Student Loan Interest Deduction 2018 Income Limit

In order to qualify for the student loan interest. Compare Rates Save Money.

Higher Education Tax Benefits Do You Qualify Business Wire

Student loan interest deduction.

Student loan interest deduction 2018 income limit. The deduction is gradually reduced and eventually eliminated by phaseout when your modified. For 2018 the amount of your student loan interest deduction is gradually re-duced phased out if your MAGI is between 65000 and 80000 135000 and. Not all loans will.

The answer is yes subject to certain limits. The maximum amount of student loan interest you can deduct each year is 2500. Compare Rates Save Money.

If your MAGI is above 80000 for a single person or 165000 for a married couple filing jointly youre out of luck no deduction. The exact amount you. The student loan interest deduction allows you to deduct up to 2500 on your federal income tax return for the loan interest you paid during the year.

The maximum amount of student loan interest you can deduct each year is 2500. Do my student loan payments qualify as a tax deduction for social security. Ad The Comfort Of a Simple Loan Refinance Is Priceless.

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. Ad Check your eligibility quickly and apply easily on mobile or desktop. 51 rows 2018 Student Loan Interest Tax Rate Calculator.

The l imits maximum income modified adjusted gross income MAGI for the student loan interest deduction is. Ad The Comfort Of a Simple Loan Refinance Is Priceless. Apply In Just 3 Minutes To Get A Personalized Student Loan Instant Decision.

Unfortunately the deduction is phased out if your. The maximum amount of student loan interest you can deduct each year is 2500. Ad Competitive Interest Rates And Various Repayment Options To Fit Your Student Loan Budget.

The student loan interest tax. Student loan interest deduction. Is student loan interest itemized deduction 2018.

The answer is yes subject to certain limits. Ad Check your eligibility quickly and apply easily on mobile or desktop. Unfortunately the deduction is phased out if your adjusted gross income AGI.

And the amount of the deduction will be reduced. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans. 165000 if married filing a joint return.

Apply In Just 3 Minutes To Get A Personalized Student Loan Instant Decision. For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and. Unfortunately the deduction is phased out if your.

The maximum student loan interest deduction limit is 2500 as of the current 2018 tax year even if you paid more to your student loans in a given year. Ad Competitive Interest Rates And Various Repayment Options To Fit Your Student Loan Budget. The answer is yes subject to certain limits.

You can deduct up to 2500 in student loan interest or the actual amount of interest you paid whichever is less if your MAGI is under the threshold where the phaseout.

Learn How The Student Loan Interest Deduction Works

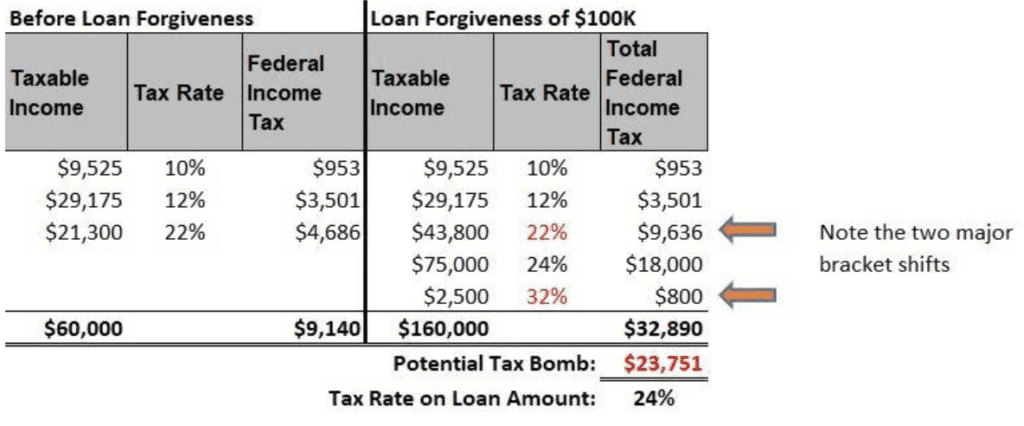

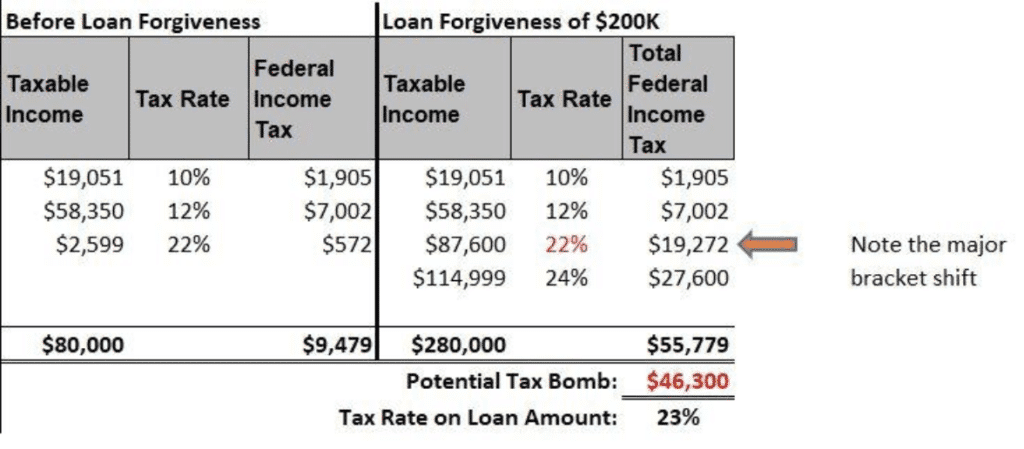

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

![]()

How Much Student Loan Interest Is Deductible Payfored

Student Loan Interest Deduction How Much Can I Save In 2022

How To Claim Your Student Loan Interest Deduction

Can I Deduct My Student Loan Interest The Motley Fool

Can The Student Loan Interest Deduction Help You Citizens Bank

Income Tax Exemptions Fy 2017 18 List Of Important It Deductions For Ay 2018 19 Income Tax Tax Deductions List Tax Deductions

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

![]()

How Much Student Loan Interest Is Deductible Payfored

Learn How The Student Loan Interest Deduction Works

Can The Student Loan Interest Deduction Help You Citizens Bank

![]()

How Much Student Loan Interest Is Deductible Payfored

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

Pub 17 Chapter Pub 4012 Tab E Federal 1040 Lines 23 37 Ppt Download

Is Student Loan Interest Tax Deductible Rapidtax

Student Loan Interest Deduction How Much Can I Save In 2022

Post a Comment for "Student Loan Interest Deduction 2018 Income Limit"