How Does Student Loan Tax Deduction Work

Average student loan interest deduction worth 188. Ad Lower Your Monthly Payment Fast and Save.

Learn How The Student Loan Interest Deduction Works

And you can deduct that on your taxes.

How does student loan tax deduction work. How Do Tax Deductions Work on Student Loans. This deduction reduces your taxable. Your student loan deduction is gradually reduced if your modified AGI is more than 140000 but less than 170000.

To claim the student loan deduction enter the allowable amount on line 20 of the Schedule 1 for your 2019 Form 1040. How does the student loan interest deduction work. If youve been paying so much in student loan debt that Sallie Mae seems like that smelly college roommate who just wouldnt go away take some.

Student loan interest can quickly add up. The interest deduction is only available for interest the parent pays on a qualifying loan not for any interest the child-student may pay on a loan he or she may have taken out. You can claim the deduction if all of the following apply.

The tax deduction works where you get a form from your loan servicer at the end of the year and it tells you how much you paid on student loan interest. If you made interest rate. You claim this deduction as an adjustment to income so you dont need to itemize your deductions.

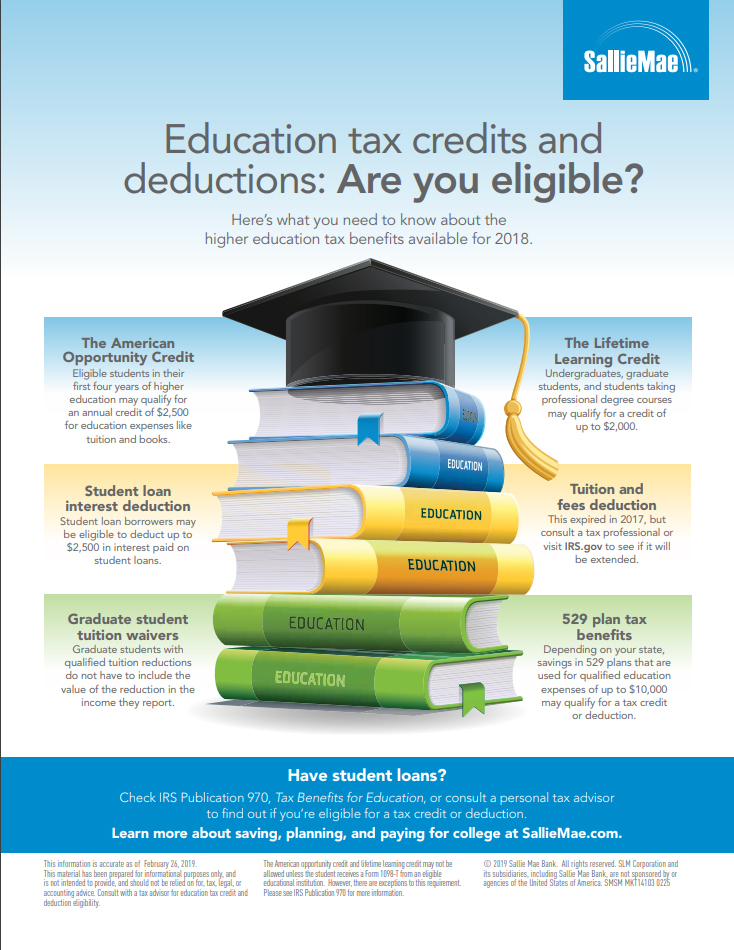

Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out. The maximum amount of student loan interest you can deduct each year is 2500. The student loan interest deduction is one tax break that mitigates the costs of a higher education by lowering your federal taxable income by up to 2500.

You can take it without itemizing or take the standard deduction as. The student loan tax deduction is classified as an above-the-line deduction. The student loan interest deduction can be claimed above the line as an adjustment to income.

But how much is the student loan interest deduction worth. In your scenario it is not a tax-free payment and the employer is not using the CARES provision correctly it is simply a taxable bonus that is included on your W-2 and you pay. Unfortunately the deduction is phased out if your adjusted gross income AGI exceeds.

You cant claim a deduction if your modified AGI is 170000. One of the main ways that the government tries to help ease the mounting burden of student loans is to offer a student loan deduction. If you paid less than 2500 in student loan interest the amount of your deduction is based on the total amount you paid.

If your MAGI is 70000 or above youll have to calculate the amount of disallowed interest. You can deduct student loan interest from your taxable income. You paid interest on a.

Youll enter the actual amount of interest paid or 2500 whichever is less on Schedule 1 line 20. If youre repaying college loans you may well be able to take up to 2500 in interest. Tax code allows you to deduct up to 2500 in student loan interest on your tax return every year depending on how much you paid.

This means you dont have to itemize your taxes in order to claim the deduction. And what are the income limits to b. Where does student loan interest deduction go on 1040.

Pay day advance loans Ideas on how to Determine Student Loan Interest Deduction. Like other tax deductions the student loan interest deduction helps you by reducing how much of your income is taxed. Ad Lower Your Monthly Payment Fast and Save.

Since its an above. Student Loan Interest.

Learn How The Student Loan Interest Deduction Works

How To Deduct Student Loan Interest On Your Taxes 1098 E Federal Student Aid

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

5 Ways To Pay Off Your Student Loans Faster Federal Student Aid

Are Student Loans Tax Deductible Rules Limits Guide Sofi

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

Is Student Loan Interest Tax Deductible Rapidtax

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Survey Majority Of Student Loan Borrowers Don T Understand How Interest Works Student Loan Hero

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Higher Education Tax Benefits Do You Qualify Business Wire

Can The Student Loan Interest Deduction Help You Citizens Bank

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

How Does Student Loan Interest Work When Interest Compounds More

Learn How The Student Loan Interest Deduction Works

Can The Student Loan Interest Deduction Help You Citizens Bank

How To Claim Your Student Loan Interest Deduction

Post a Comment for "How Does Student Loan Tax Deduction Work"