Can You Write Off Student Loan Payments

Student Loan Tax Deduction. Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better.

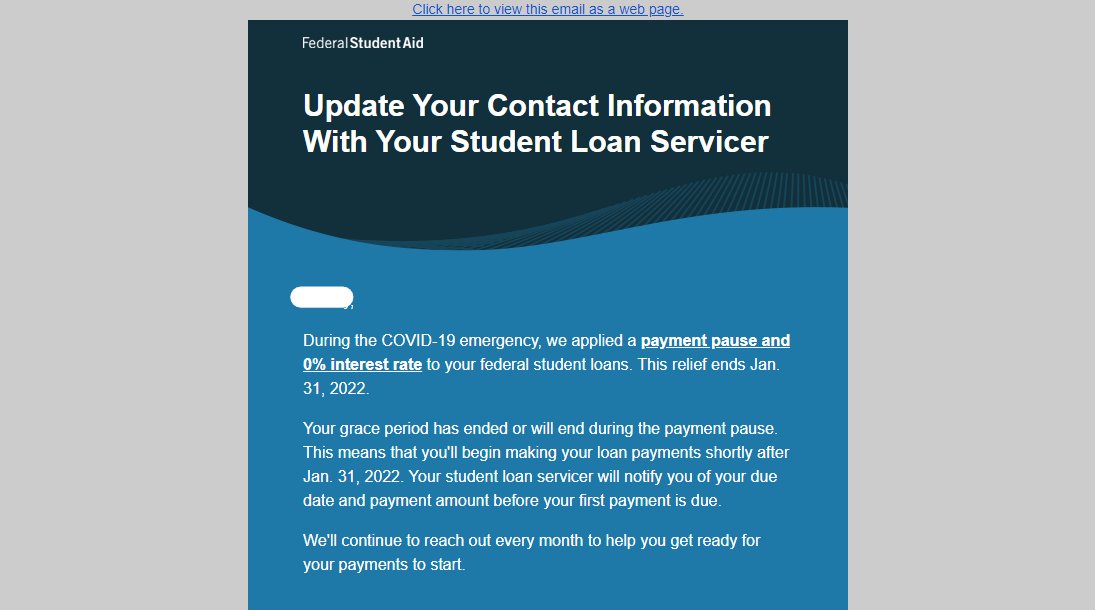

Servicers Prepare For Student Loan Payments To Resume

Multi-Year Approval Options Available.

Can you write off student loan payments. The amount you can deduct is the smaller of the amount of. You claim this deduction as an adjustment to income so you dont need to itemize your deductions. Lewis then revealed when your student loan will be wiped out if you havent managed to pay it back.

Complete Your App Today. Ad Check your eligibility quickly and apply easily on mobile or desktop. Plan Long-Term with Our Multi-Year Approval Loan Options.

The answer is yes subject to certain limits. Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in. There are a few options for deducting student loan interest and student loan payments on your federal income tax returns including the student loan interest deduction.

The student loan interest deduction allows you to write off up to 2500 per year from your taxes in student loan interest payments. Plan Long-Term with Our Multi-Year Approval Loan Options. Many taxpayers usually qualify to deduct interest paid on qualifying student loans.

Ad Check your eligibility quickly and apply easily on mobile or desktop. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay. You dont have to be a student to deduct loan interest.

Ad Get a Low Payment Based on your Income and Get Forgiven after 240 Months. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans.

Ad Apply for a Loan with a Trusted Lender. Ad Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. Youve graduated most likely making your loan payments you can deduct it.

Federal Student Loan Consolidation and Forgiveness under the Obama Forgiveness Program. I think youre a little confused. Because this is a tax deduction and not a.

Ad Apply for a Loan with a Trusted Lender. You can claim the deduction if all of the following apply. You paid interest on a.

The answer is yes subject to certain limits. Its important to understand that the loan may be wiped before you. When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational.

The answer is yes subject to certain limits. Multi-Year Approval Options Available. Complete Your App Today.

Student Loan Interest Deduction H R Block

3 Ways To Spot Student Loan Scams Federal Student Aid

Alarming Restart Of Student Loans May Cost Student Loan Borrowers 85 Billion

Paying Student Loan Debt Modification Repayment Options

How To Claim Your Student Loan Interest Deduction

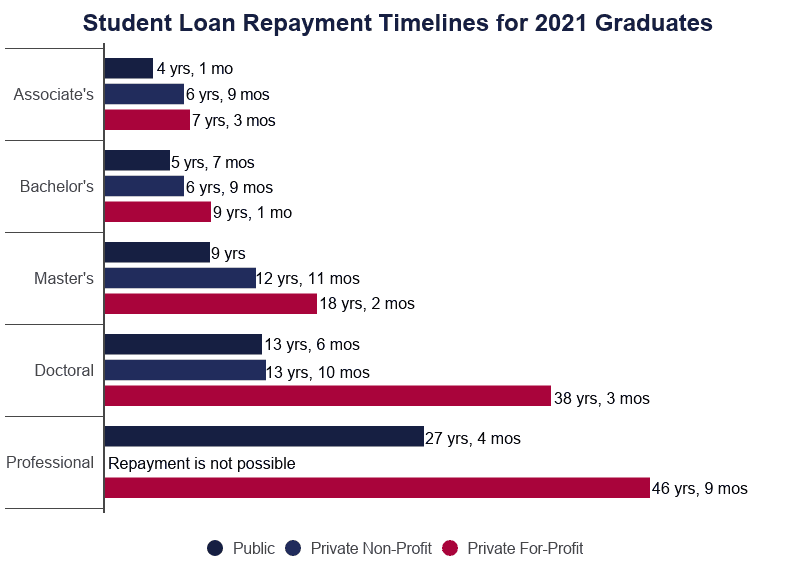

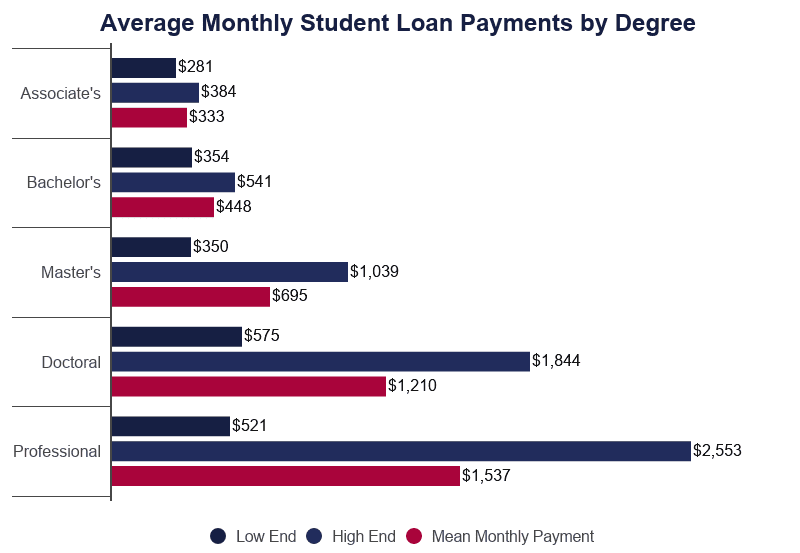

Average Time To Pay Off Student Loans 2021 Data Analysis

How To Deduct Student Loan Interest On Your Taxes 1098 E Federal Student Aid

5 Ways To Pay Off Your Student Loans Faster Federal Student Aid

Average Student Loan Payment 2021 Cost Per Month

A Guide To Getting Late Student Loan Payments Off Credit Report

How To Make Principal Only Payments On Student Loans Student Loan Hero

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Student Loan Interest Deduction Calculator Student Loan Hero

Pros And Cons Of Income Driven Repayment Plans For Student Loans

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Student Loan Payment Pause Record Inflation Adds To Pressures On Biden To Grant Another Extension

5 Ways To Pay Off Your Student Loans Faster Federal Student Aid

Beware Of Student Loan Interest Rates Or You Ll Pay For It Student Loan Hero

Is Student Loan Forgiveness Taxable It Depends

Post a Comment for "Can You Write Off Student Loan Payments"