Employer Student Loan Repayment Tax

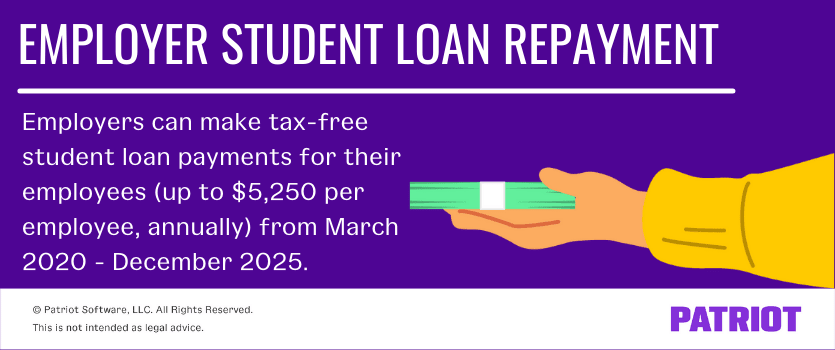

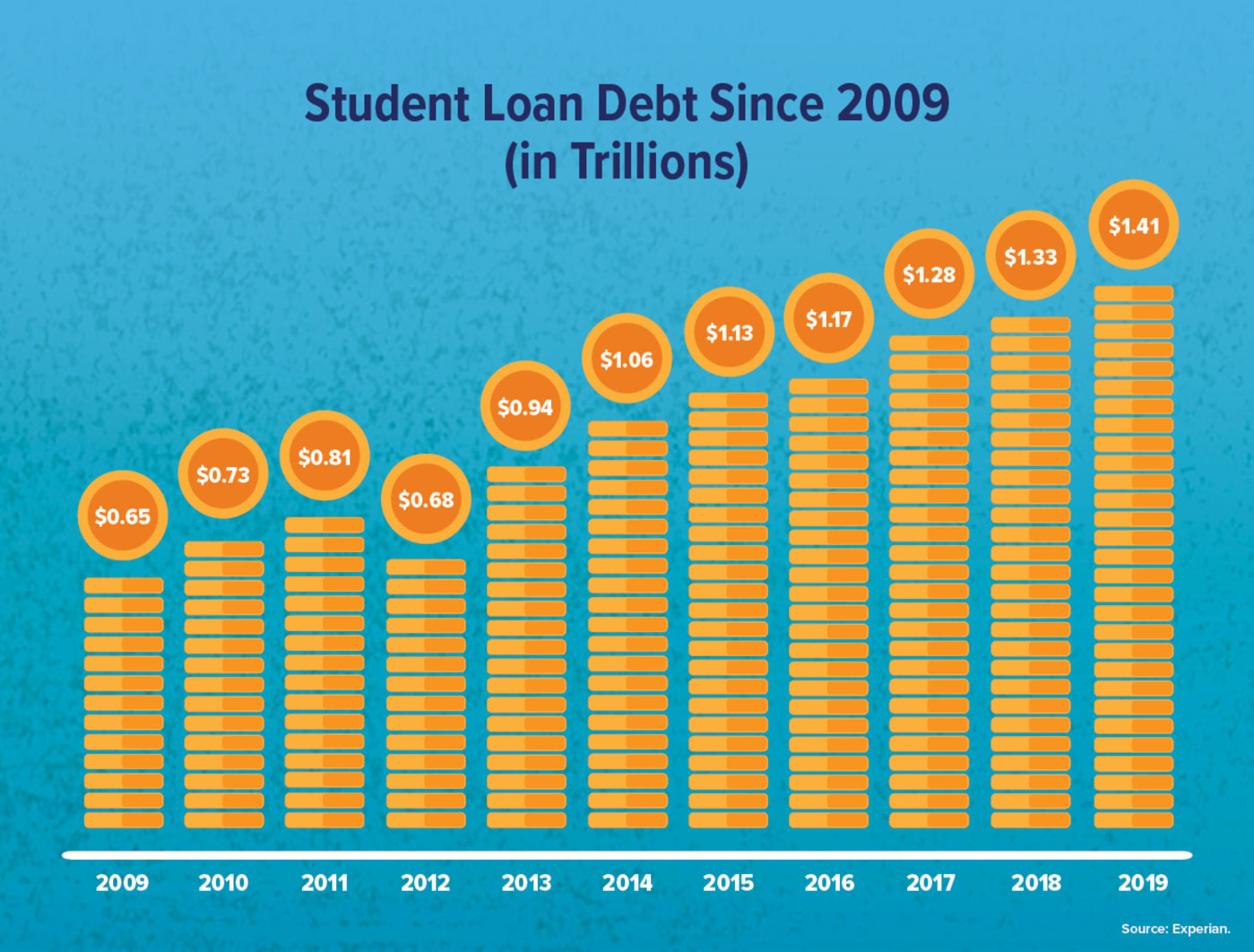

Congress could further expand and improve upon the CARES Act and CAA tax-free student loan repayment assistance provision in three main ways. You can give each employee up to 5250 per year toward student loan payments.

Student Loan Payment Assistance How To Convince Your Boss To Help Student Loan Hero

Is an employees student loan repayment benefit taxed as income.

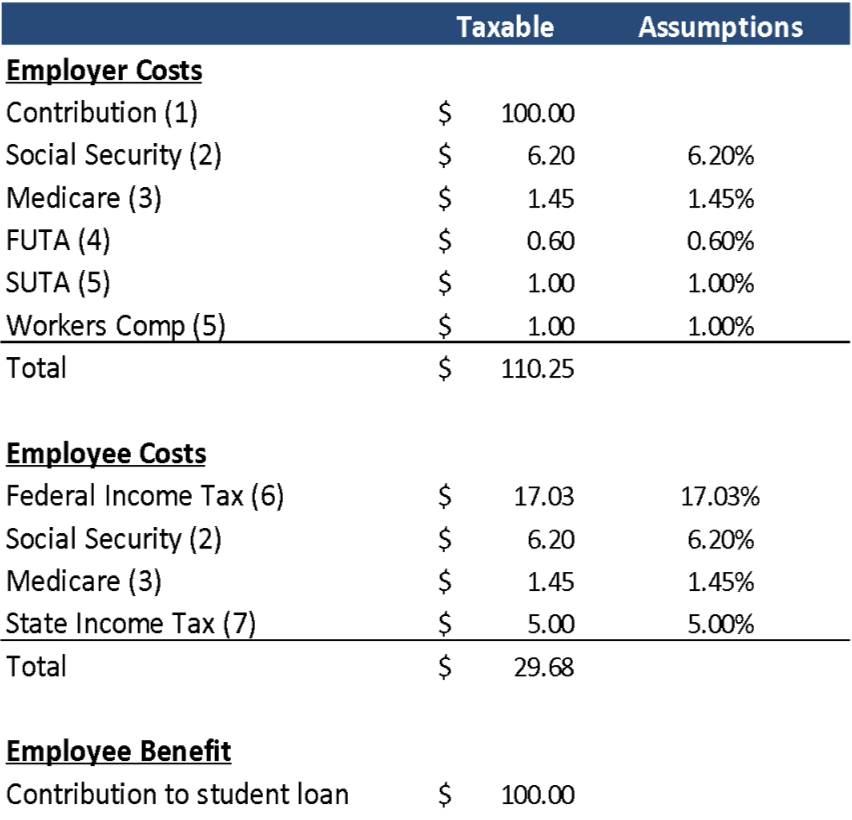

Employer student loan repayment tax. Although borrowers received a tax. Ad Check your eligibility quickly and apply easily on mobile or desktop. Prior to March 27 2020 taxes were taken out of individual employer student loan repayment contributions and the total you receive was added to your taxable income.

Here are six major employers that offer student loan repayment. Any amount an employer pays to a student loan held by an employee up to 5250 is qualified for the income and payroll tax exclusion if the payments are made before Dec. One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt.

Understanding Employer Match of Student Loan Repayment. Make the tax-free student. Keep in mind that the tax-free amount of.

Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in. Do not include this amount in the employees income. Ad Help Your Employees Pay Off Student Loans Faster with Loan Repayment Admin from ISTS.

Aetnas Student Loan Repayment Program will match up to 2000 in student loan payments annually. But theres one drawback to employer-sponsored student loan benefits. Ad Help Your Employees Pay Off Student Loans Faster with Loan Repayment Admin from ISTS.

Comprehensive Services Proven Technology and Expert Program Managers. Ad Check your eligibility quickly and apply easily on mobile or desktop. Comprehensive Services Proven Technology and Expert Program Managers.

Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. What is an employer student loan repayment. Under tax laws employer student loan repayment is usually taxable.

Find Your Path To Student Loan Freedom. With the Consolidated Appropriations Act 2021 signed into law at the end of 2020 the ability for employers to offer tax-free student loan repayment for employees through. Until the end of 2020 employers can.

2020 Cares Act Repay Employee Student Loans Up To 5 250 Tax Free Extended Through December 31 2025 Core Documents

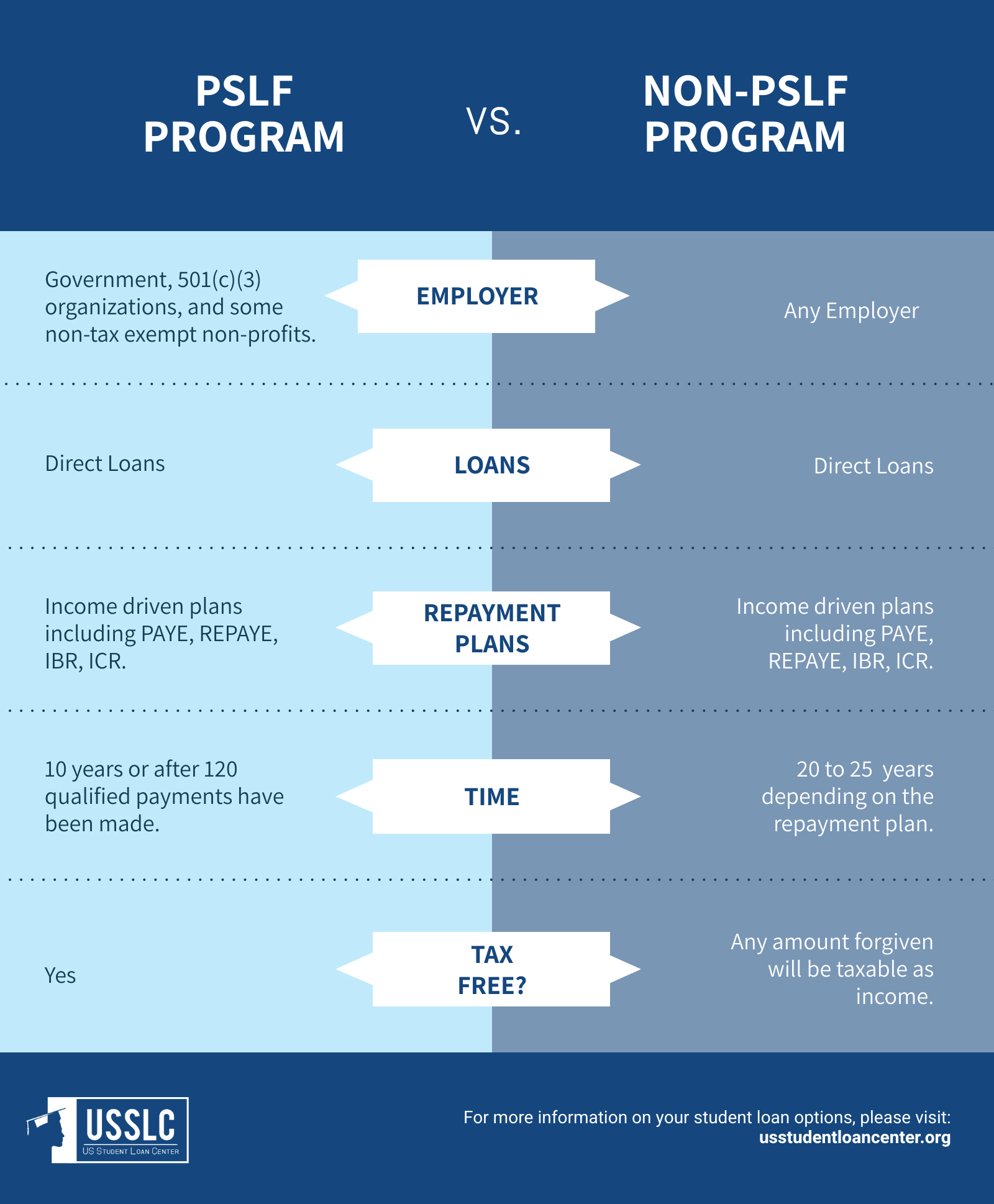

Public Service Loan Forgiveness Program

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

Student Loan Repayment Benefit How It Works Company List Payments

The Business Case For Employee Student Loan Repayment Programs

Up To 5 250 Of Employer Student Loan Assistance Is Tax Free Through 2025

Student Loans And Their Effect On Retirement

Employers Paying Workers Student Loans Helps Narrow Racial Wealth Gap

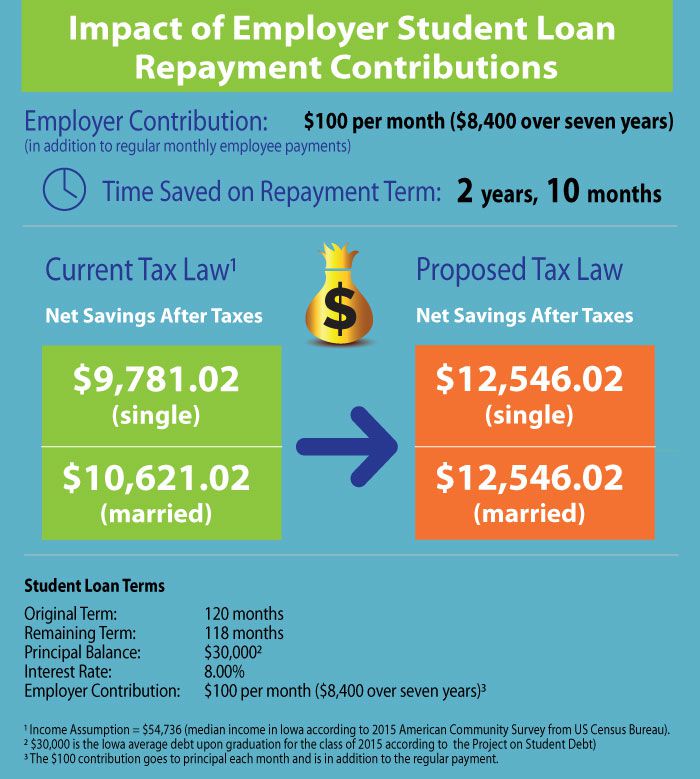

Iowa Employer Sponsored Student Loan Repayment

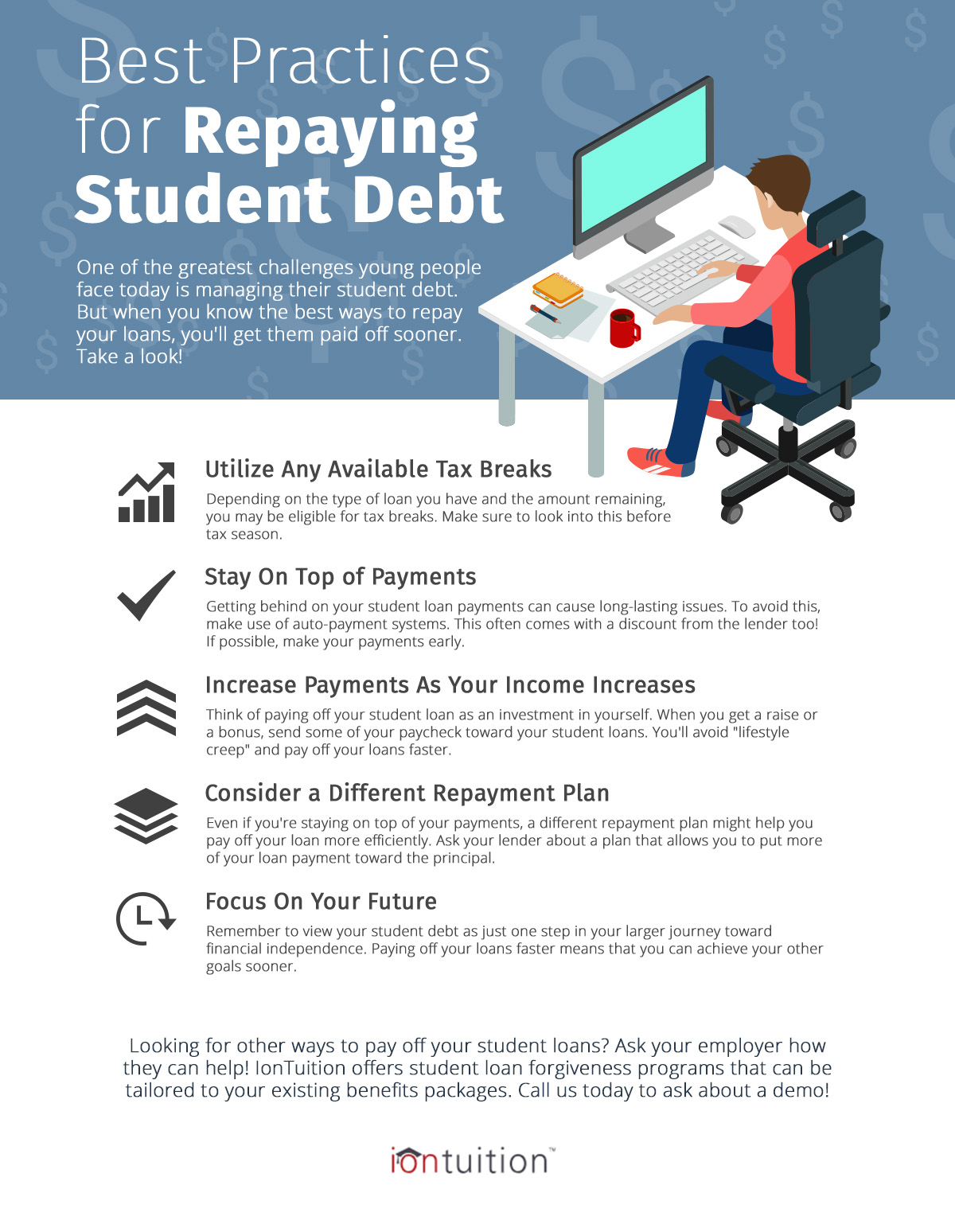

Student Loan Repayment Best Practices Iontuition

Up To 5 250 Of Employer Student Loan Assistance Is Tax Free Through 2025

Employer Student Loan Repayment Tax Free Benefit Q A

Employer Student Loan Tax Benefit In The Cares Act Usi Formerly Findley

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

Briefing On Tax Free Student Loan Repayment Peanut Butter Student Loan Assistance

Your Employer Can Pay 5 250 Annually Towards Your Student Loans Tax Free Until 2025

Employer Student Loan Repayment Tax Free Benefit Q A

Student Loan Forgiveness What S Changing And Who Is Eligible

Is Student Loan Forgiveness Taxable It Depends

Post a Comment for "Employer Student Loan Repayment Tax"