Maximum Income To Deduct Student Loan Interest

You cant claim the deduction if your MAGI is 85000 or more 170000 or more if you file a joint return. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans.

How To Claim Your Student Loan Interest Deduction

The maximum amount of student loan interest you can deduct each year is 2500.

Maximum income to deduct student loan interest. When your modified adjusted gross income MAGI reaches the yearly limit for your tax filing status the deduction. According to IRS student loan rules you are not eligible if your Modified Adjusted Gross Income MAGI is more than 80000 per year or 165000 if you file a joint return. The student loan interest deduction allows you to deduct up to 2500 on your federal income tax return for the loan interest you paid during the year.

Heres how it works. The maximum amount of student loan interest you can deduct each year is 2500. For tax year 2019 the taxes you file in 2020 the MAGI threshold was increased to 70000 for single filers.

The deduction is reduced for taxpayers with modified adjusted gross incomes MAGIs in a certain phaseout range and is eventually eliminated entirely if your MAGI is too high. Taxpayers can deduct interest paid on student loans in full or in part with a qualifying credit card. The maximum amount of student loan interest you can deduct each year is 2500.

The maximum amount of student loan interest you can deduct each year is 2500. In addition to a deduction limit there are rules regarding how much money you can earn to use the student loan interest deduction. The answer is yes subject to certain limits.

The deduction is phased out if your adjusted gross income AGI exceeds certain levels. If you qualify you can deduct up to 2500 of student loan interest per year. For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and 170000 if you file a joint return.

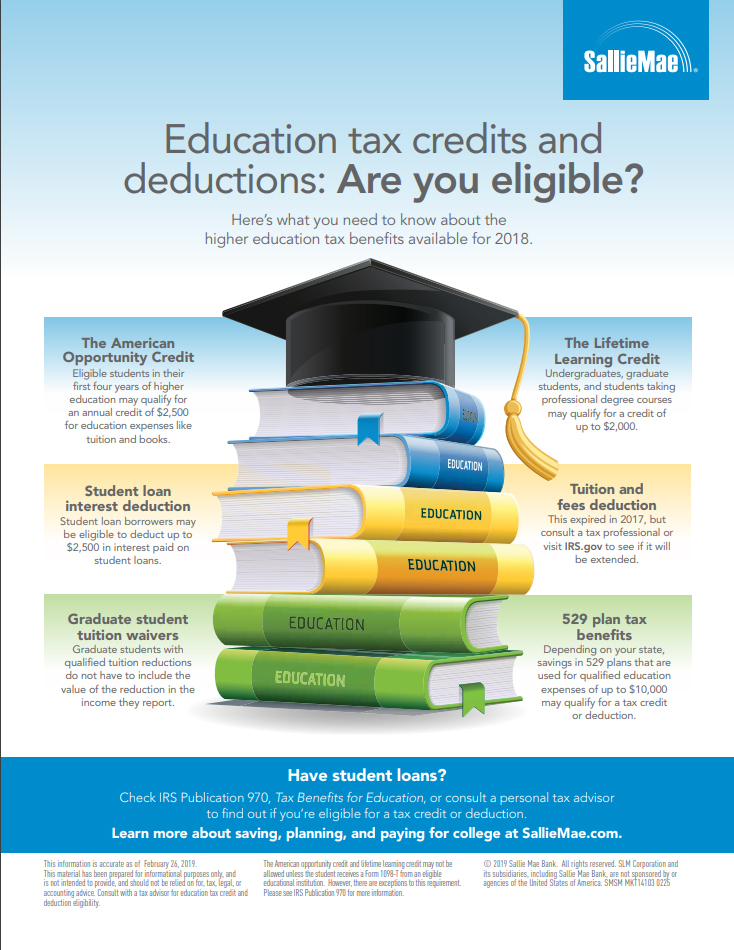

Refinance Parent Plus loans Spouse Loans Individual Student Loans. It allows eligible filers who paid interest on a qualified student loan during a tax year to deduct up to 2500 from their taxable income. The student loan interest deduction is available for both private and government student loans.

If you received money from an employer-sponsored student loan repayment program after March 27 2020 it is not taxable income. Unfortunately the deduction is phased out if your adjusted gross income AGI exceeds certain levels and as. The largest amount you can claim for a student loan interest deductible is 2500 for 2021 but that is limited by your income eligibility.

Income limitations when it comes down to student loan interest deduction You qualify for the deduction if for example the changed adjusted gross income MAGI is actually 70000 or significantly less for a single filer and 140000 or much less for those of you with married processing joint standing. It includes both required and voluntarily pre-paid interest payments. The exact amount you can deduct depends on how much interest you paid and your income.

The interest must be for a qualified education loan which means a debt incurred to pay tuition room and board and related expenses to attend a post-high school educational institution including certain vocational schools. If your MAGI was between 70000 and 85000 170000 if filing jointly you can deduct less than than the maximum 2500. For 2020 the deduction is phased out for taxpayers who are married filing jointly with AGI between 140000 and 170000 70000 and 85000 for single filers.

Income limits for claiming the deduction For your 2020 taxes which you will file in 2021 the student loan interest deduction is worth up to 2500 for a single filer head of household or qualifying widower with MAGI of. Is student loan interest deductible in 2021. For 2021 the deduction is phased out for married couples filing jointly with AGI between 140000 and 170000 70000 and 85000 for singles.

You can claim student loan interest on your taxes however the student loan interest deduction begins to phase out if your adjusted gross income AGI is. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. Unfortunately the deduction is phased out if your adjusted gross income AGI exceeds certain levels and as.

Its between 140000 and 170000 if you file a joint return in 2021 rising to 145000175000 in 2022. Student loan interest deduction. So if your MAGI was 70000 or less in 2019 and your tax filing status is single you could potentially deduct the full amount of qualified student loan interest you paid up to a maximum of 2500.

It can be limited by your income. 80000 if filing single head of household or qualifying widow er 165000 if married filing jointly. The maximum student loan interest deduction you can claim is 2500 as of the 2020 tax year and it might be less.

The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the annual limit for your filing status. You may have paid more interest than that during the year but that is the limit of your claim. Student loan interest is deductible if your modified adjusted gross income or MAGI is less than 70000 140000 if filing jointly.

The maximum amount of student loan interest you can deduct annually is 2500. The amount of deductible interest depends on the number of remaining monthly payments at the end of the year. The student loan interest deduction allows you to subtract up to 2500 from your taxable income for interest paid on student loans.

9 You cant claim the deduction if your MAGI is above the maximum amount. Ad Answer a few questions to find your student loan refinance rate. The deduction is phased out if your adjusted gross income AGI exceeds certain levels.

It can be limited by your income.

Ecsi Student Loan Tax Incentives

Student Loan Interest Deduction How Much Can I Save In 2022

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

Student Loan Interest Deduction Definition

Learn How The Student Loan Interest Deduction Works

Can The Student Loan Interest Deduction Help You Citizens Bank

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

Can I Deduct My Student Loan Interest The Motley Fool

Student Loan Interest Deduction How Much Can I Save In 2022

Are Student Loans Tax Deductible Rules Limits Guide Sofi

Is Student Loan Interest Tax Deductible Rapidtax

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

Learn How The Student Loan Interest Deduction Works

Can The Student Loan Interest Deduction Help You Citizens Bank

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

Learn How The Student Loan Interest Deduction Works

Higher Education Tax Benefits Do You Qualify Business Wire

Income Based Repayment Of Student Loans Plan Eligibility

Student Loan Tax Deductions Education Credits Save On Your Taxes

Post a Comment for "Maximum Income To Deduct Student Loan Interest"