Student Loan Debt Relief Tax Credit For Tax Year 2020

Student loan interest can quickly add up. Everyone is always looking for ways to reduce their tax liabilities but many people have no idea that this significant tax deduction is widely available.

Consolidate your Student Loans out of Navient Today get a Fresh Start with a New Lender.

Student loan debt relief tax credit for tax year 2020. Ad Try Our Free PSLF Tool To See Your Options and Eligibility For Student Loan Forgiveness. Complete the Student Loan Debt Relief Tax Credit application. In fact the 2500 deduction can be.

If you made interest rate. Student Loan Forgiveness and Other Ways the Government Can Help You Repay Your Loans. You can claim the deduction if all of the following apply.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. You paid interest on a qualified student loan in tax year 2020.

The accrual of interest on Department of Education ED held student loans and certain non-ED-held. Youre legally obligated to pay interest on a qualified student loan. And then they can file tax returns next year to get the rest of that money.

Maryland taxpayers who have. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Student Loan Debt Relief Tax Credit for Tax Year 2020.

2 days agoWhat you need to know about the extended student loan payment pause child tax credit. Check with your loan provider for information on relief for debt payment during the COVID-19 pandemic. For Maryland Residents or Part-year Residents Tax Year 2020 Only.

Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out. Student Loan Debt Relief Tax Credit for Tax Year 2021. Student Loan Debt Relief Tax Credit for Tax Year 2020 Maryland OneStop.

Easy Fast Secure. The COVID-19 Student Loan Relief Act of 2020 and the Student Borrower Bankruptcy Relief Act of 2019 which would eliminate or amend the section of the Bankruptcy. Ad Navient is known for Predatory Lending and one of the most Aggressive Debt Collectors.

These deferred payments dont necessarily apply to private student loans. Until the end of 2020 employers can. Ad Check your eligibility quickly and apply easily on mobile or desktop.

Find Your Best Repayment Options And Check Loan Forgiveness Eligibility In Only 3 Minutes. Student Loan Debt Relief Tax Credit Application. Instructions are at the end of this application.

Tax Relief Expanded for Student Loan Debt Discharge in Certain Cases. Security CARES Act PL. Subject to Credit Approval.

The IRS announced an expansion of relief to additional individuals. Ad Variable Rates as Low as 213 APR. From July 1 2021 through September 15 2021.

One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt. January 16 2020 by Ed Zollars CPA. 116-136 provide additional student loan relief measures.

Ad Check your eligibility quickly and apply easily on mobile or desktop.

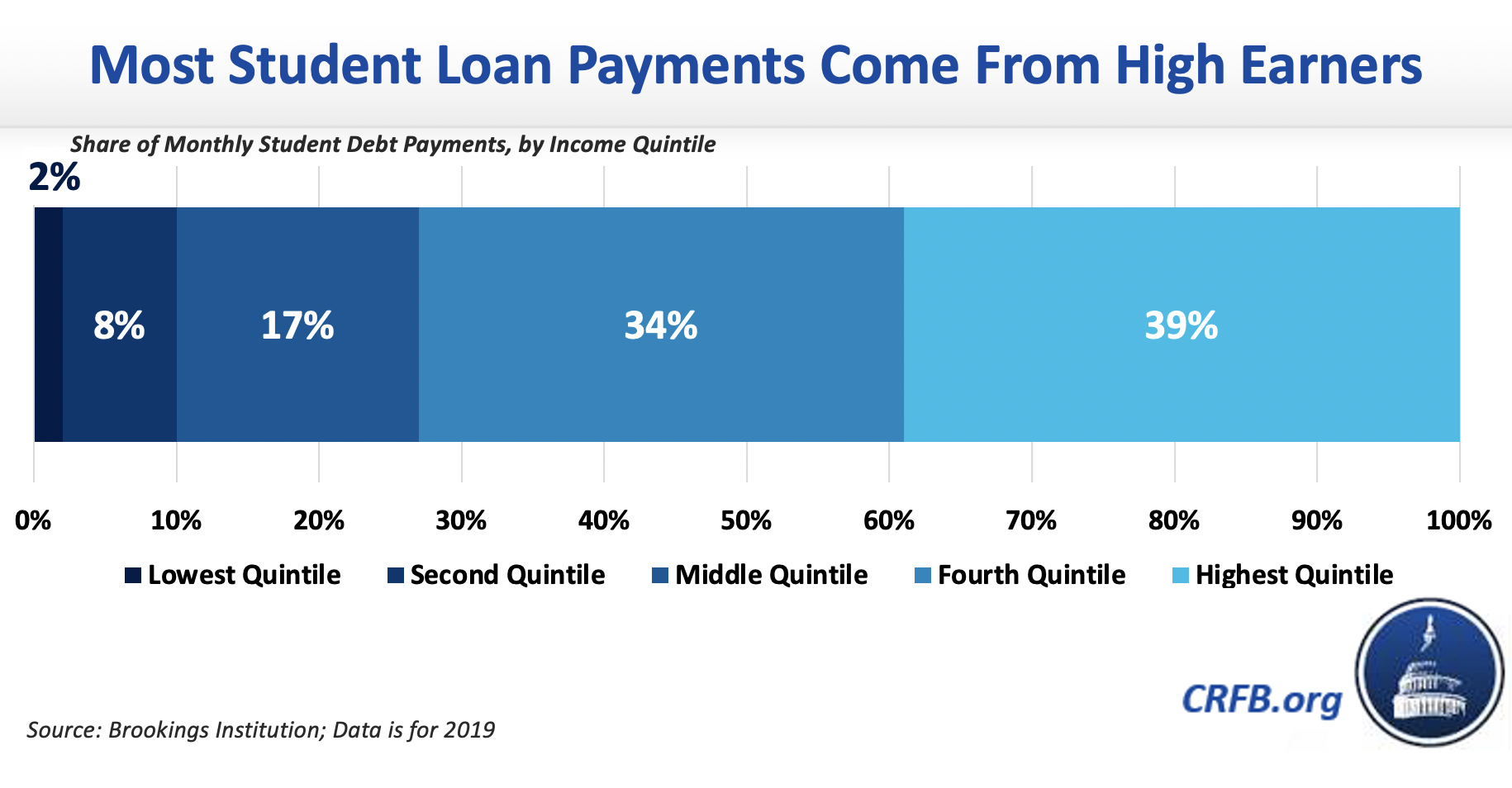

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Senate Passes Stimulus Bill With Student Loan Tax Relief Will It Pave The Way To Cancel Student Debt

Can Debt Forgiveness Cause A Student Loan Tax Bomb Turbotax Tax Tips Videos

Biden Expands Emergency Student Loan Relief Key Details

What Biden S Election Could Mean For Student Loans The New York Times

What Tax Incentives Exist To Help Families Pay For College Tax Policy Center

Will Student Loans Take My 2020 Tax Refund Nerdwallet

What Biden S Student Loan Forgiveness Plan Means For Borrowers

Is Student Loan Forgiveness Taxable It Depends

These Student Loan Borrowers Could Lose Their Child Tax Credit

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

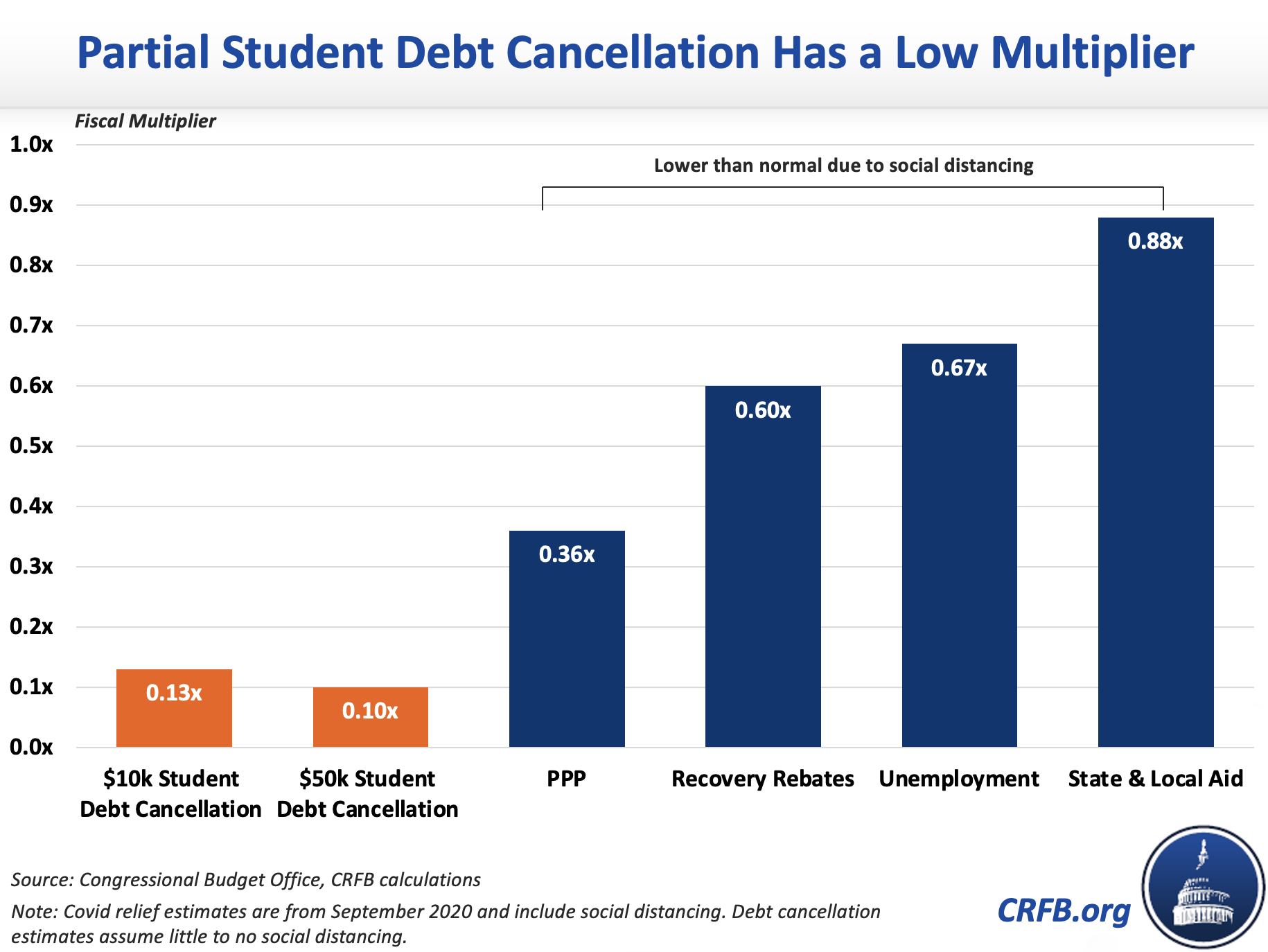

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Can The Student Loan Interest Deduction Help You Citizens Bank

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Learn How The Student Loan Interest Deduction Works

Private Student Loan Borrowers Got No Relief During The Pandemic Nextadvisor With Time

Post a Comment for "Student Loan Debt Relief Tax Credit For Tax Year 2020"