Max Student Loan Interest Deduction 2015

You can deduct up to 2500 in student loan interest or the actual amount of interest you paid whichever is less if your MAGI is under the threshold where the phaseout. A Increase in dollar limitation and repeal of limitation based on income.

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Calculating Your Student Loan Interest Deduction.

Max student loan interest deduction 2015. Student loan interest deduction. It includes both required and voluntarily pre-paid interest payments. Deduct up to 2500 of the loan interest you paid during the year.

You can claim student loan interest on your taxes however the student loan interest deduction begins to phase out if your adjusted gross income AGI is. 80000 if filing single. The standard deduction rises to 6300 for singles and married persons filing separate returns and 12600 for married couples filing jointly up from 6200 and 12400.

The answer is yes subject to certain limits. Section 221 b of the Internal Revenue Code of 1986. Unfortunately the deduction is phased out if your adjusted gross income AGI.

Under current rules borrowers can deduct up to 2500 in qualifying interest paid as an. The deduction is phased out if your adjusted gross income AGI exceeds certain levels. The student loan interest deduction is claimed as an.

You can deduct up to 2500 of student loan interest paid in a given year. Is student loan interest deductible in 2021. If you have started to pay back your student loans you may be able to reduce your taxable income by up to 2500 of the student loan.

According to the New York Federal Reserve student loan debt in the US. The maximum amount of student loan interest you can deduct each year is 2500. The student loan interest deduction could be eliminated under the proposed tax plan.

So what is the student loan interest deduction really worth. For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and. Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out.

Unfortunately the deduction is phased out if your adjusted. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans. You get the amount of qualified interest you paid during 2021 from the organizations to whom you owe the interest on Form.

As with many tax rules there is an income limit to this deduction. The answer is yes subject to certain limits. The answer is yes subject to certain limits.

Student Loan Interest Deduction. The maximum amount of student loan interest you can deduct each year is 2500. Increase in deduction for student loan interest.

The maximum amount of student loan interest you can deduct annually is 2500. If you made interest rate payments on your student loans during the tax. Well based on these criteria 65000 130000 MFJ of taxable income puts you in the 25 tax bracket.

Income limits for claiming the deduction For your 2020 taxes which you will file in 2021 the student loan interest deduction. You may deduct the lesser of 2500. So if you have paid at least.

If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans. The student loan interest deduction. Student loan interest is interest you paid during the year on a qualified student loan.

This deduction can reduce the amount of your income subject to tax by up to 2500 in 2015 and 2016 he said.

Pub 17 Chapter Pub 4012 Tab E Federal 1040 Lines 23 37 Ppt Download

How To Claim Your Student Loan Interest Deduction

:max_bytes(150000):strip_icc():format(webp)/GettyImages-481567642-566206a33df78ce16194b621.jpg)

Student Loan Debt 2021 Statistics And Outlook

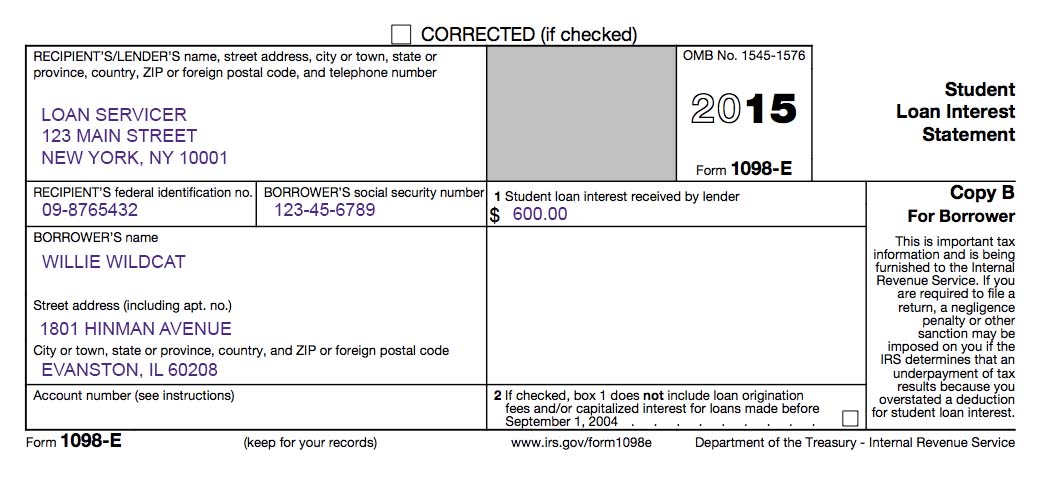

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

Student Loan Tax Deductions Education Credits Save On Your Taxes

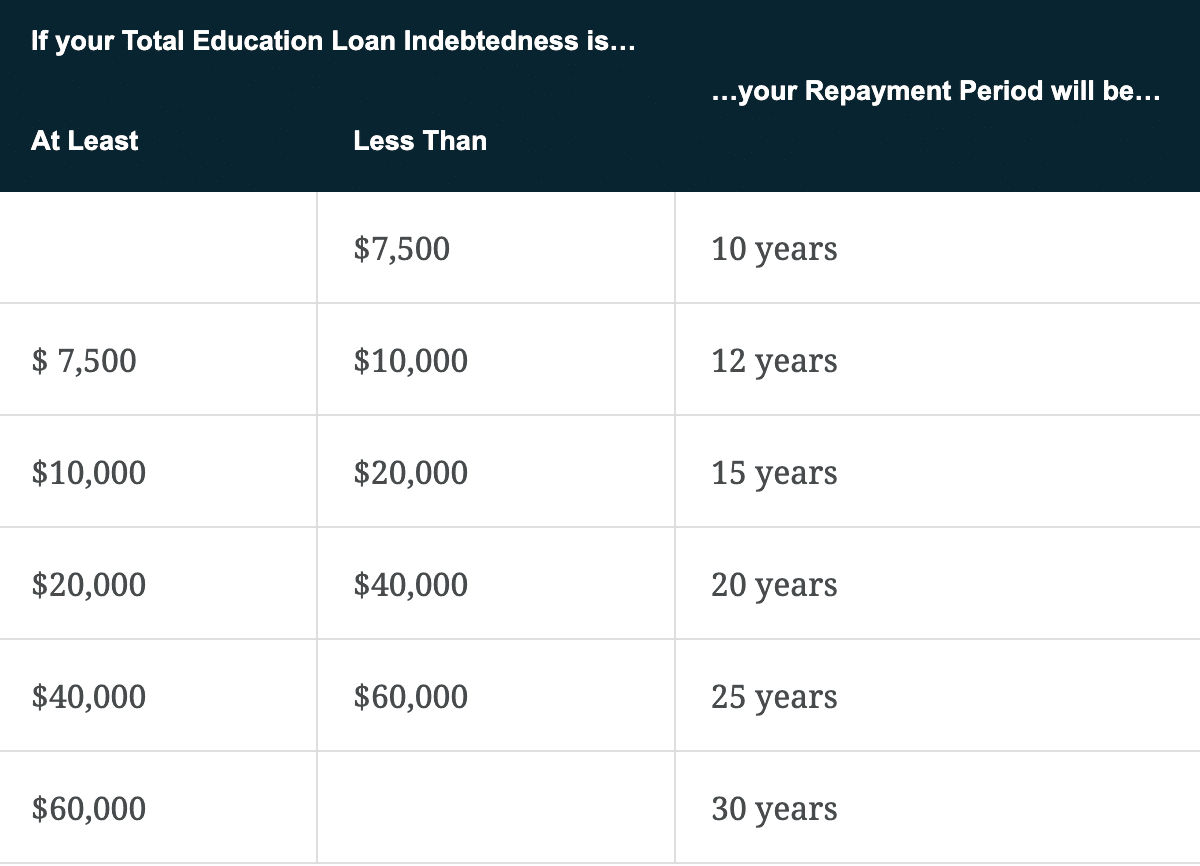

How Long Does It Take To Pay Off Student Loans Student Loan Planner

Common Deductions And Exemptions Investing Deduction Income Tax

Fedloan Servicing The Worst Student Loan Servicer

Is Student Loan Interest Tax Deductible Rapidtax

Student Loan Interest Deduction H R Block

1098 E Student Loan Interest Statement Financial Wellness Northwestern University

Ecsi Student Loan Tax Incentives

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Is Student Loan Interest Tax Deductible Rapidtax

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22 Income Tax Tax Forms Tax Deductions List

Student Loan Interest Can You Deduct It On Your Tax Return Cordasco Company

529 Plan Vs Life Insurance Federal Navigators How To Plan Budget Planner 529 Plan

Survey Majority Of Student Loan Borrowers Don T Understand How Interest Works Student Loan Hero

Post a Comment for "Max Student Loan Interest Deduction 2015"