Cares Act Employer Student Loan

Ad Start Your Application for Income-Based Federal Student Loan Forgiveness. The Coronavirus Aid Relief and Economic Security CARES Act signed into law in March 2020 temporarily allowed employers to provide up to 5250 in tax-exempt student loan.

4 Loan Forgiveness Programs For Teachers Federal Student Aid

Essentially the CARES Act expands the scope of Sec.

Cares act employer student loan. Easily Pay Your Student Loan Now. Payments automatically deferred and interest is waived on federally held student loans through Sept. Ad Read Expert Reviews Compare Your Private Student Loan Options.

The CARES Act provides employers with the ability to make tax-deductible student loan payments on behalf of their employees without triggering any employee income tax by expanding Section. Ad Best Repayment Programs Compared Scored. The Comfort of a Simple Student Loan is Priceless.

127 which addresses employer-paid tuition benefits to cover student loan payments. Entering Employer Student Loan CONTRIBUTION. Ad Read Expert Reviews Compare Your Private Student Loan Options.

Compare Online Save Money. A notable aspect of the CARES Act in terms of student loans is a provision that allows employers to make tax-free payments of up to 5250 towards their employees student. Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in.

In March 2020 Congress passed the CARES Act not only pausing payments but setting interest rates on student loans to 0 and halting collections on defaulted student. Companies with the available resources can take their support for employees with student loans a step further providing the additional benefit of student loan payments. Ad Answer a few questions to find your student loan refinance rate.

More than 35 million of these borrowers qualified for general. Compare Online Save Money. The Coronavirus Aid Relief and Economic Security Act the CARES Act signed into law on March 27 2020 provides employers with a new mechanism to assist their.

The CARES Act provides pandemic relief for employers to help repay employee student loans through an amendment to Section 127 of the IRS Code extended through. Ad Check your eligibility quickly and apply easily on mobile or desktop. Do Not Click Here if You Make Less Than 25k per Year Because You Dont Qualify.

Ad Check your eligibility quickly and apply easily on mobile or desktop. Employer Student Loan Repayment - CARES Act. Coronavirus COVID-19 CARES Act Student Loan Fact Sheet.

Click Now Apply Online. The 5250 that employees are permitted to receive. Refinance Parent Plus loans Spouse Loans Individual Student Loans.

Read Expert Reviews Compare Student Loan Repayment Options. The CARES Act provision allowing employers to contribute up to 5250 tax-free annually to their employees. In addition to establishing the Paycheck Protection Program and Employee Retention Credit the CARES Act made employer student loan repayments tax-free until the end.

The CARES Act and Employer Student Loan Contributions Update 1227. The CARES Act allows. Under CARES an employer can now make tax free contributions to an employees student loans up to 5250 a year.

With the new CARES Act employers can pay up to 5250 toward student loans and this amount is tax free to the. The Comfort of a Simple Student Loan is Priceless. Approximately 429 million Americans with federal student loan debt each owe an average 37105 for their federal loans.

The Coronavirus Aid Relief and Economic Security CARES Act which became law in March 2020 paused federal student loan payments through Sept.

Promote Economic And Racial Justice Eliminate Student Loan Debt And Establish A Right To Higher Education Across The United States Equitable Growth

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Military Student Loan Forgiveness And Discharge Programs Military Com

Federal Student Loan Forbearance Is Ending But Many Employees Aren T Prepared Plansponsor

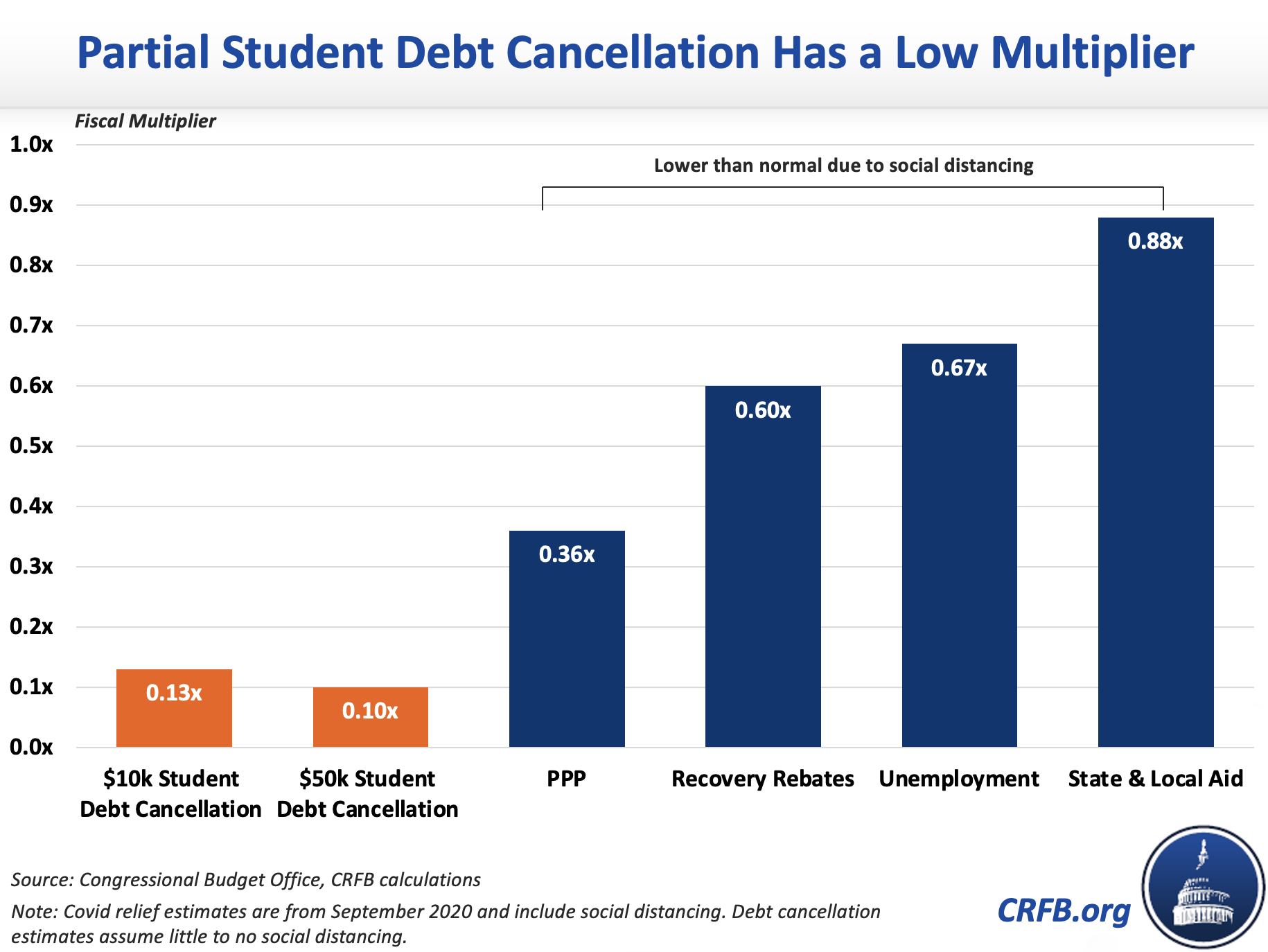

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Student Loan Forgiveness Statistics 2021 Pslf Data

Pause On Federal Student Loan Payments Extended Through May 1 Whnt Com

Student Loan Expert Calls Repayment System Frankenstein S Monster Student Loans Student Loan Repayment Repayment

Refinance Medical School Loans Complete Guide The White Coat Investor

Employer Student Loan Repayment Tax Free Benefit Q A

Student Loan Assistance Benefits Extended Through 2025 Word On Benefits

These Companies Offer Student Loan Repayment Assistance

Interest Free Loans For Students Why They Help And How To Find Them Student Loan Hero

How To Calculate Your Expected Family Contribution Expected Family Contribution Financial Aid For College Financial Aid

What S Changing In Student Loan Forgiveness And Do I Qualify Kxan Austin

4 Loan Forgiveness Programs For Teachers Federal Student Aid

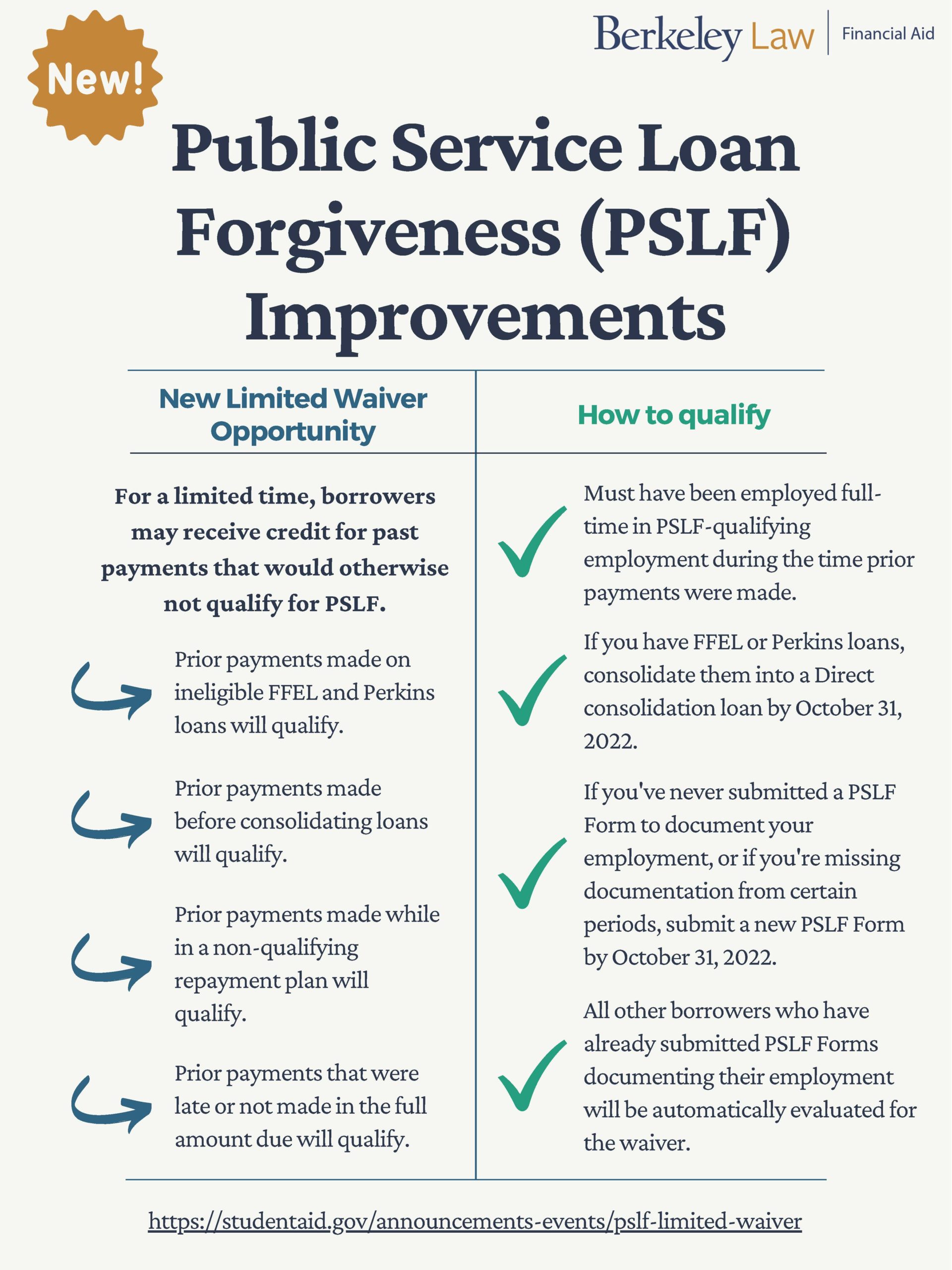

Covid 19 Student Loans Berkeley Law

Post a Comment for "Cares Act Employer Student Loan"