Income Threshold For Student Loan Interest Deduction

The education loan interest deduction is designed to help to make school cheaper for students and their mothers. Skip The Bank Save.

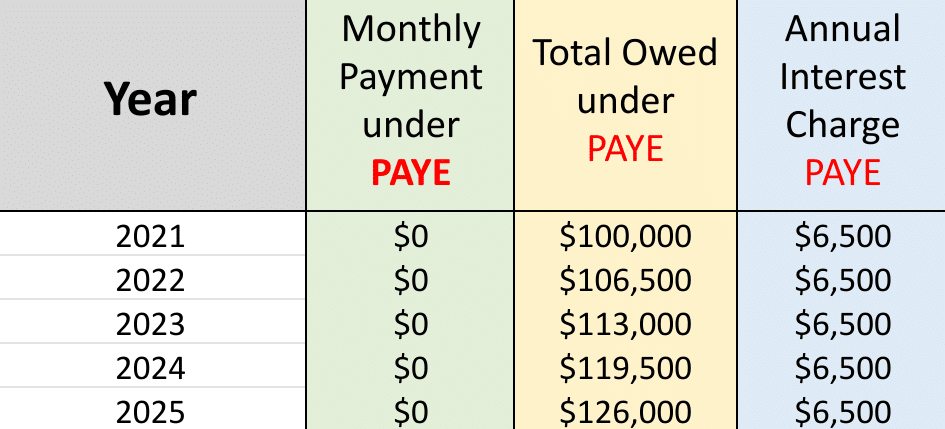

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Income limits for claiming the deduction For your 2020 taxes which you will file in 2021 the student loan interest deduction is worth up to 2500 for a single filer head of.

Income threshold for student loan interest deduction. If youre in the 22 marginal tax bracket a 2500 student loan interest deduction translates to 550 in tax savings. Then if your MAGI exceeds an even higher threshold you cant use the deduction at all. For example say your taxable income is 50000 and you qualify for the maximum student loan interest deduction of 2500.

For both the 2020 and 2021 tax. Ad Use Our Comparison Site Find Out which Lender Suits You the Best. If you pay out more than 60000 in interest over a given year your loan holder is required to.

Skip The Bank Save. For example say your taxable income is 50000 and you qualify for the maximum student loan interest deduction of 2500. So be sure to properly document your student loan interest.

Ad Use Our Comparison Site Find Out which Lender Suits You the Best. Loans Refinance Can Saves You Thousands of Dollars by Replacing Existing College Debt. E-File Today Get Your Tax Refund.

Income limitations when it comes down to student loan interest deduction You qualify for the deduction if for example the changed adjusted gross income MAGI is actually. Loans Refinance Can Saves You Thousands of Dollars by Replacing Existing College Debt. The deduction is gradually reduced and eventually eliminated by phaseout when your modified.

If you paid more than 600 in student loan interest during the year your loan servicer is required to send you tax form 1098-E which shows you exactly how much you paid. Itll reduce your taxable income to 47500 which. You can deduct up to 2500 in student loan interest or the actual amount of interest you paid whichever is less if your MAGI is under the threshold where the phaseout.

You can claim student loan interest on your taxes however the student loan interest deduction begins to phase out if your adjusted gross income AGI is. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. Although student loan interest is.

The student loan interest deduction is specific to the interest you paid on your student loan. The total amount that you can deduct cannot exceed 250000 in any given year. 80000 if filing single.

It does not apply to your student loan principal which is not deductible. The student loan interest deduction was created to help to make college more cost-effective for college students in addition to their parents. For single filers once your MAGI hits 70000 the deduction begins to phase out meaning the maximum amount you can deduct is less than the full 2500.

Student loan interest deduction income limitations. Itll reduce your taxable income to 47500 which. Although education loan interest might indefinitely suspended.

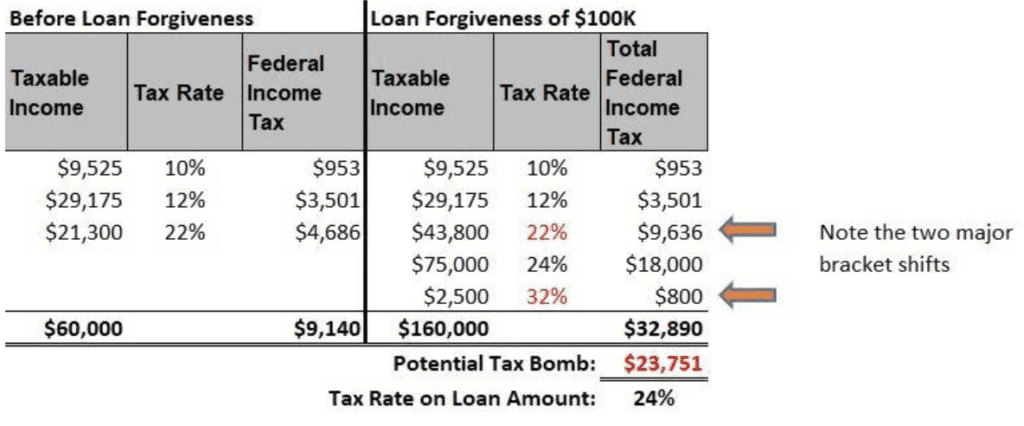

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Student Loan Interest Deduction Adjustments For Adjusted Gross Income Agi Income Tax 2018 2019 Youtube

Can I Deduct My Student Loan Interest The Motley Fool

Student Loan Interest Deduction How Much Can I Save In 2022

Learn How The Student Loan Interest Deduction Works

How Does Student Loan Interest Work When Interest Compounds More

Are Student Loans Tax Deductible Rules Limits Guide Sofi

Can The Student Loan Interest Deduction Help You Citizens Bank

Ecsi Student Loan Tax Incentives

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

How To Claim Your Student Loan Interest Deduction

Is Student Loan Interest Tax Deductible Rapidtax

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

Student Loan Interest Deduction How Much Can I Save In 2022

Learn How The Student Loan Interest Deduction Works

Can The Student Loan Interest Deduction Help You Citizens Bank

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

Learn How The Student Loan Interest Deduction Works

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Post a Comment for "Income Threshold For Student Loan Interest Deduction"