Student Loan Cosigner Death

Many private student loans can be discharged due to the death of the primary borrower. In general if the borrower has passed away the cosigner will be released from future repayment obligations and the remaining loan balance will be forgiven.

What Happens When A Student Loan Cosigner Dies Student Loan Hero

There is no law requiring lenders to cancel private student loans upon the death of the borrower.

Student loan cosigner death. Acceptable documentation includes an original death certificate a certified copy of the death certificate or an accurate and complete photocopy of one of those documents. I checked with a number of the big banks and the answers were all. You have federal student loans.

Before entering into these agreements it is important for both parties to understand the obligation and the fine print of their agreement. Depending on your loan agreement different scenarios could occur if a cosigner passes away. If the primary borrower dies the private student loan is cancelled and the cosigner is not expected to.

With private loans it depends on the terms of the note. In this situation your parent or another co-signer might have to repay the loan because it wont be discharged. Discharge due to death is generally not accessible if the cosigner passes away however.

If your co-signer dies or ends up going bankrupt the entire balance of your loan automatically becomes due. If you cosign a federal student loan and the student dies those loans have a debt discharge that wipes them out. You may be able to continue with the loan as long as you keep on making regular payments.

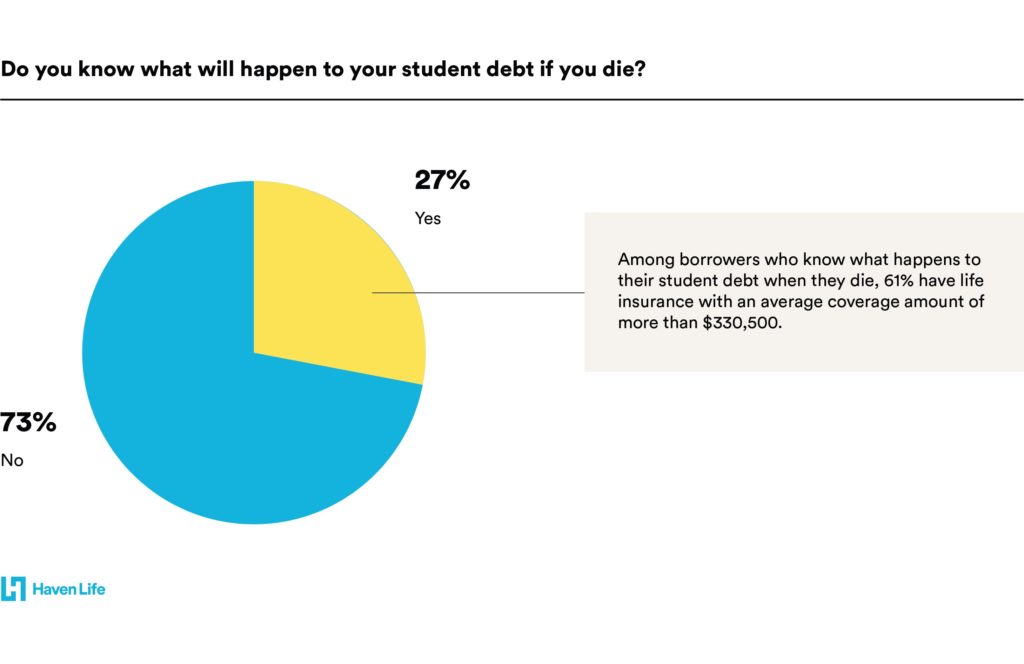

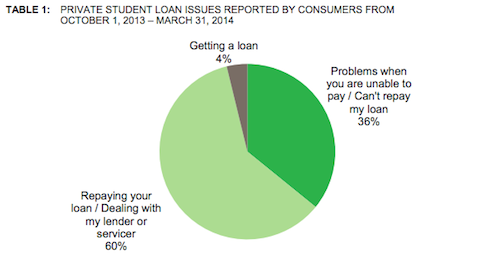

The death of a student debt cosigner can sometimes cause the loan to auto-default. Take the time to figure out what happens to your debt when you die because the outstanding balance could be passed onto your family or estate. CFPB has proposed that lenders adopt the following alternatives to auto-default when a cosigner dies or files bankruptcy.

Evaluate the borrower for cosigner release based on a history of consistent payments for a sufficient period that the lender knows they are a. While its now rate it used to be common for private student loans used to go into automatic default when the borrower died. While your student loans might not be impacted it is possible that they could go into automatic default in the event of a student loan cosigner death.

Im afraid they will then come for my families home which my dad owns. However some lenders will require you to find a new co-signer or even make the loan due upon the death of a. Private student loans with multiple parties may be eligible for release of one partys obligation upon that persons death.

There are different types of loans such as personal loans mortgage student loans and car loans. The loan will be discharged if a family member or other representative provides the loan servicer acceptable documentation of the borrowers or parents death. Theres no easy answer to the question of what happens to a student loan if a co-signer dies but much depends on the nature of your individual loan agreement.

Heres what you should consider if. If you have a loan with a cosigner and want to take this burden off of them you could consider trying to refinance the loan in only your name. This essentially makes the remaining loan balance due immediately.

Generally speaking what happens when a cosigner on a loan dies is that the liability falls entirely on the primary borrower. Many private student loans have automatic default clauses that are triggered when a loans co-signer dies or declares bankruptcy. About half of private student loan programs offer death discharges that are similar to the discharges on federal student loans.

If you die a private lender will likely seek to collect payment from the cosigner. Several private lenders offer student loan death discharges. If only your dad owned the home it might now belong to the estate and need to be probated.

While dealing with student loan debt is probably the last thing you want to think about as you grieve. Some private student loans may offer a discharge but many dont. Thats because many loan contracts with a cosigner include a clause about what happens if they die.

These lenders include but arent limited to Sallie Mae and SoFi. Cosigning a house or auto loan is a special case because the asset is collateral for the loan. Some lenders may waive the remaining debt if the primary borrower student dies.

If you have a cosigner on a private student loan you could be faced with an unwelcome surprise if they pass away. The death of a student loan co-signer can cause problems as well. Federal law dictates that if your cosigner dies youll either need to find another cosigner or refinance the loanin this regard you could apply for a credit card consolidation.

For the loan to be discharged we must receive an original or a copy of the death certificate which can be mailed to. If a cosigner passes away on the other hand the primary borrower is responsible for the remaining amount due. A private student loan that has a co-signer a parent or someone else might not be discharged.

Some do call the note due in the event of the death of the cosigner. The TLDR Version. In some cases the contract states that the loan will automatically go into default if the cosigner passes away.

If you cosign a loan and the person dies you likewise are required to immediately pay the loan off. If your co-signer dies you generally need a new cosigner for the loan agreement to be valid. Additionally if you are a parent PLUS loan borrower your loan may be discharged if the student becomes deceased.

Private Student Loan Cancellation. Co-signing a loan is not a step you should take lightly because even in death youll be liable for the loan. Things however could have been very different.

The surviving borrower would remain responsible for repayment of the loan. In the sad event that your student loan cosigner dies you may have to take steps to protect your finances and credit. One of the things that private student loan issuers often do is include an automatic default policy as part of the loan agreement.

Federal loans may be discharged upon death of the borrower. Some private student loan agreements include provisions for the lender to automatically put a student loan into default if the co-signer dieseven if the borrower is making consistent payments. Private loans tend to have stricter requirements for approval and a co-signer may be on the hook for repaying the loan no matter the reason including death.

State laws on this will vary but you very much.

What Happens To Student Loans If Cosigner Dies

What Happens If A Cosigner On A Student Loan Dies Debt Com

What Happens When A Student Loan Cosigner Dies Student Loan Hero

My Cosigner Died What Happens To My Student Loan

What Happens When A Student Loan Cosigner Dies Student Loan Hero

Private Student Loan Borrowers Face Automatic Default Because Of Co Signer Provisions Consumerist

Cosigner Student Loan Refinance White Coat Investor

How To Remove A Cosigner From Your Student Loan Ascent Funding

What Happens When A Student Loan Cosigner Dies Student Loan Hero

What Debts Are Forgiven At Death Self Credit Builder

What Debts Are Forgiven At Death Self Credit Builder

When Student Loan Borrowers And Their Cosigners Need Life Insurance

How To Remove A Cosigner From Your Student Loans Step By Step Guide

What Happens To A Parent Plus Loan If A Parent Dies Student Loan Ranger Us News

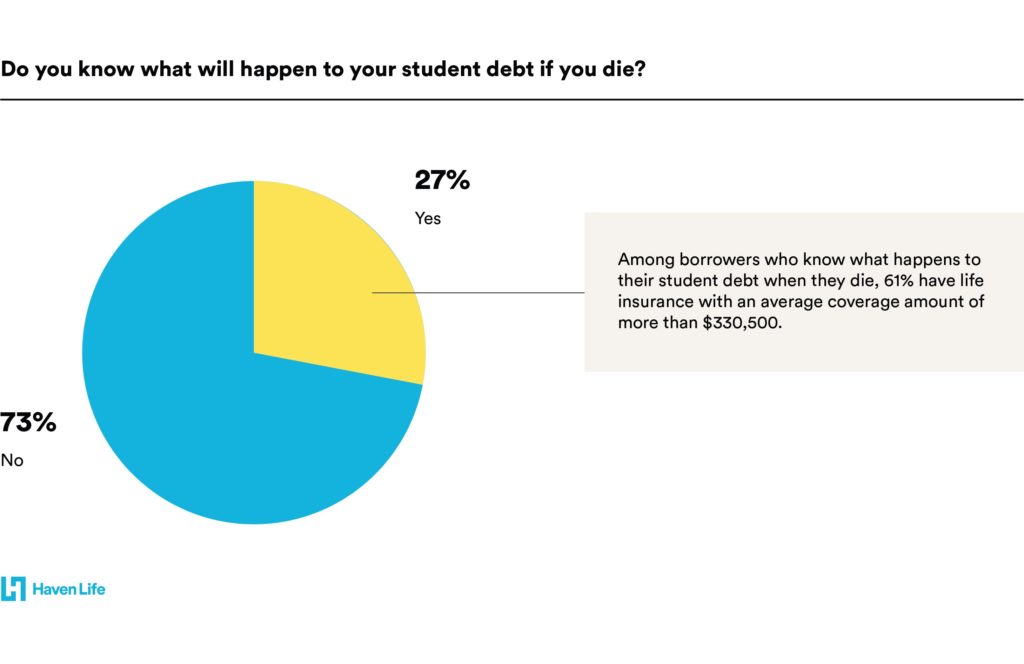

Does Student Loan Debt Die When You Do Haven Life

What Happens To Student Loans When You Die Student Loan Hero

Why Cosigners Should Get Life Insurance For Student Loans Elfi

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1164339481-f400e13f74a846d19dd2c3ae7da578e6.jpg)

What Happens To Student Loans After Death

What Happens When A Student Loan Cosigner Dies Student Loan Hero

Post a Comment for "Student Loan Cosigner Death"