single head of.

Can The Student Loan Interest Deduction Help You Citizens Bank

Student loan interest deduction.

Phaseout of student loan interest deduction. The deduction is gradually. The maximum amount of student loan interest you can deduct annually is 2500. Unfortunately the deduction is phased out if your.

The answer is yes subject to certain limits. Unfortunately the deduction is phased out if your adjusted gross income AGI. The deduction is phased out if your adjusted gross income AGI exceeds certain levels.

The student loan interest deduction can reduce your taxable income by up to 2500 There is a phaseout for the Student loan interest deduction which means the amount. The maximum amount of student loan interest you can deduct each year is 2500. Student loan curiosity deductions can partially scale back the curiosity paid on student loans every year.

The maximum student loan interest deduction is 2500. The maximum amount of student loan interest you can deduct each year is 2500. Your MAGI impacts how much you can deduct once it reaches a certain amount the 2500 deduction begins to.

For instance in case your. 3 rows For single filers once your MAGI hits 70000 the deduction begins to phase out meaning the. 5 rows You can deduct up to 2500 in student loan interest or the actual amount of interest you paid.

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. Your MAGI impacts how much you can deduct --. If you qualify the amount you can deduct will depend on these factors.

The Student Loan Interest Deduction phases out at 70000 to 85000 for single taxpayers and 145000 to 175000 for married taxpayers who file a joint return. It includes both required and voluntarily pre-paid interest payments. It doesnt matter when the loan was taken out or whether interest payments made in earlier years on the loan were deductible or not.

For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and. You can claim student loan interest on your taxes however the student loan interest deduction begins to phase out if your adjusted gross income AGI is. Student Loan Interest Phaseout Adjusted Gross Incomes.

In 2021 the deduction will be unavailable to you if your modified AGI is higher than 85000 for Single Head of. The deduction is phased out if your adjusted gross income AGI exceeds certain levels. If you are single head of household or a qualifying widower your student loan interest phase-out starts at 70000 modified AGI and the phase-out ends at 85000.

The maximum amount of student loan interest you can deduct each year is 2500. The amount of interest you paid on your student loans.

New Proposed Bill To Pay Student Loans With 401k Plans Kemberley Washington Cpa

The Student Loan Interest Deduction Explained Student Debt Warriors

Student Loan Interest Deduction What It Is How To Claim Benzinga

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

![]()

How Much Student Loan Interest Is Deductible Payfored

Is Student Loan Interest Tax Deductible Rapidtax

Student Loan Interest Deduction How Much Can I Save In 2022

Back To School Myths The Student Loan Interest Deduction Is Gone

Can The Student Loan Interest Deduction Help You Citizens Bank

Publication 970 Tax Benefits For Higher Education Chapter 3 Student Loans Student Loan Interest Deduction

Learn How The Student Loan Interest Deduction Works

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

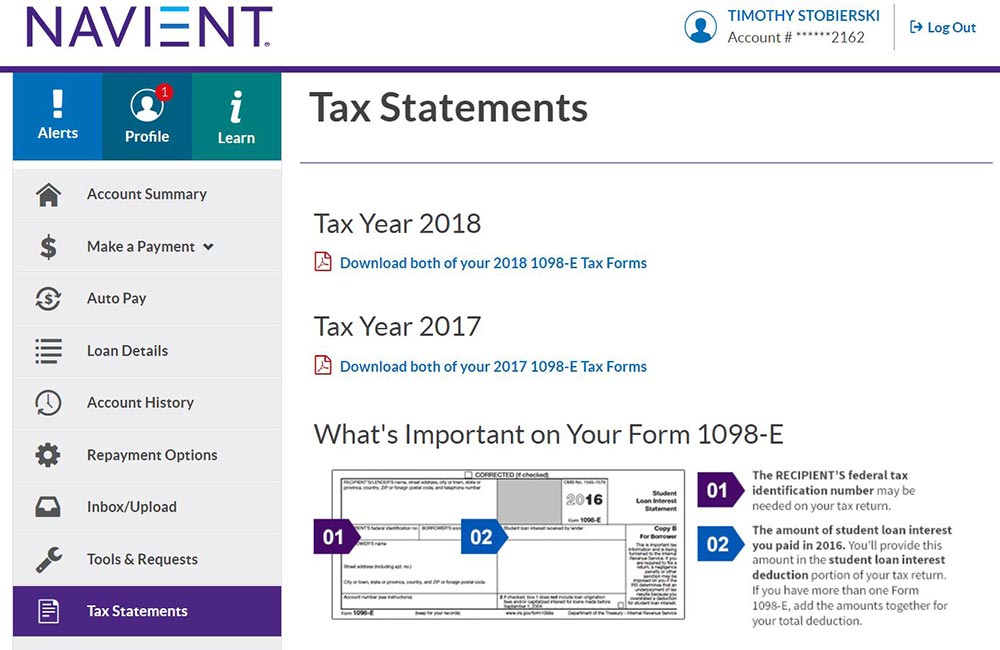

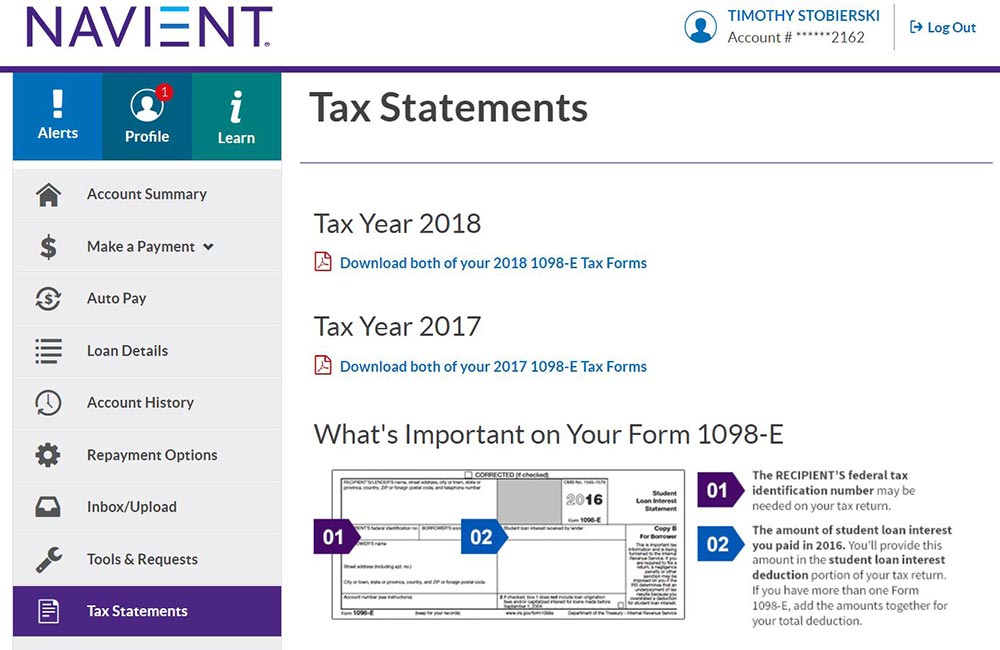

Two Student Loan Providers One 1098 E

Publication 970 Tax Benefits For Higher Education Chapter 3 Student Loans Student Loan Interest Deduction

![]()

How Much Student Loan Interest Is Deductible Payfored

Learn How The Student Loan Interest Deduction Works

Student Loan Debt And Your Taxes Deductions Cancellation Of Debt The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Student Loan Interest Deduction How Much Can I Save In 2022

Family And Education Tax Breaks Make Raising Kids Less Costly Jackson Fox Pc Ardmore Ok

Post a Comment for "Phaseout Of Student Loan Interest Deduction"