Maximum Deduction Allowed For Qualified Student Loan Interest

If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans. Unfortunately the deduction is phased out if your adjusted gross income AGI.

Can The Student Loan Interest Deduction Help You Citizens Bank

You can claim student loan interest on your taxes however the student loan interest deduction begins to phase out if your adjusted gross income AGI is.

Maximum deduction allowed for qualified student loan interest. 80000 if filing single. E-File Today Get Your Tax Refund. The student loan interest deduction allows you to deduct up to 2500 on your federal income tax.

It includes both required and voluntarily pre-paid interest payments. It can be limited by your. It can be limited by your income.

Its the above the line adjustment to your adjusted. What is the income limit for student loan interest deduction 2020. The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid.

The maximum amount of student loan interest you can deduct each year is 2500. If you qualify the amount you can deduct will depend on these. Ad Check your eligibility quickly and apply easily on mobile or desktop.

How much can I deduct for student loan interest. Unfortunately the deduction is phased out if your adjusted gross income AGI. The answer is yes subject to certain limits.

The interest must be for a qualified education loan which means a debt incurred to pay tuition. For 2020 taxes which are to be filed in 2021 the maximum student loan interest deduction is 2500 for a single filer head. The maximum amount of student loan interest you can deduct each year is 2500.

Unfortunately the deduction is phased out if your adjusted gross income AGI. What is the maximum deduction allowed for qualified student loan interest. The maximum amount of student loan interest you can deduct each year is 2500.

The maximum student loan interest deduction is 2500. The maximum student loan interest deduction you can claim is 2500 as of the 2020 tax year and it might be less. You may deduct the lesser of 2500.

The maximum amount of student loan interest you can deduct each year is 2500. Ad Check your eligibility quickly and apply easily on mobile or desktop. Student loan interest is interest you paid during the year on a qualified student loan.

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

Can I Deduct My Student Loan Interest The Motley Fool

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

How To Claim Your Student Loan Interest Deduction

Is Student Loan Interest Tax Deductible Rapidtax

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

Learn How The Student Loan Interest Deduction Works

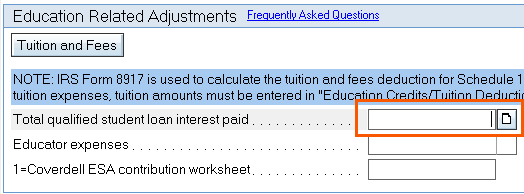

How To Enter Total Qualified Student Loan Interest Intuit Accountants Community

![]()

How Much Student Loan Interest Is Deductible Payfored

There S A Deduction For Student Loan Interest But Do You Qualify For It Dougfreemancpa Com

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

Can The Student Loan Interest Deduction Help You Citizens Bank

Learn How The Student Loan Interest Deduction Works

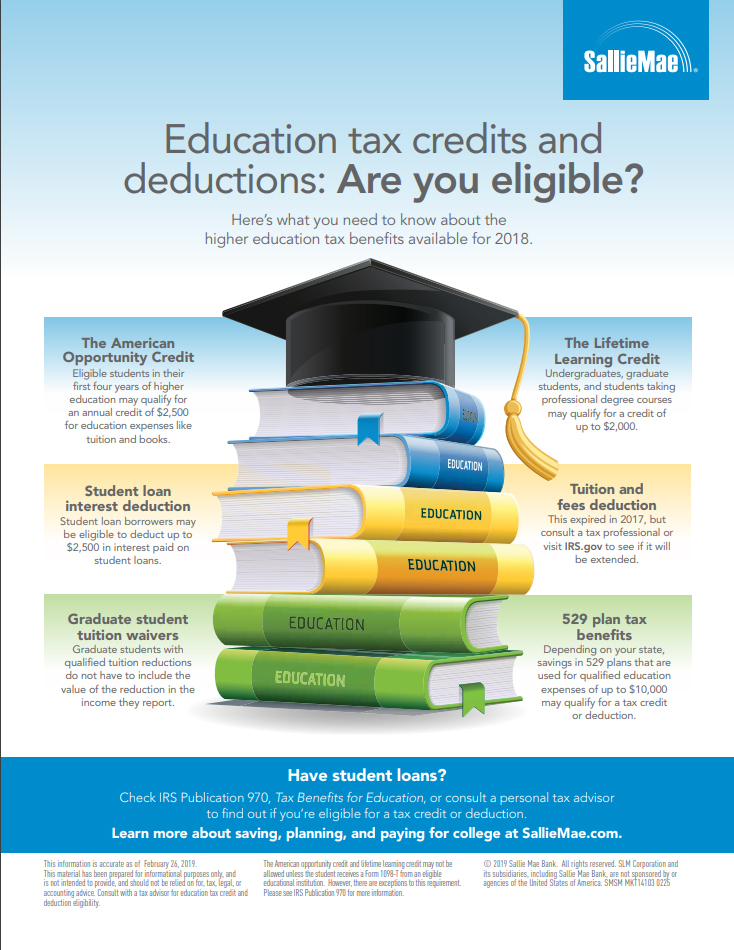

Higher Education Tax Benefits Do You Qualify Business Wire

Learn How The Student Loan Interest Deduction Works

Are You Eligible To Deduct Student Loan Interest Payments Mlr

Student Loan Interest Deduction H R Block

Don T Overlook Student Loan Tax Break On Amounts Paid Before Covid Relief Don T Mess With Taxes

Post a Comment for "Maximum Deduction Allowed For Qualified Student Loan Interest"