Employer Student Loan Repayment Policy

Ad Read Expert Reviews Compare Federal Student Loan Repayment Options. Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020.

Student loan repayment plans SLRPs let employers make monthly contributions directly to an employees student loan servicer while employees continue to make regular.

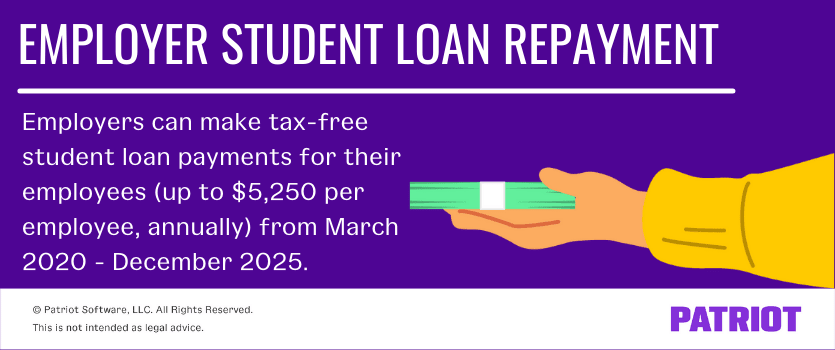

Employer student loan repayment policy. Student Loan Repayment Policy March 2007 3 E. Employees tackle their student loan debt and to help them qualify for existing student loan repayment benefits including Public Service Loan Forgiveness. Recent legislation allows employers to assist employees with repayment of their student loans on a tax-free.

The 5250 limit is the maximum amount per employee that employers may contribute toward repayment of student loans taken out for tuition and related expenses such. Easily Pay Your Student Loan Now. Ad Fixed Rates as Low as 289 APR.

Ad Start Your Application for Income-Based Federal Student Loan Forgiveness. Join the Growing Number of Employers Now Offering Student Loan Repayment Assistance. Here are six major employers that offer student loan repayment.

Ad Check your eligibility quickly and apply easily on mobile or desktop. With the recent extension of the rules set forth in the CARES Act employer student loan repayment contributions up to 5250 are payroll-tax and income-tax free until January. You can give each employee up to 5250 per year toward student loan payments.

Ad Help Your Employees Pay Off Student Loans Faster with Loan Repayment Admin from ISTS. Best Repayment Programs Compared Scored. Subject to Credit Approval.

Student loan assistance have done so in the form of repayment benefits under which employers agree to make a monthly payment toward their employees student loans. Student loan repayment benefit means the benefit provided to an employee under this part in which an agency repays by a direct payment on behalf of the employee a qualifying student. The end result is that tax-free.

Join the Growing Number of Employers Now Offering Student Loan Repayment Assistance. Employer-provided student loan repayments. Exclusion for Certain Employer Payments of Student Loans.

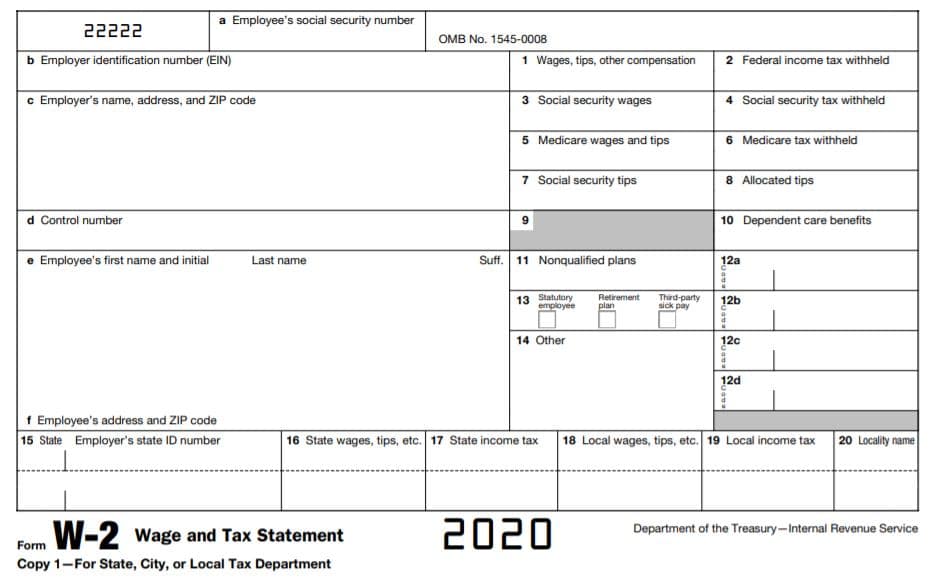

Do not include this amount in the employees income. Do Not Click Here if You Make Less Than 25k per Year Because You Dont Qualify. Employer student loan repayment programs are typically administered via a third party such as IonTuition Tuitionio Gradifi Fidelity Investments and Peanut Butter that pay.

Ad Help Your Employees Pay Off Student Loans Faster with Loan Repayment Admin from ISTS. Ad Check your eligibility quickly and apply easily on mobile or desktop. The CAA extended the availability of this tax-free student loan repayment assistance option for employers through the end of 2025.

Keep in mind that the tax-free amount of. Under the Coronavirus Aid Relief and Economic Security CARES Act employers can now make nontaxable payments of up to 5250 to employees as student loan repayment. Under the this program after.

Aetnas Student Loan Repayment Program will match up to 2000 in student loan payments annually. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Find Your Path To Student Loan Freedom.

Unsubsidized Loan -- The student is responsible for paying the interest accrued while the student is in school during the 6-month.

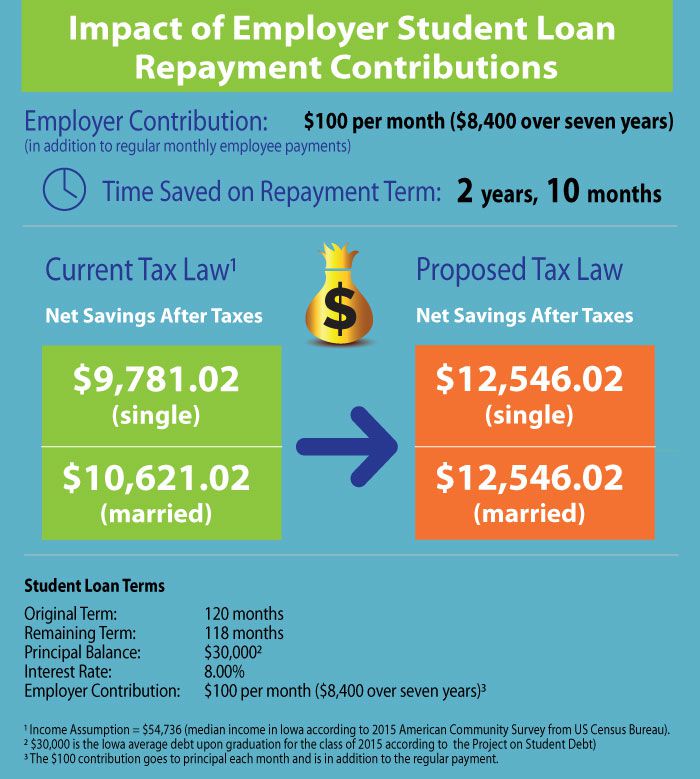

Iowa Employer Sponsored Student Loan Repayment

The Business Case For Employee Student Loan Repayment Programs

Nacs Gradifi Employee Student Loan Repayment Program Nacs

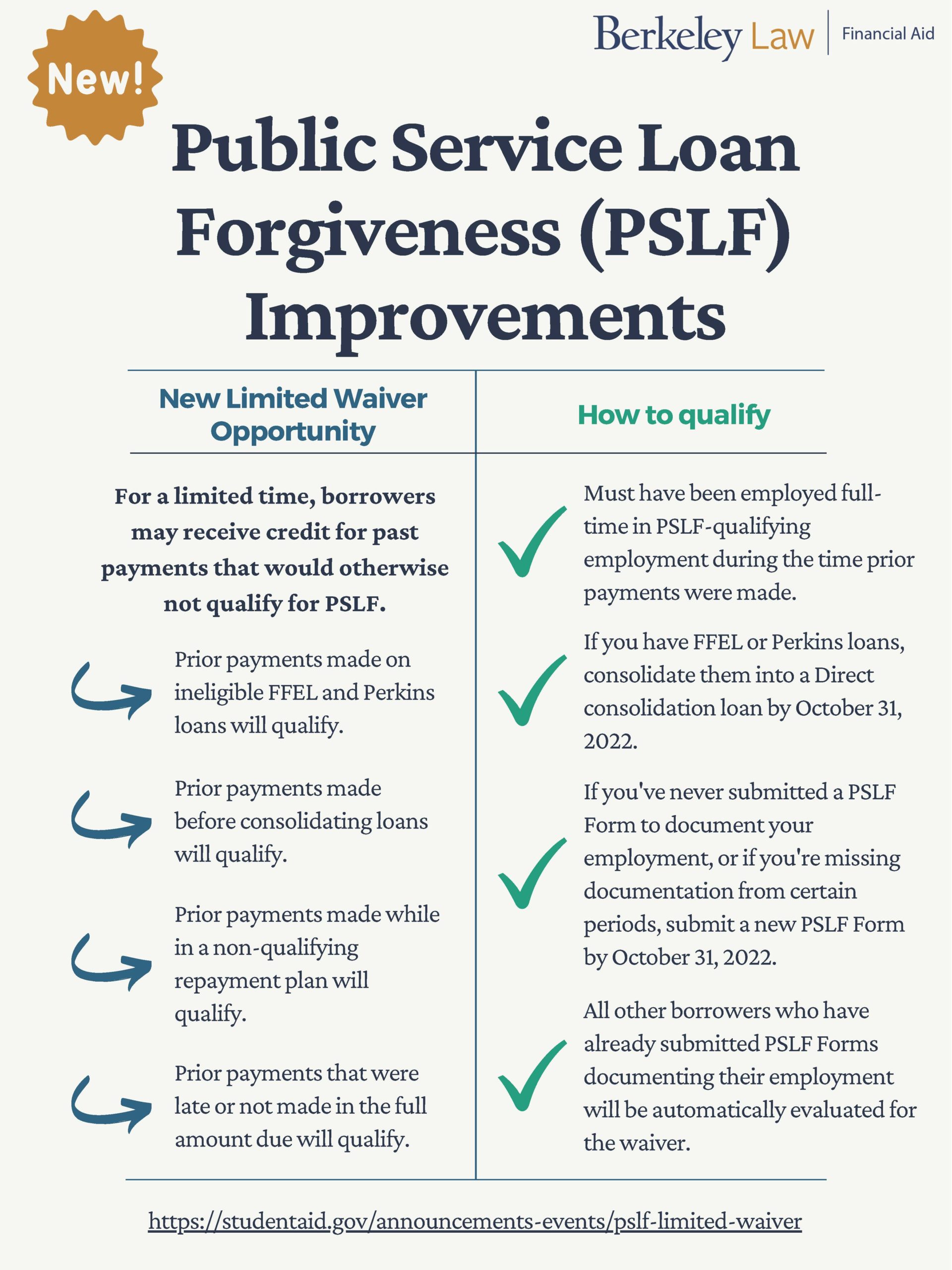

Covid 19 Student Loans Berkeley Law

Carvana Rolls Out Student Loan Repayment Perk Employee Benefit News

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

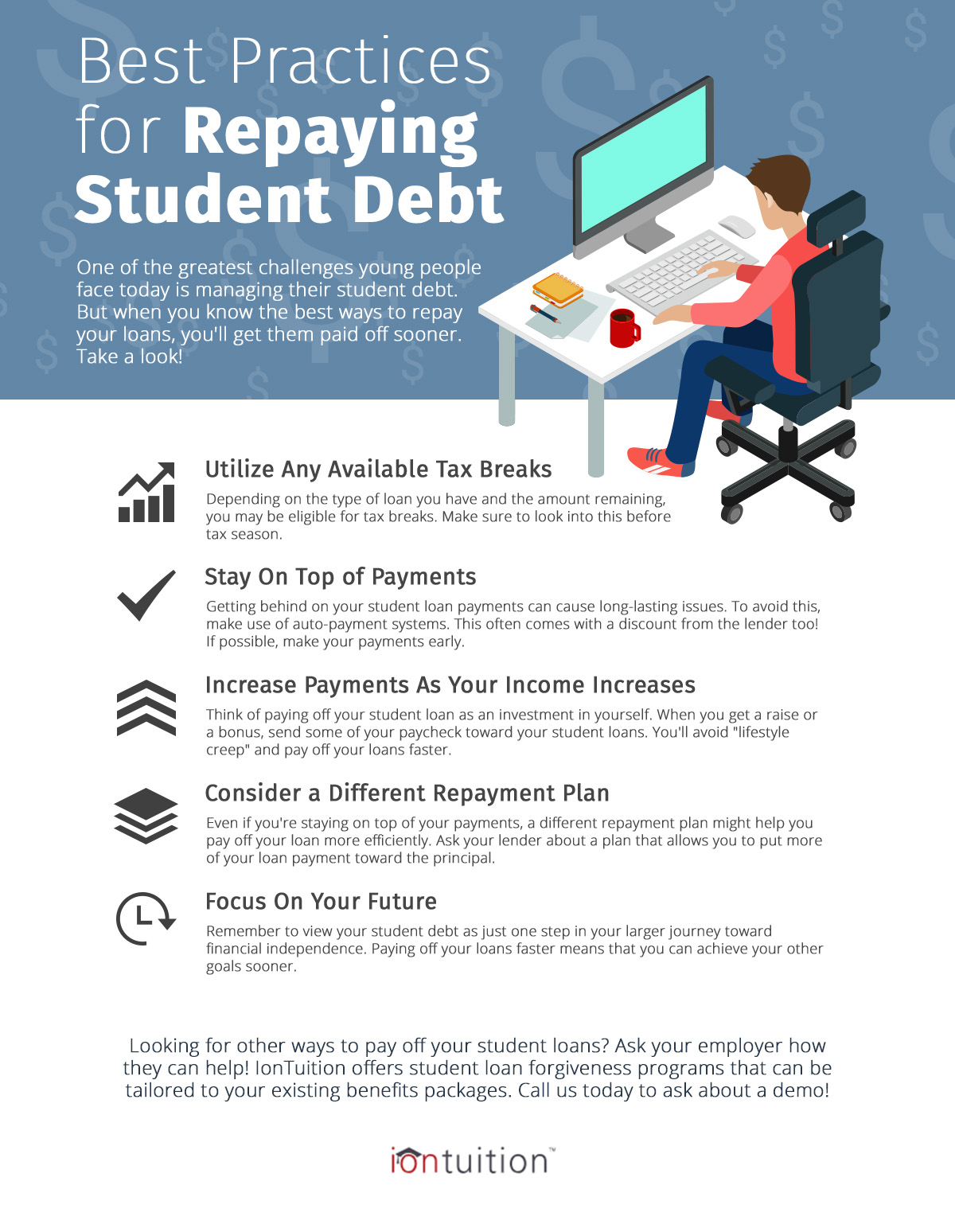

Student Loan Repayment Best Practices Iontuition

Pdf Evaluating The Effectiveness Of Employer Provided Student Loan Repayment Assistance Programs Journal Of Financial Planning

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Student Loans And Their Effect On Retirement

Employer Student Loan Repayment What S New Fast Loans Payday Loans Online Best Payday Loans

Student Loan Forgiveness What S Changing And Who Is Eligible

New Search Tool Finds Employers Who Help Pay Student Loans Money

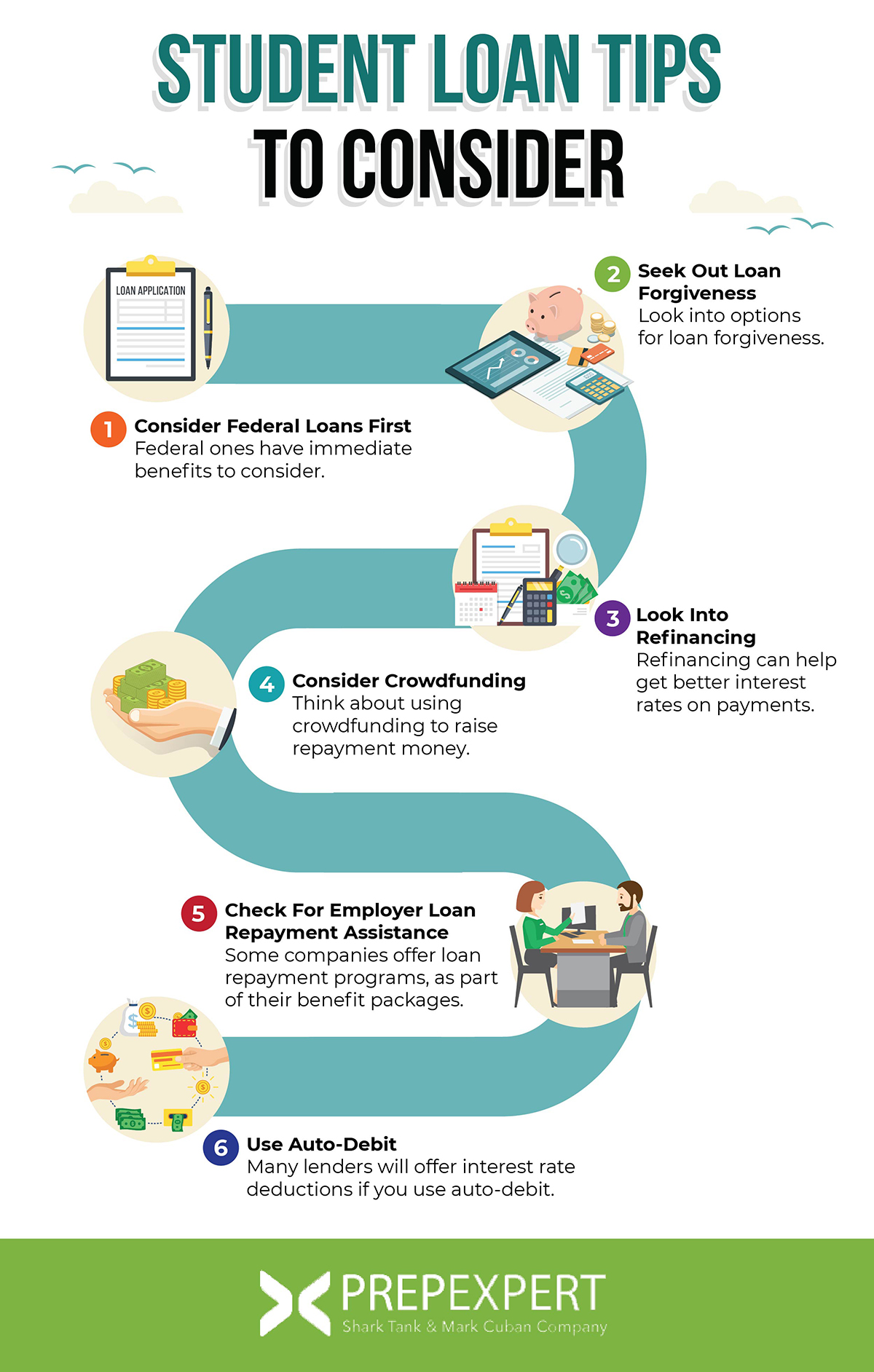

Student Loan Tips To Use When Applying Repaying Prep Expert

Employer Student Loan Repayment Tax Free Benefit Q A

Employer Student Loan Repayment Program

Post a Comment for "Employer Student Loan Repayment Policy"