I Paid Off My Student Loan Can I Claim It On My Taxes

Ad Read Expert Reviews Pay Back Your Student Loan Easily. It allows eligible filers who paid interest on a qualified student.

How To Claim Your Student Loan Interest Deduction

So you can also take the standard deduction.

I paid off my student loan can i claim it on my taxes. Click Now Apply Online. Who can claim interest paid on student loans. Please enter the information.

You cant claim the loan itself but the interest you paid during the year on a qualified student loan used to pay for tuition fees room and board books and supplies for. You can claim the deduction if all of the following apply. Who is Eligible for a Student.

The Student Loan Interest Deduction is a tax deduction provided by the IRS that allows taxpayers to deduct up to 2500 from their taxable income based on interest paid during the tax year on. There are a few situations in which someone else may pay your student loans off for you. You can take this deduction without itemizing.

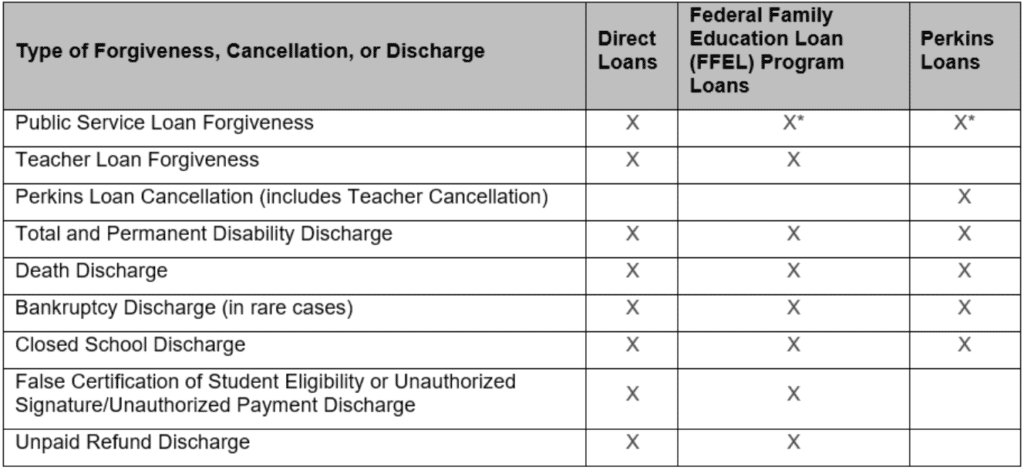

Click Now Apply Online. 1 So individuals who fall in the 22. If you have federal student loans and can qualify for the federal Public Service Loan Forgiveness program the government will forgive your remaining.

Here are the rules that determine who can claim a deduction for student loan interest. Take note that if your parents took out the student loan in their name they would have to claim the. However you may be able to claim interest youve paid when you file your taxes if you take out a loan or accrue credit card charges to finance business expenses.

Because this is a tax deduction and not a. You claim this deduction as an adjustment to income so you dont need to itemize your deductions. Ad Read Expert Reviews Pay Back Your Student Loan Easily.

The student loan interest deduction allows you to write off up to 2500 per year from your taxes in student loan interest payments. Luckily student loans are considered for taxes and you can claim any interest you pay for eligible loans on your tax return as a nonrefundable credit. When a student loan is refinanced or multiple loans are consolidated all of the capitalized interest is considered paid by the proceeds from the new loan.

Just paid lump sum 27000 to pay off my student loan. You paid interest on a. You cant be a dependent or use the tax filing status married filing separately If.

Had to share with someone as I dont want to come off as boasting to my friend group a lot of them struggling with loans. One of these is the student loan interest deduction which allows for the deduction of up to 2500 of the interest paid on a student loan during the tax year. In this case you can claim a deduction us 80E for AY 2019-20 to AY 2026-27 ie.

In other words student loans can be paid off by family members or non-relatives without paying any gift tax as long as you file the proper paperwork. When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational. The student loan interest deduction is a tax break you may be able to claim on your federal income tax return.

Its a generous impulse but choosing to pay down your childs student debts does have a few possible ramifications that you should be aware of before you start writing checks to lenders. Heres some good news. But there may be tax consequences to paying off student loans.

Learn How The Student Loan Interest Deduction Works

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Can I Deduct Student Loan Interest On My Taxes If The Loan Was From A Non Us Bank

Are Student Loans Tax Deductible Rules Limits Guide Sofi

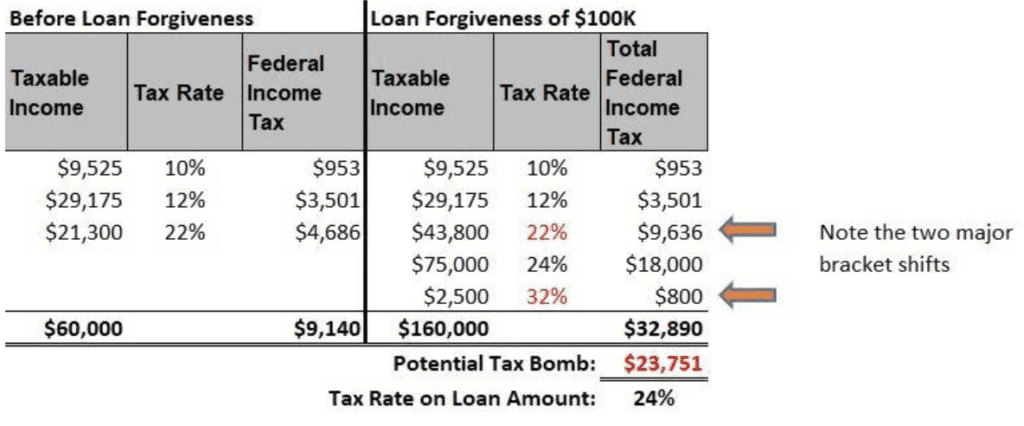

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Is Student Loan Forgiveness Taxable It Depends

Obtaining Cash For College Nowadays Seems All But Inescapable For Everybody But The Most Afflue Student Loan Forgiveness Student Loans Paying Off Student Loans

How Can I Stop Student Loans From Taking My Taxes

How To Deduct Student Loan Interest On Your Taxes 1098 E Federal Student Aid

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Learn How The Student Loan Interest Deduction Works

Student Loan Wage Garnishment And Tax Refund Debt Com

How They Paid Off 200k Of Student Debt In 19 Months Student Loans Student Debt Money Management

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Student Loans May Qualify For Federal Forgiveness

Tax Credits And Deductions For A College Education Education College Tax Credits Tax Deductions List

Can Debt Forgiveness Cause A Student Loan Tax Bomb Turbotax Tax Tips Videos

Student Loan Tax Deductions Education Credits Save On Your Taxes

Post a Comment for "I Paid Off My Student Loan Can I Claim It On My Taxes"