Does Student Loan Reimbursements Count As Income In Ct

Federal and state tax refunds and other non-recurring lump sums of money such as insurance settlements or back benefits from other programs do not count as income. The Public Service Loan Forgiveness PSLF Program is an importantbut largely unmetpromise to.

2738 c 1.

Does student loan reimbursements count as income in ct. Governor Lamont Announces Payment Relief for Student Loan Borrowers. Lump sum funds are treated as a resource in the month received not income unless they regularly recur. Although the qualifying income for the CHFA income limits will be based solely on the income of the.

Income for persons over the age of 23 with dependent children. Student loan debt has been increasing steadily as the cost of education rises in our country with student loan debt accounting for over 15 trillion in 2019 compared to 260. Once you know your gross income you can subtract IRS-approved deductions to get your adjusted gross income AGI.

A 10000 loan with a 20-year term 240 monthly payments of 72 and a. Do student loans count as income. October 6 2021.

Understanding Employer Match of Student Loan Repayment. 31 2025 because of disability or death it wont be counted as taxable income. As expected all income from your employer is includedall gross wages or salary as well as any tips overtime shift differentials and commissions WITHOUT subtracting any.

From 2019 to 2020 CTs average teacher salaries rose by 55 percent. When an employer pays you for expenses they can pay you either under an accountable plan or a non-accountable plan. The median teacher salary is around 79742 and most teacher incomes are on the rise.

Other financial aid including. Unfortunately the law is. Does reimbursement count as income.

If your federal student loan is discharged between Jan. This applies whether your entire loan is forgiven or just a portion. Maxes out at 7 ½ years which totals 9000 in student loan.

An accountable plan is when. Determining whether the borrower has the ability to repay the loan. For purposes of this paragraph financial assistance does not include loan proceeds for the purpose of determining income.

1 2018 and Dec. For a variable loan after your starting rate is set your rate will then vary with the market. HARTFORD Governor Ned Lamont and Banking Commissioner Jorge Perez in.

The money graduates pay towards their student loan debt is deducted from their state income taxes up to a benchmark amount. The value of those payments is added to the employees W-2 as taxable income and since it is taxable the employee can use the student loan interest deduction. Non-federal financial aid used for anything other than living expenses is not counted.

Loans and Stafford loans. The monthly benchmark amount ranges from 72 to 377. Work-study earnings do not count as income.

MPP 63-501111 ACIN I-12-19 See the sections of. Connecticut has seven student loan forgiveness and reimbursement incentive programs in statute. For those that are self-employed these deductions.

April 21 2020. Press Office 202 401-1576 pressedgov. 1 Thats one of the fastest.

Alimony child support and maintenance payments are to be considered in this. 2019-R-0262 November 13 2019 Page 2 of 4 However according to the Office of. Installment loans student loans and revolving credit is 45 of the borrowers gross monthly income.

Congress specified and the IRS clarified that forgiven PPP loans will not count as income.

5 Ways To Pay Off Student Loans Fast Paying Off Student Loans Student Loans Student

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Student Loan Scams 3 Warning Signs To Watch For Money

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

These States Might Forgive Some Of Your Student Debt Student Debt College Debt Student Loan Forgiveness

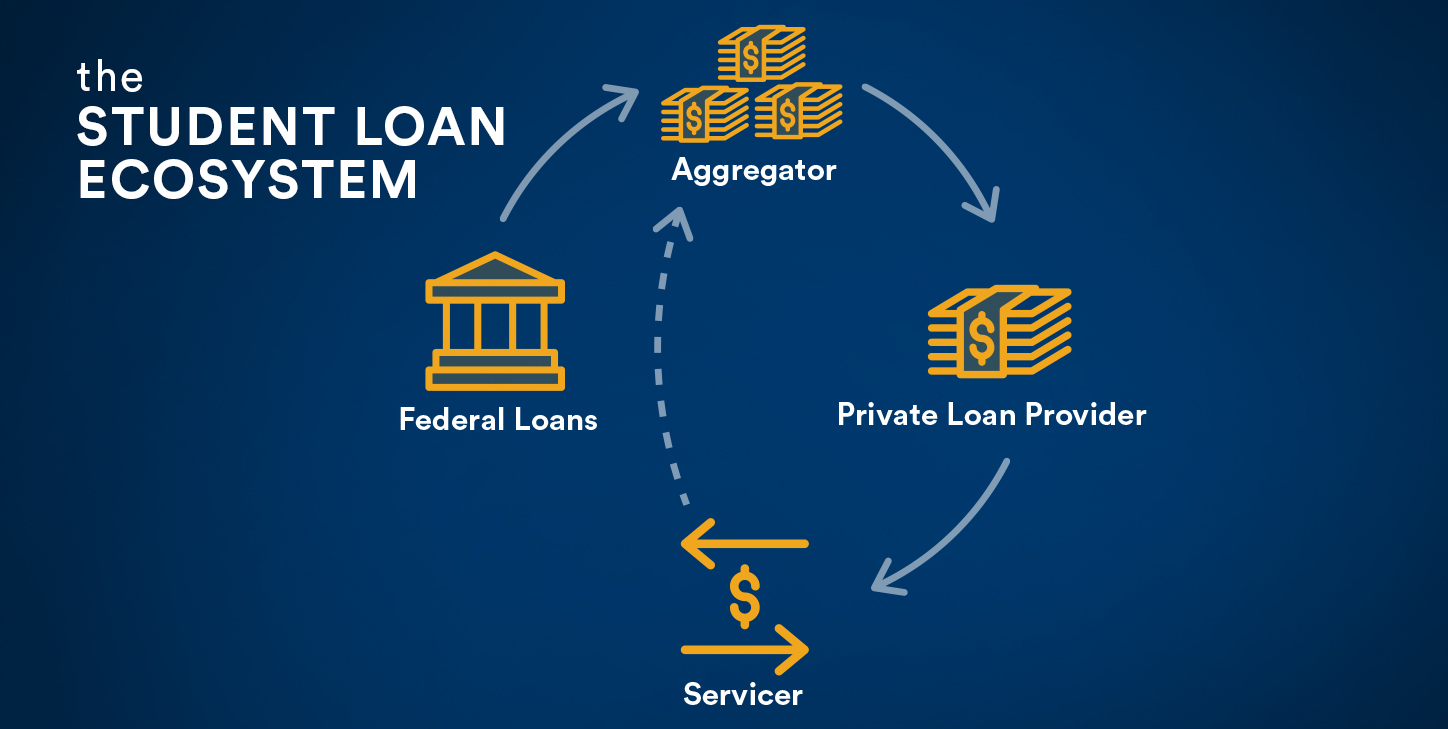

The 4 Types Of Student Loan Sites You Need To Know Laurel Road

Student Loan Payment Assistance How To Convince Your Boss To Help Student Loan Hero

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Amid Attempts To Expand Community College Access Current Students Struggle To Graduate Hartford Business Journal

Learn More About Federal Student Loan Forgiveness And Debt Repayment Connecticut Education Association

Connecticut Student Loan And Financial Aid Programs

Join This Free Student Loan Repayment 101 Webinar With David Carlson Author Of Student Loan Solution Student Loan Repayment Saving Money Earn Money Blogging

Taking Out Connecticut Ct Student Loans

It S Really Troubling Parts Of America Are Trapped In A Catch 22 Economic Situation Student Debt Student Student Loans

Post a Comment for "Does Student Loan Reimbursements Count As Income In Ct"