Student Loan Interest Deduction Phase Out 2018

The answer is yes subject to certain limits. Student Loan Interest Deduction Phases Out.

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

The deduction is available to anyone earning less than 80000 or 165000 if you file a joint return but its gradually phased out if your modified adjusted gross income is.

Student loan interest deduction phase out 2018. The maximum amount of student loan interest you can deduct each year is 2500. You can deduct up to 2500 in student loan interest or the actual amount of interest you paid whichever is less if your MAGI is under the threshold where the phaseout. Ad Re-Fi Your Student Loans with PenFed Credit Union.

The deduction is phased out if your adjusted gross income AGI exceeds certain levels. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the annual limit for your filing. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans.

Student loan interest deduction. Phase-out Amounts For 2021 the deduction. If youre paying back college loans for yourself or your children you may wonder if you can deduct the interest you pay on the loans.

51 rows 2018 Student Loan Interest Tax Rate Calculator. There is a phase-out of this deduction based on how a person or couple files their taxes and their income. For single filers once your MAGI hits 70000 the deduction begins to phase out meaning the maximum amount you can deduct is less than the full 2500.

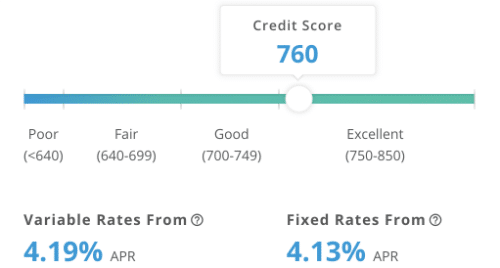

If you apply before 12152021 the index is the one-month London Interbank Offered Rate. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. According to IRS student loan rules you are not eligible if your Modified Adjusted Gross Income MAGI is more than 80000 per year or 165000 if you file a joint return.

You can claim the full 2500 student loan deduction if your modified AGI is 70000 or less. You may be eligible for a deduction of up to 2500 on your 2018 federal tax return if you meet 4 requirements. The deduction is phased out if your adjusted gross income AGI exceeds certain levels.

The deduction is gradually reduced and eventually eliminated by phaseout when your modified. It doesnt matter when the loan was taken out or whether interest payments made in earlier years on the loan were deductible or not. Your deduction is gradually reduced if your modified AGI is 70000 but less.

The answer is yes subject to certain limits. You paid interest on an eligible student loan 2. Ad Re-Fi Your Student Loans with PenFed Credit Union.

For 2021 the deduction. It doesnt matter when the loan was taken out or whether interest payments made in earlier years on the loan were deductible or not. Answer a few questions to find your student loan refinance rate.

Duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and 170000 if you file a joint return. For 2018 the amount of your student loan interest deduction is gradually re-duced phased out if your MAGI is between 65000 and 80000 135000 and. The maximum amount of student loan interest you can deduct annually is 2500.

Answer a few questions to find your student loan refinance rate. The student loan interest tax. Earnest variable interest rate student loan refinance loans are based on a publicly available index.

You cant claim the deduction if your MAGI is 85000 or.

Learn How The Student Loan Interest Deduction Works

How To Claim Your Student Loan Interest Deduction

Can The Student Loan Interest Deduction Help You Citizens Bank

Can The Student Loan Interest Deduction Help You Citizens Bank

Survey Majority Of Student Loan Borrowers Don T Understand How Interest Works Student Loan Hero

![]()

How Much Student Loan Interest Is Deductible Payfored

Learn How The Student Loan Interest Deduction Works

![]()

How Much Student Loan Interest Is Deductible Payfored

Survey Majority Of Student Loan Borrowers Don T Understand How Interest Works Student Loan Hero

Mohela Student Loans Review For December 2021

Student Loan Interest Deduction How Much Can I Save In 2022

Student Loan Interest Deduction How Much Can I Save In 2022

Back To School Myths The Student Loan Interest Deduction Is Gone

Is Student Loan Interest Tax Deductible Rapidtax

Beware Of Student Loan Interest Rates Or You Ll Pay For It Student Loan Hero

What Is The Student Loan Interest Deduction Sofi

Student Loan Interest Deduction H R Block

Can I Deduct My Student Loan Interest The Motley Fool

Pub 17 Chapter Pub 4012 Tab E Federal 1040 Lines 23 37 Ppt Download

Post a Comment for "Student Loan Interest Deduction Phase Out 2018"