Dependent Student Loan Interest Deduction

If your student is required to file their own return you can still claim. Student loan interest can quickly add up.

Learn How The Student Loan Interest Deduction Works

The interest deduction is only available for interest the parent pays on a qualifying loan not for any interest the child-student may pay on a loan he or she may have taken out.

Dependent student loan interest deduction. Neither of you can deduct the loan interest if both of these are true. The interest deduction is only available for interest the parent pays on a qualifying loan not for any interest the child-student may pay on a loan he or she may have taken out. In this case the interest deduction is only available for interest the parent pays on a qualifying loan not for any of the interest the child may pay on a loan the student may have.

But if your loans are in your name and you are not a. Can I claim my students income on my tax return. It can be limited by your income.

If your parents are required to pay the loan interest or they claim you as their dependent you cant claim the deduction. For example say a parent is paying for the college education of a child whom the parent is claiming as a dependent. Heres how it works.

Only the person whose name is on the student loan and who is legally obligated to pay the loan can deduct the student loan interest. Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out. David files as a qualified widower with a dependent child.

You cant deduct qualified student loan interest payments you paid on a loan in your dependents name. The student loan interest deduction allows you to subtract up to 2500 from your taxable income for interest paid on student loans. If you made interest rate.

The amount of student. Unfortunately the deduction is phased out if your adjusted gross income AGI. The maximum student loan interest deduction you can claim is 2500 as of the 2020 tax year and it might be less.

You cant deduct as interest on a student loan any in-terest paid by your employer after March 27 2000 and before January 1 2026 under an educational as-sistance program. The maximum amount of student loan interest you can deduct each year is 2500. It can be limited by your.

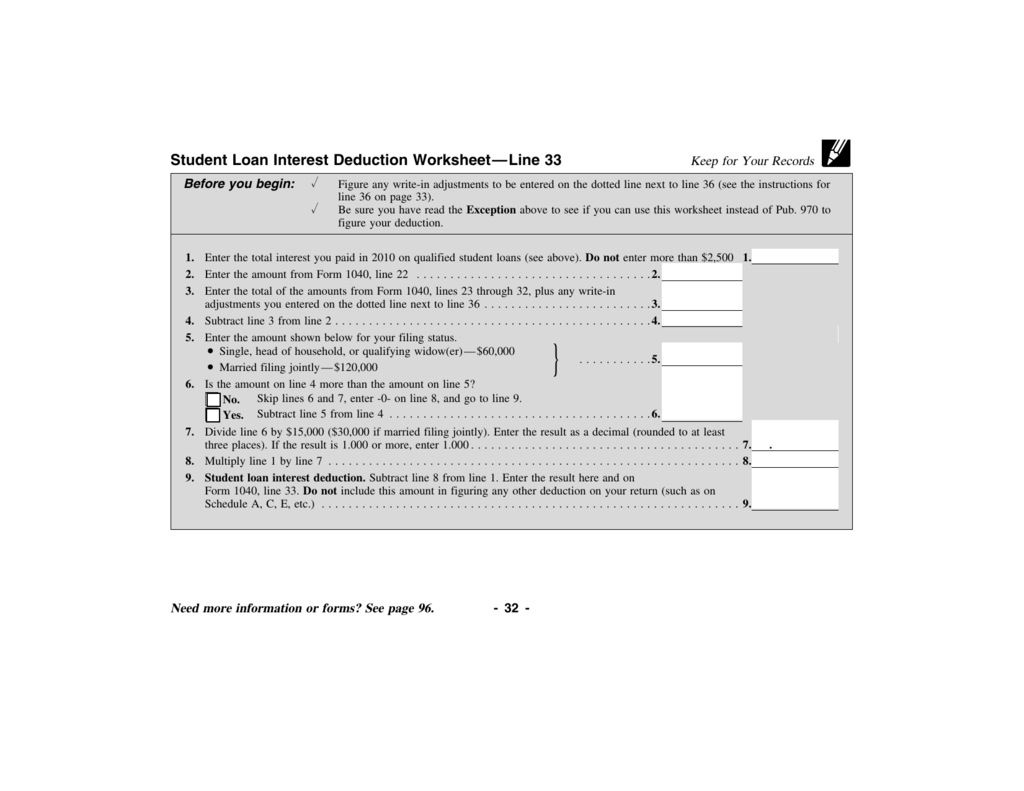

His modified AGI for the year was 83000 line 4 of the Student Loan Interest Deduction Worksheet. The deduction is gradually reduced and eventually eliminated by phaseout when your modified. If you did not sign or co-sign for the loan you.

In this case the interest deduction is only available for. You may take the deduction if all four of the following apply. Read more about the student loan interest deduction here.

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. The only student loans that qualify for the student loan interest deduction are those that are for the benefit of you your spouse or your dependent and spent on qualifying. You paid interest during the year on a qualified student loan any loan you took out to pay the qualified higher.

To claim the student loan interest deduction the borrower must be 1 legally obligated to make the payments on the student loans this includes co-signers who are legally. Student Loan Interest Deduction is a tax deduction for interest paid on post-secondary education loans during the tax year in the US the deduction amount being the.

Is Student Loan Interest Tax Deductible Rapidtax

Student Loan Interest Deduction Worksheet Line 33

Can I Deduct My Student Loan Interest The Motley Fool

Learn How The Student Loan Interest Deduction Works

Can The Student Loan Interest Deduction Help You Citizens Bank

How To Claim Your Student Loan Interest Deduction

Learn How The Student Loan Interest Deduction Works

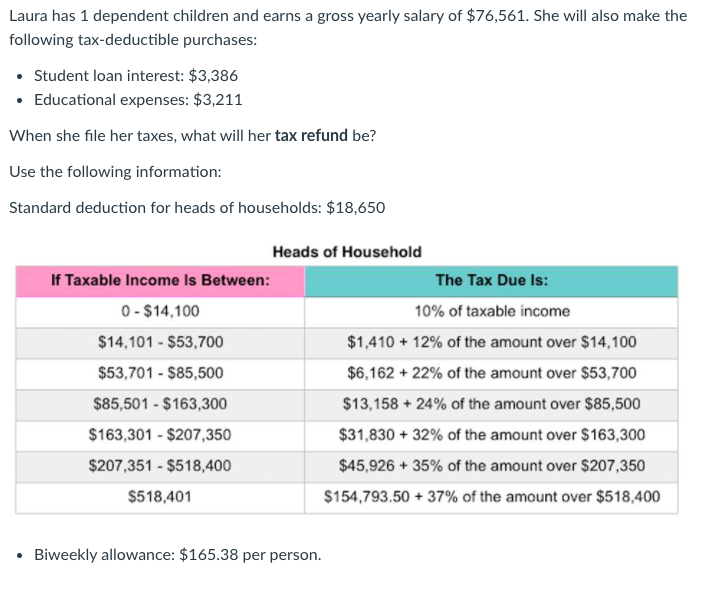

Solved Laura Has 1 Dependent Children And Earns A Gross Chegg Com

Can The Student Loan Interest Deduction Help You Citizens Bank

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

![]()

How Much Student Loan Interest Is Deductible Payfored

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

![]()

How Much Student Loan Interest Is Deductible Payfored

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Ecsi Student Loan Tax Incentives

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

Post a Comment for "Dependent Student Loan Interest Deduction"